Friends,

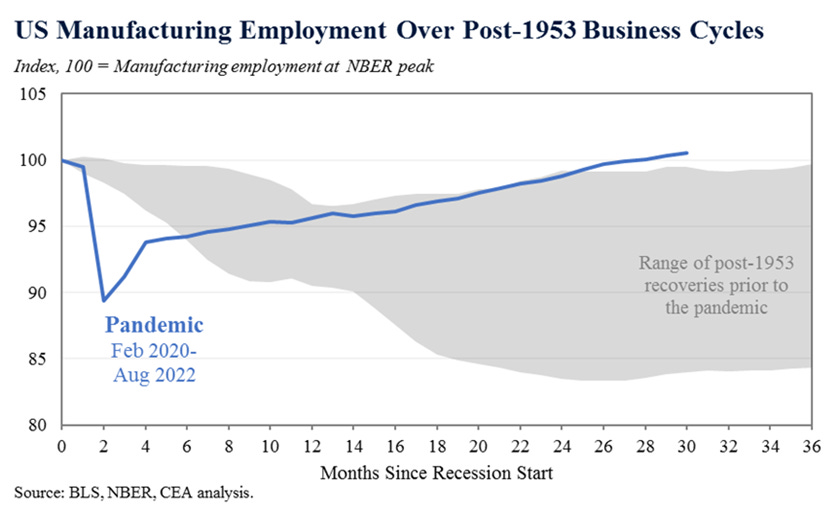

How’s this for a headline? The New York Times this week published a story titled “Factory Jobs Are Booming Like It’s the 1970s.” Jim Tankersley, Alan Rappeport and Ana Swanson report that the boom in domestic manufacturing is a direct response to blockages we’ve seen in the international supply chain throughout the pandemic, as well as increased consumer spending and a strong labor market.

Brian Deese, director of the National Economic Council, told the Times that companies are investing in American manufacturing because “not only did the pandemic highlight the need for more resilience in their supply chains,” but the Biden Administration is “creating a policy environment that makes long term investment here in the United States more attractive.”

Specifically, the authors cite the Biden Administration’s investments in infrastructure and semiconductor manufacturing, as well as executive orders calling on the federal government to buy American products whenever feasible, as leading causes of the boom. But they also cite a general sense of skepticism that our trade relationship with China will continue to run smoothly in the years and decades ahead. As a result, manufacturing employment is stronger now than in any other period of economic recovery since at least the 1950s.

A decade ago, the conventional wisdom had it that American manufacturing was a thing of the past, a relic of pre-globalization times, and that those jobs were moving to extractive nations with rock-bottom wages, never to return. Back then, headlines like the one the New York Times published this week were absolutely unthinkable. Remember this the next time someone tells you that a high federal minimum wage is impossible, or that the service sector will always be largely made up of low-wage and poor quality jobs. The status quo is never eternal, conditions can change very quickly, and conventional wisdom usually best serves those who profit the most.

The Latest Economic News and Updates

The size and shape of American inequality

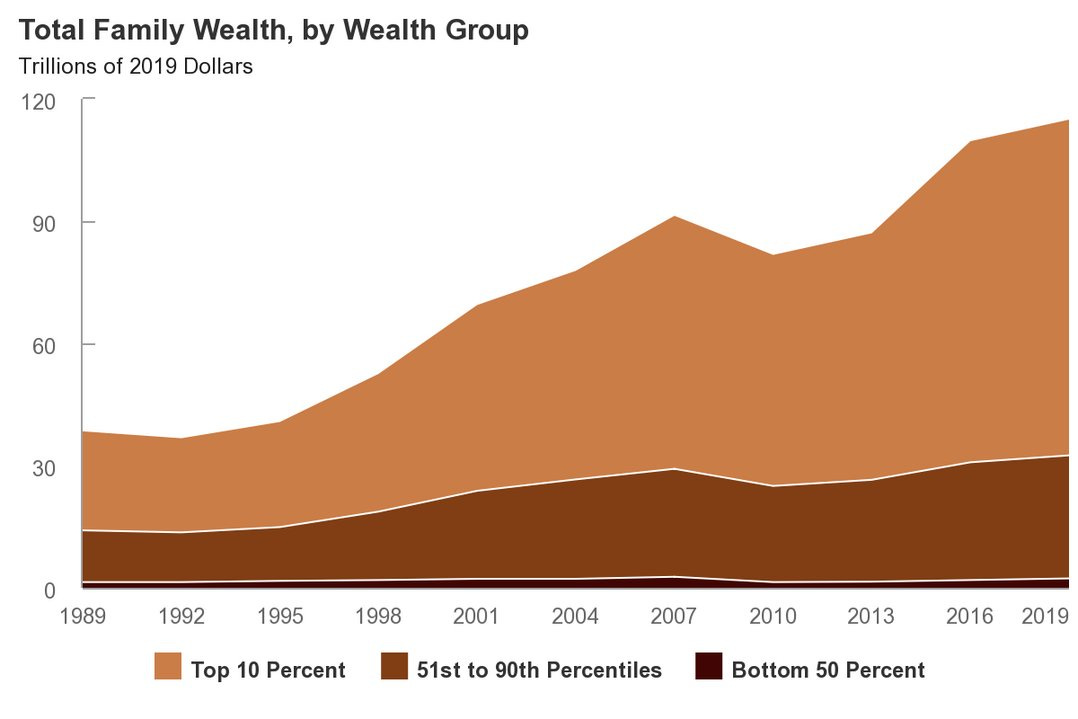

A new report from the Congressional Budget Office adds some new information to our understanding of how income inequality has grown in America since the 1980s. Specifically, the wealthiest 10 percent have made significant gains since 1989, the 51st to 90th percentile has basically held even, and the 150 million people that make up the bottom 50 percent of the economy only own 2 percent of the nation’s wealth. If you squint 🤨,you can make out that 2 percent on the bottom of this graph—it’s the tiny black line at the bottom:

So how much personal wealth does the ordinary American possess? In 1989, people in the top ten percent of the economy held an average of $2.5 million dollars. In 2019, that ballooned to $6.4 million. The bottom quarter of the economy held exactly zero dollars in wealth on average in 1989. By 2019, the average wealth of the bottom 25% had dropped to -$11,000. (Yes, that’s negative $11,000.) That’s not just bad for the people at the bottom—it’s what makes our current economy fragile, and therefore perilous, for everyone.

Let’s be as clear as possible: This is the result of 40 years of trickle-down economics. As we’ve said in this newsletter many times before, extractive policies have taken some 50 trillion dollars from the paychecks of ordinary Americans and funneled it up to the wealthiest 1 percent. Until we end this unprecedented transfer of wealth and ensure that ordinary Americans can participate in the economy, personal debt will grow, fewer Americans will be able to afford housing, and our economy will continue to fall behind those of other wealthy nations. In order for it to truly work, the American Dream has to be possible for everyone—not just those lucky enough to be born into generational wealth.

UK PM Truss Becomes the Trickle-Down Poster Child

In this newsletter, we tend to keep a tight focus on America’s economic issues. But because our economy reacts to and with every other nation’s economy, it’s important to step back occasionally and take in a broader scope. That’s why I’m calling your attention to an editorial written by Civic Ventures founder Nick Hanauer and his frequent collaborator, the Oxford Professor (and The Origin of Wealth author) Eric Beinhocker, published in The Guardian over the weekend.

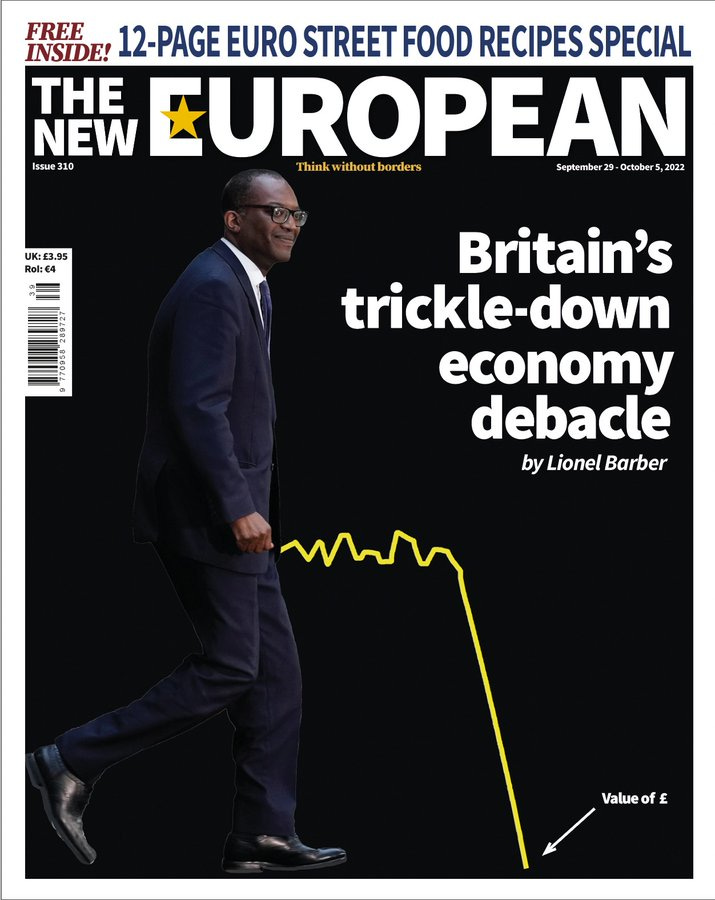

The editorial focuses largely on new UK Prime Minister Lizz Truss, who is an unabashed proponent of trickle-down economics. Truss’s new proposed budget hews closely to the trickle-down dogma of tax cuts for the rich, deregulation for the powerful, and decreased investments in the working class—and she faithfully repeats the trickle-down lie that the best way to create economic growth is by giving it to the wealthiest one percent of the population.

In case you think they’re mischaracterizing Truss, here’s a direct quote from last week: “Lower taxes lead to economic growth, there is no doubt in my mind about that.”

Of course, that’s not true. That claim is just as much a lie now as it was when Ronald Reagan said it in 1981, only now we have a mountain of facts that prove it as a lie. It doesn’t result in more jobs, or in shared prosperity. In the piece, Beinhocker and Hanauer point out Truss’s firm connection to that legacy of trickle-down, and they make the case for a middle-out economic policy reset like the one promoted by the Biden Administration.

It’s honestly remarkable that Truss has chosen to be such a vocal proponent of trickle-down. Truss’s proposed budget has already inspired members of her own party to submit votes of “no confidence” in her leadership over fears that she will “crash the economy”—a historic embarrassment for a brand-new prime minister. And this magazine cover featuring Truss’s economic adviser Kwasi Kwarteng demonstrates how much ridicule Truss’s economic policies have been receiving from her European peers:

Truss’s historic unpopularity is another sign that around the globe, trickle-down’s popularity as an economic philosophy is at its lowest ebb in our lifetimes.

Trickle-down doesn’t buy votes the way it used to, because a majority of the American people recognize that they’ve been getting screwed by tax cuts for the rich. After all, 40 years of evidence proves that tax cuts for the rich actually kill broad economic growth, while investing in working Americans actually creates prosperity for everyone.

“Decades of evidence and policy experience now make it clear that, in actuality, growth is generated by those in the broad middle of the income distribution, from the 10th to the 90th deciles,” Beinhocker and Hanauer write. That broad majority of the population does “the bulk of the working, saving, consuming and innovating in the economy, and if their finances are healthy, the economy will grow and be healthy too.”

The more that people understand how the economy actually grows, the worse trickle-downers will do with the voting public. Truss surely won’t be the last unapologetic trickle-downer to hold public office, but she’s definitely part of a dying breed.

Is trickle-down finally trickling away?

Umair Haque wrote an excellent post explaining how trickle-down economics came to capture both the Republican and Democratic Parties:

The Washington Consensus — formalized in the 90s, as a matter of domestic and foreign policy both — went like this: everything was to be privatized, from water to energy to healthcare, competition was to be the sole activity in the economy, profit was to be the only point of society, and all that was going to lift living standards up for everyone — even if the rich got richer first, in the end, even the average Joe would see a better life.

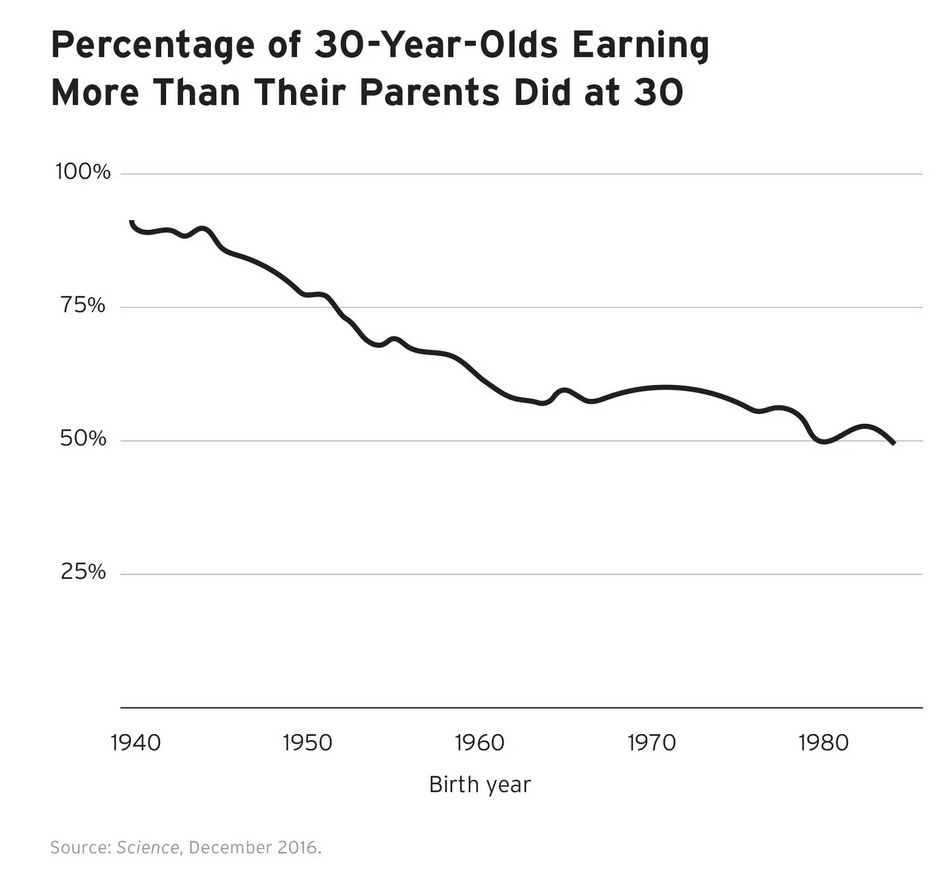

But as podcaster and entrepreneur Scott Galloway’s new book Adrift points out, that has resulted in a hugely unequal system in which 30-year-old American adults have a 50-50 chance of earning more than their parents made at age 30. Before trickle-down took hold, children were 90 percent more likely to do better than their parents.

Alex Shephard at the New Republic says that Democrats should be more forceful in their arguments against trickle-down economics in the midterms, even characterizing it as something just as extremist in its own way as the far-right MAGA wing of the Republican Party:

When in power, Republicans only have one real economic idea: Cut taxes for corporations and the ultrawealthy, cut social services, and sit back while they—and their donors—reap the rewards. Donald Trump’s only meaningful legislative accomplishment as president was a bill that drastically lowered the corporate tax rate. That’s it: The only thing you can reliably count on Republicans to do, put in power, is to cut taxes for the rich. Nothing else.

But the inconvenient truth is that trickle-down wouldn’t have become the dominant paradigm if only Republicans adhered to it. The fact is that we had two Democratic presidents in the last 40 years whose major economic policy advisers largely embraced trickle-down assumptions. That’s why Haque believes that President Biden’s embrace of middle-out is so important—because it introduces a new, contrasting idea to the trickle-down conversation, breaking the consensus.

Bidenomics is a sea change — and a necessary one. And no, it’s not just empty rhetoric either — I’d be the first to say it was, if it were. But it’s being backed up with real levels of investment, though there’s a long way to go yet. But even those small steps? Climate bills, debt forgiveness, and so on? They’re giant leaps, because the Grand Experiment [of trickle-down] — and its viziers of the Washington Consensus — said that they should never, ever happen. It’s in all those senses that Bidenomics is pretty radical.

Taking stock of inflation

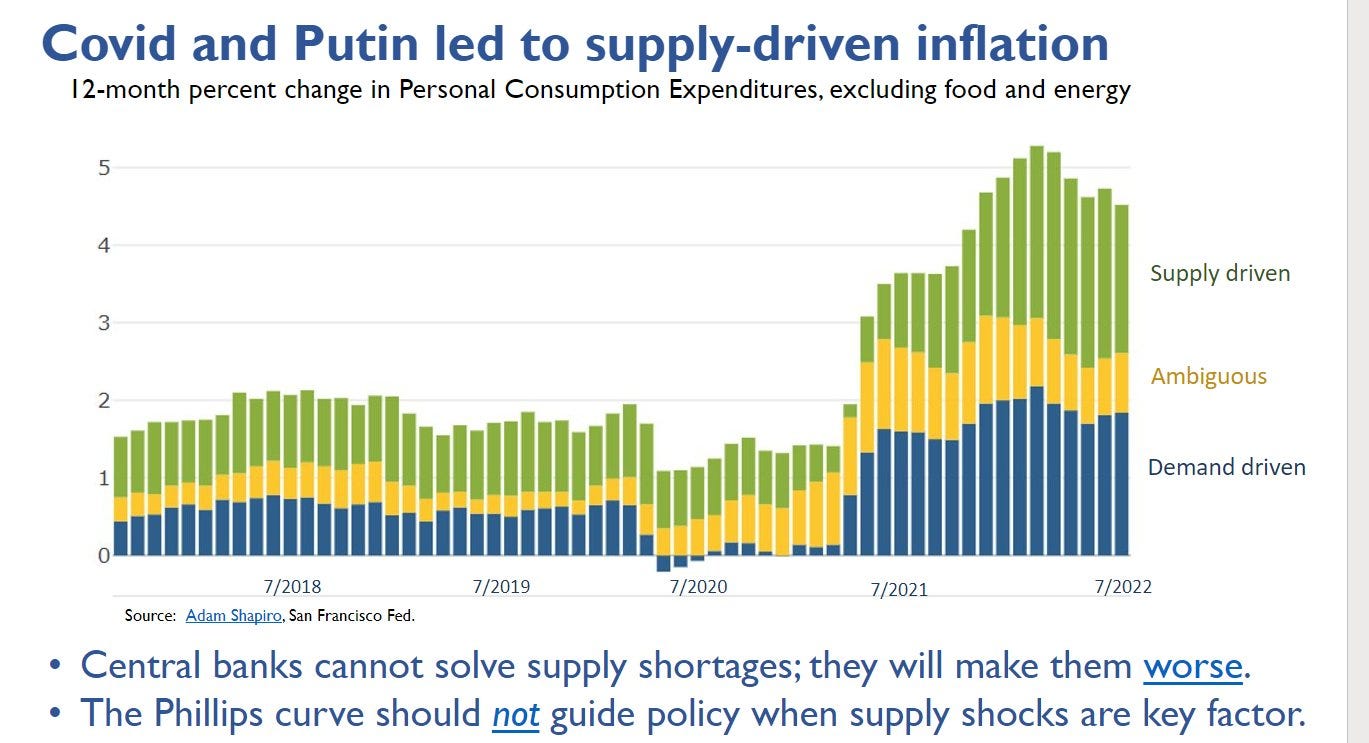

On her excellent Substack “Stay-At-Home Macro,” economist Claudia Sahm shared a recent talk she gave in Berlin titled “Five Facts About Inflation.” In the talk, Sahm said that the inflationary prices we’re all paying are largely due to the Russian invasion of Ukraine and global supply chain snags, and so are not likely to be resolved by the Federal Reserve’s push to raise interest rates and slow the economy down.

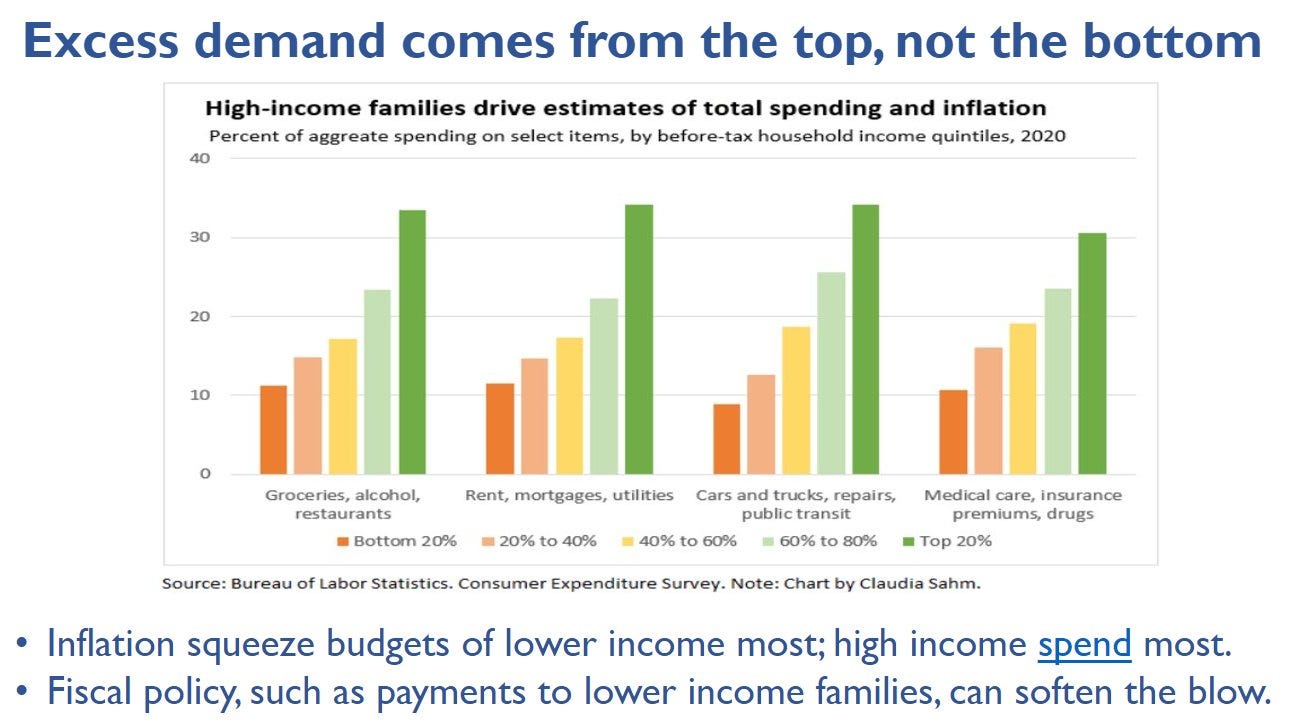

And while Federal Reserve Chair Jerome Powell has openly stated that he expects the unemployment rate to rise, Sahm points out that the lower-wage employees who are likely to lose jobs during a recession aren’t the consumers who are driving up prices.In fact, wealthy people are driving the demand side of the equation right now, with the wealthiest 20 percent of the income scale dominating sales in groceries, housing, transportation, and health care.

But because middle- and working-class Americans hugely outnumber the wealthy few, that increased spending in the top 20 percent isn’t enough to grow the economy for everyone—people in the top quintile of the economy may spend more money on a single pair of shoes, but they’re not going to buy as many shoes as the huge number of American families in the bottom 80 percent of the economy. If we want the economy to truly turn around, we need to drive spending among all Americans—not just the ones at the top.

We spent most of last week’s issue explaining why the Federal Reserve’s decision to raise interest rates is a bad idea, so we won’t spend too much time going back over that information here. But suffice it to say that we are not alone in our opinions: Sahm’s criticism is cited in a popular CBS News report from Irina Ivanova titled “Buckle up, America: The Fed plans to sharply boost unemployment.”

No doubt because of that pulls-no-punches headline, Ivanova’s article went viral, and it raised visibility of two eye-popping predictions: First, that the Federal Reserve’s rate increases have likely already started a process that will wipe 800,000 jobs from the economy in the next few weeks and months; and second, that Bank of America expects the Fed’s actions to result in at least three million additional unemployed Americans by this time next year.

And in the New York Times, Peter Coy warns that Fed Chair Jerome Powell could be lost in the shadow of his economist forebears, leaving him unable to see the true contours of our current crisis. It’s so rare to see such widespread criticism of the Federal Reserve from such a wide variety of mainstream sources—and it’s almost unprecedented to see such consistency in the arguments against the Fed’s actions. We’re truly in uncharted economic waters now.

How CEOs are contributing to inflation

The economy is still in a profoundly weird place, and nobody can predict where things are headed. As gas prices fell in September, consumer confidence increased and new home sales rose slightly. At the same time, Wall Street investors seem to believe that the economy is headed for dire times, rejecting the Federal Reserve’s predictions of a weakened-but-resilient economy through 2024.

Jenna Smialek at the New York Times says that if we want to understand where the economy is headed, we have to keep our eyes on three important factors: “Supply chains have not completely healed. Demand may be slowing down, but it still has momentum. And companies that have grown used to charging high prices and raking in big profits are proving hesitant to give those up,” she writes.

That last one is particularly important: We know that a large share of the higher prices we’re paying are due to greedflation—corporations using the inflation crisis as an excuse to raise prices and increase profit margins. In large part, our economic future hinges on that profit-to-price ratio. And because it wouldn’t do us any good to patiently wait for CEOs to lower profit margins of their own volition, our leaders should be investigating ways to rein in runaway greedflation. In Canada, leaders are calling for a government probe into runaway grocery store profit margins. And for Citywatch, Barbara Ellis looks at President Richard Nixon’s successful 90-day price freeze in 1971, which slowed inflation for two years.

Ellis quotes Sarah Miller, Executive Director of the American Economic Liberties Project, who offers a more surgical response to greedlfation than Nixon’s blunderbuss price freeze approach:

Megacorporations are a key driver of high prices—and we need bold action to rein them in….to attack concentrated corporate power immediately and aggressively across the board. That means levying excess profits taxes, ensuring big penalties for price-fixing, and resourcing enforcement agencies to prosecute price-gouging and other forms of corporate abuse. And it means banning large mergers, stock buybacks, and ‘payoffs for layoffs’ to help build durable market power for working people and consumers and level the playing field for small businesses and entrepreneurs.

Real-Time Economic Analysis

Civic Ventures provides regular commentary on our content channels, including analysis of the trickle-down policies that have dramatically expanded inequality over the last 40 years, and explanations of policies that will build a stronger and more inclusive economy. Every week I provide a roundup of some of our work here, but you can also subscribe to our podcast, Pitchfork Economics; sign up for the email list of our political action allies at Civic Action; subscribe to our Medium publication, Civic Skunk Works; and follow us on Twitter and Facebook.

On Civic Action Live tomorrow, we’ll be discussing America’s surprising manufacturing boom, our growing child care crisis, and how our leaders can combat greedflation. Join us at 10:30 am on Facebook—we’ll also be answering your economic questions live.

On the Pitchfork Economics podcast this week, Nick and Goldy talk with economist Marshall Steinbaum about student loan debt forgiveness. It’s a lively conversation with one of the economics world’s smartest bomb-throwers about why forgiving up to $20,000 in student loan debt is a good thing for the economy—and why President Biden should have forgiven even more debt while he was at it.

Closing Thoughts

While inflation continues to dominate headlines, Rachel M. Cohen at Vox writes about a labor problem that’s flying under the radar: America’s worsening child care crisis.

“Despite the long wait lists, nearly 90,000 fewer people are working in the child care industry today compared to February 2020,” Cohen writes, adding “Many child care centers say they are losing workers because it has become impossible to compete with the rising wages and benefits offered by large corporations like Amazon, Target, Starbucks, and McDonald’s.”

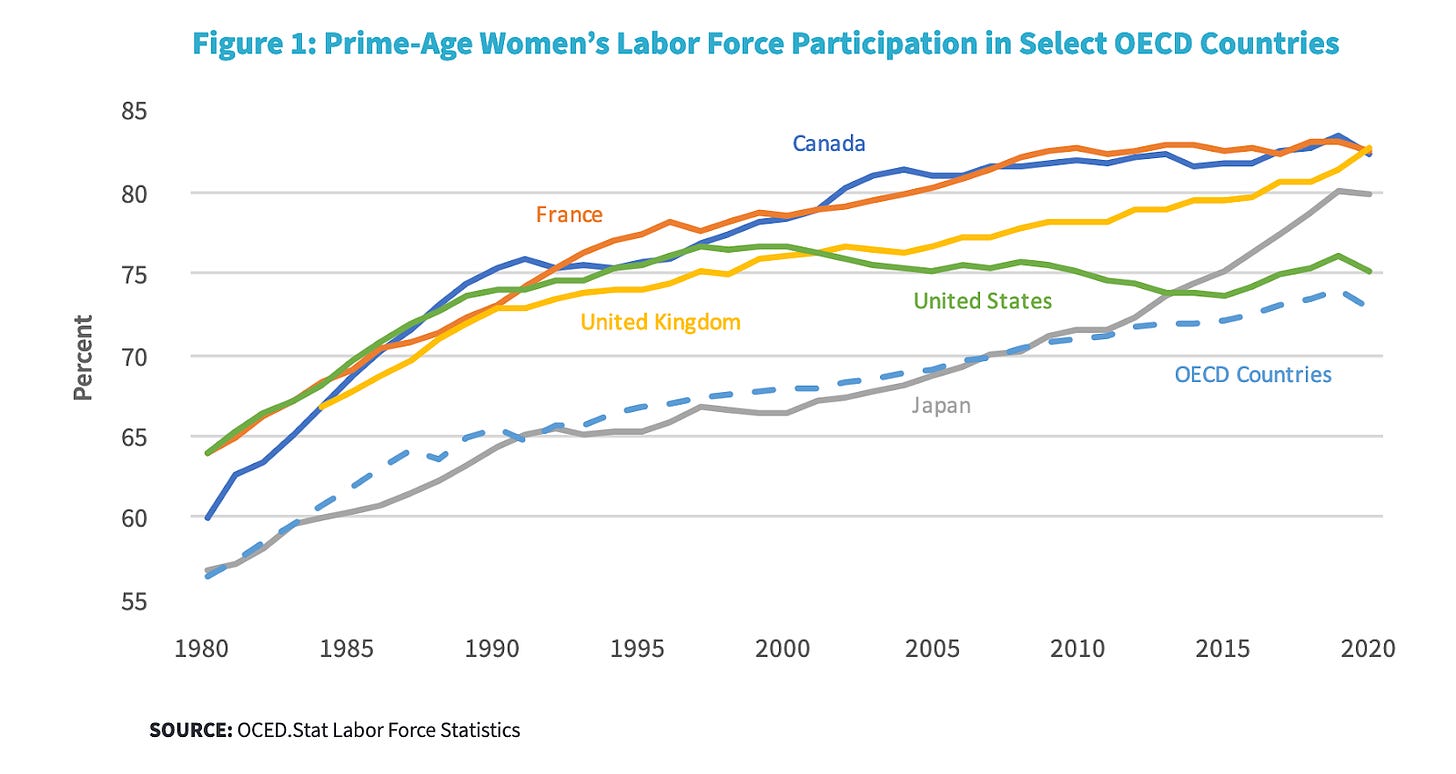

Depending on which source you trust, we have anywhere from 8 to 9 percent fewer child care providers in the industry than before the pandemic. The Treasury department warns that turnover for childcare workers falls between 26 to 40 percent, meaning roughly one in every three childcare workers leave their job (and quite possibly the industry) every year. That gap is driving down the labor force participation of American women compared to other nations.

When you consider Cohen’s claim that it’s “impossible” to pay child care workers a decent wage, it becomes clear that the free market hasn’t done a great job of efficiently providing child care to the American people. Cohen notes that Nordic countries subsidize about 87 percent of the revenue of child care providers. A trickle-downer would characterize that figure as “socialism,” but really a robust investment in child care would supercharge the economy. When more women can participate in the workforce, and when workers at quality child care centers are properly compensated for their time and labor, they can broadly participate in the economy and their spending creates even more jobs. The profit motive clearly isn’t going to save the day here; it’s time for a middle-out solution to the child care crisis.

Be kind. Be brave. Get vaccinated—and don’t forget your booster.

Zach