Zero Inflation

The Pitch: Economic Update for August 11th, 2022

Friends,

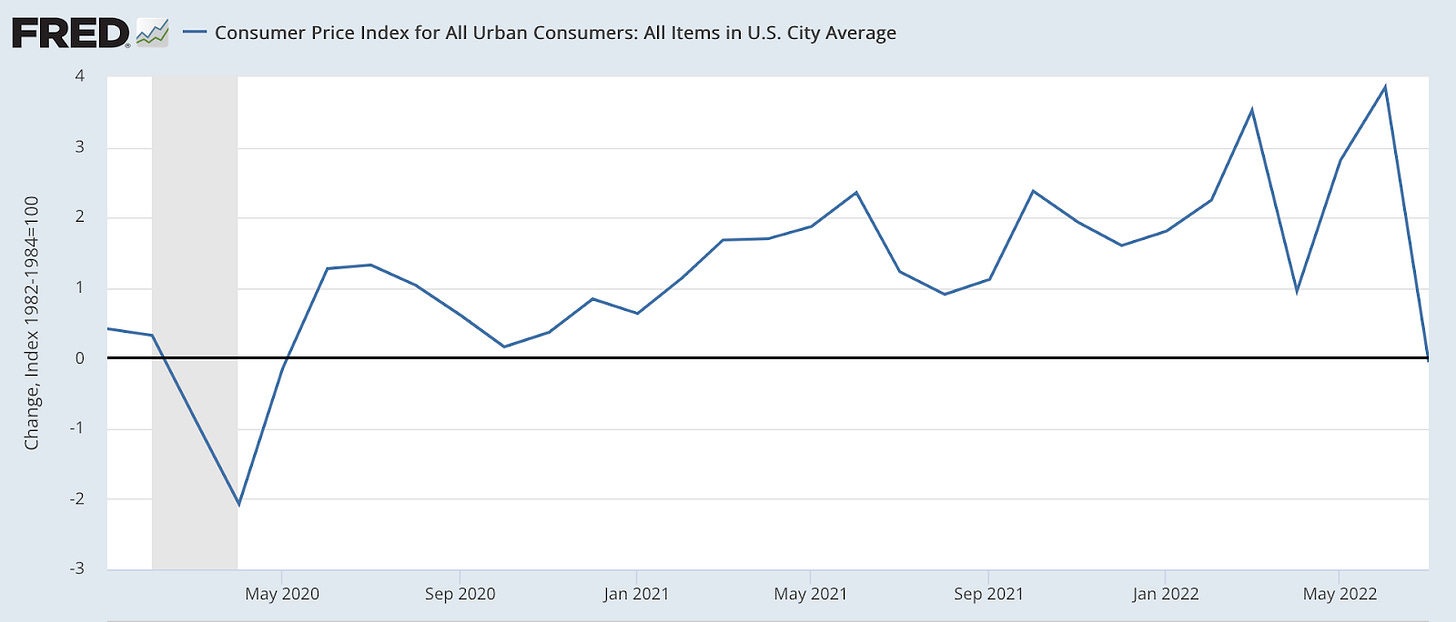

We have to open this letter by acknowledging yesterday’s astounding CPI report. The Department of Labor’s monthly Consumer Price Index report tracks the market price of a basket of consumer goods, and calculates how much inflation has gone up or down over the last month based on whether those prices have increased or decreased. Yesterday’s report came in much lower than virtually every economists’ expectations: The United States saw ZERO inflation growth for the month of July, and wages are finally rising up over the inflation level. Here’s what the monthly CPI has looked like since the beginning of the pandemic with yesterday’s figures added in:

And just today, we saw even more good news on the inflation front: The monthly core producer price index (PPI) report—basically reporting how much it costs manufacturers to build products in America—dropped by a half of a percentage point. This was the first decline in PPI numbers since the pandemic began, and a promising sign for future inflation reports.

It’s obvious that these inflationary drops were spurred by the fastest decline in gas prices in over a decade. American families are now paying over $100 less per month for gas than they were when prices were at their peak in the middle of June. But even subtracting those huge declines in gas prices, the core inflation metric—which looks purely at goods and services prices without the sometimes-volatile energy and food prices included—is lower than at any point since the inflationary crisis began, at 3%:

We’re not out of the woods yet, of course—we need to see several months of inflationary decline and wage increases before we can call this a trend and not an aberration. And many American families will struggle with the higher prices that have accumulated over the last year for some time to come.

But President Biden took a little bit of a victory lap yesterday morning when he announced July’s zero percent inflation and acknowledged that unemployment is near record lows: “That’s what happens when you grow an economy from the bottom up and from the middle out,” Biden said. And that much is definitely true—we certainly wouldn’t be seeing strong economic numbers if millions of Americans were out of work and paychecks were shrinking in response to massive layoffs, as economists like Larry Summers have been calling for over the last year. If the average American is hurting, the economy will take a dive. It couldn’t be any simpler.

The Latest Economic News and Updates

IRA: Good for revenue

By the time you read this, the House may very well have passed the Inflation Reduction Act, which passed through the Senate last weekend. Or, because this is Washington DC we’re talking about, maybe the IRA will have hit another snag on its way to President Biden’s desk. But people are starting to look at the economic benefits that the IRA will create, and this issue of the newsletter is going to dive deep into those explorations.

The Washington Center for Equitable Growth opens with an overview of IRA’s tax policy, which both generates new sources of revenue (from a higher corporate tax and funding of the IRS to go after tax cheats) and encourages Americans to invest in the green economy through tax rebates. “The strong evidence base behind both the investment and revenue components of the bill is one reason former government officials, budget experts, and academic economists—including seven Nobel laureates in economics and five John Bates Clark medalists—have all endorsed the proposed bill,” WCEG writes.

As expected, some Republicans have rolled out the tired trickle-down argument that taxing employers more will drive worker pay down and kill jobs, which supposedly means the IRA will—all together now—hurt the very people it is intended to help. The WCEG replies with an elegant graphic I’ve never seen before—one which proves that American workers were paid more when American corporations were taxed the most:

And the Institute on Taxation and Economic Policy praises IRA’s late-breaking addition of a 1 percent excise tax on stock buybacks, noting that the tax “would also make the country’s tax code fairer by ensuring that income transferred from corporations to wealthy shareholders does not continue to escape taxation.”

Americans for Tax Fairness issued a letter strongly praising the IRA, noting that five former Treasury Secretaries—from Democratic and Republican administrations—support the bill and arguijng that “enactment of the IRA will represent a historic rebuke of failed supply-side economics. Hopefully, it will end 40 years of Congress cutting taxes on the rich and corporations based on the false notion that the benefits will trickle down to working people,” they conclude.

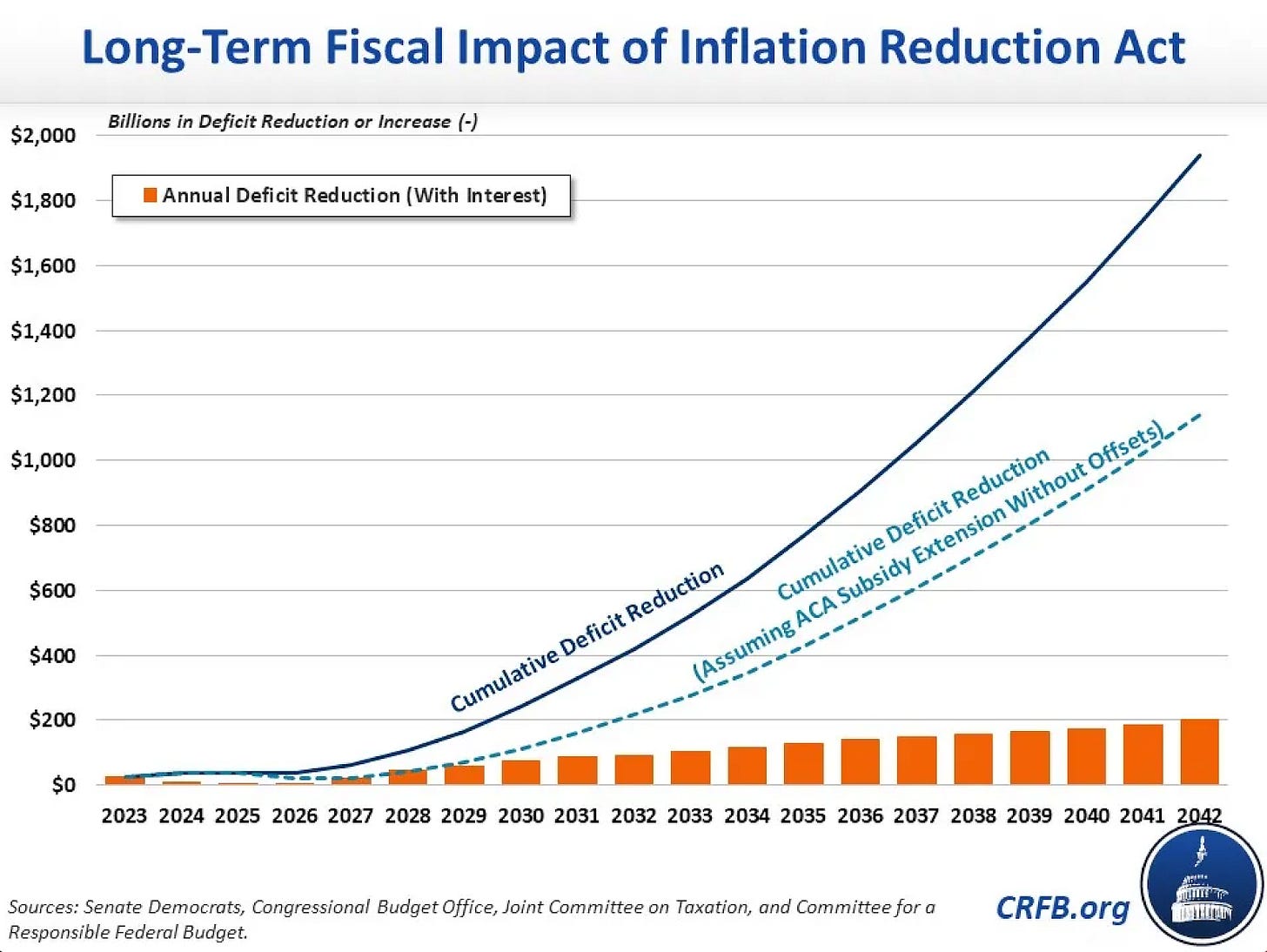

And while concern over the federal deficit is overplayed by trickle-downers who want to cut government investments in ordinary Americans, it does seem worthwhile to note that the Committee for a Responsible Federal Budget found that IRA would save almost $2 trillion over the next twenty years, which is more than any Republican president in living memory has done to reduce the deficit.

IRA: Good for health care

Much noise has been made of the fact that the IRA will lower medication costs for the average American by allowing Medicare to negotiate for lower drug prices. And for good reason! Democrats have tried and failed to do this for three decades.

“Between 2009 and 2018, the average price more than doubled for a brand-name prescription drug in Medicare Part D, the program that covers products dispensed at the pharmacy,” write Sheryl Gay Stolberg and Rebecca Robbins for the New York Times. They add that “Between 2019 and 2020, price increases outpaced inflation for half of all drugs covered by Medicare,” and those higher medication prices have contributed to our inflationary crisis over the past year.

According to the Committee for a Responsible Federal Budget, all of this means that the IRA will save the nation $600 billion in national health expenditures over the next decade, and it will not reduce benefits at all.

David Leonhart at the Times wrote an excellent newsletter explaining how much the IRA will change health care in America for the better—but he notes that it’s up to politicians to explain all this to the American people. A lot of these benefits will save Americans from incurring huge bills, and it’s always very hard to argue that things might have been worse had the legislation never passed.

IRA: Good for the environment

The Rocky Mountain Institute has published a great exploration of the climate benefits of the IRA. They argue that it will make the USA a global leader in reducing emissions, building important green-energy technologies like batteries, and fostering innovations in combating climate change like hydrogen power and green-friendly construction materials.

“The nonpartisan Committee for a Responsible Federal Budget estimates that the bill would put about $385 billion into combating climate change and bolstering U.S. energy production through changes that would encourage nearly the whole economy to cut carbon emissions,” notes the Washington Post. “With the planet rapidly warming, Senate Majority Leader Charles E. Schumer (D-N.Y.) has said the bill would reduce carbon emissions by roughly 40 percent by 2030, close to President Biden’s goal of cutting U.S. emissions by at least 50 to 52 percent below 2005 levels by 2030.”

And while it’s often hard to sell environmental protections to the general public, RMI notes that ordinary Americans will see real savings from the IRA: “The residential tax credits — which can be used for heat pumps, electric water heaters, energy audits, electrical upgrades, and better insulation — could save 103 million households $37 billion a year on energy bills.”

The best analysis of IRA’s impact on climate that I’ve seen comes from Gregg Small, the executive director of Northwest nonprofit Climate Solutions. In Post Alley, Small calls IRA an essential fourth pillar in “the foundation of climate action in the U.S. at a meaningful scale,” alongside private-sector investments and state and local policies supporting a shift into a green economy.

Now that the foundation is fully in place, Small writes, “the hard work begins.” He lays out five essential steps for advancing clean energy and fighting climate change, including making sure that the implementation and investments in the IRA are executed efficiently, ensuring that the benefits of a green economy are spread equally around the country, and making it easier to build even more solutions as the green economy grows. This week has seen a lot of optimism from people who have devoted their lives to combating climate change, and smart people like Small are now preparing to put that optimism into action.

Are we in a boom or a bust?

At this time last week, it was impossible to go to a news site without the word “Recession” blaring from at least one giant headline. But in the wake of last week’s amazing job report, and yesterday’s surprise finding that inflation hit zero in July, some of the heat has left the discussion around a possible recession.

So if we’re not on the cusp of a huge global recession, does that mean we’re in an economic boom? Again, that doesn’t feel right, either. Prices are too high for American families, wages aren’t climbing enough to counter inflation, and housing costs are out of control. We can’t argue that the economy is flourishing when there’s so much misery in people’s lives.

Maybe the problem is just that the economy is incredibly weird right now. None of us have ever gone through a global pandemic, and so all these strange signals of recessions or economic booms could just be what happens when you throw global supply chains up in the air and let them crash to the ground. Or as Ben Casselman writes for the New York Times, “Typically, in recessions, the problem is that businesses don’t want to hire and consumers don’t want to spend. Right now, businesses want to hire, but can’t find the workers to fill open jobs. Consumers want to spend, but can’t find cars to buy or flights to book.”

And a similar exploration of the weird economy by David J. Lynch at the Washington Post puts the story right up top: “Pick your economy: Booming labor market or fizzling growth,” reads the headline, with the kicker explaining that the “Shape-shifting U.S. economy changes its look from one week to the next.”

Unfortunately, this bizarre boom-and-bust economy is arriving at a time when our politics are suffering from an incredible partisan fracture, so leaders and voters on both sides of the aisle can find all the supporting evidence they need to support their worldview—no matter what they may believe. If you want to believe that Joe Biden is destroying the American economy, you can just look at the cost of chicken at the grocery store and the slow housing starts numbers. If you want to cast Biden as the next Franklin Delano Roosevelt, you can look at the fact that more Americans are working now than at any point in history and this week’s plummeting inflation numbers.

Because we’ve never been in an economy like this before, we have no way of knowing when, or even if, things will get back to—and I use this word cautiously—normal. So the best thing for our leaders to do right now is to make sure that the economy is working for the most people possible. That means creating and passing policy to address the real problems facing ordinary Americans—including skyrocketing housing costs, wage inequality, and massive personal debt.

Real-Time Economic Analysis

Civic Ventures provides regular commentary on our content channels, including analysis of the trickle-down policies that have dramatically expanded inequality over the last 40 years, and explanations of policies that will build a stronger and more inclusive economy. Every week I provide a roundup of some of our work here, but you can also subscribe to our podcast, Pitchfork Economics; sign up for the email list of our political action allies at Civic Action; subscribe to our Medium publication, Civic Skunk Works; and follow us on Twitter and Facebook.

On Civic Action Live this week, we’ll discuss the fantastic inflation numbers and what they might mean for the economy going forward, we’ll look at the Inflation Reduction Act’s progress through Congress, and we’ll propose ways for our leaders to raise wages for all Americans—not just a few at the top of the economic spectrum. Join us on Friday at 10:30 am PST.

In this week’s episode of Pitchfork Economics, Nick and Goldy talk with former Romney adviser Oren Cass about whether there’s a path forward for conservative economics as a serious ideology.

In his Business Insider column, Paul examines the Inflation Reduction Act and looks at how it can reduce inflation and improve economic outcomes for the average American.

Closing Thoughts

When we talk about the importance of raising wages for American workers, it’s essential to acknowledge that we mean all workers—not just an elite few. The economy requires widespread consumer demand in order to grow. If a few higher wage-earners near the top see bigger paychecks but nobody else does, the economy will suffer. That means it’s essential for our leaders to identify the jobs and demographics where paycheck disparity is largest, and then work to close that gap so those on the lower end have more money to spend.

A stunning new report from the Wall Street Journal finds that even for college graduates, gender pay inequality begins earlier than we ever suspected. Within three years of graduating college, three-quarters of men in the workforce earn markedly more than their female counterparts. Men with nursing degrees, for example, earned nearly $200,000 salaries just out of school while women with the same degrees were earning $115,000 annually. Part of this is happening because the nursing careers that women are more likely to pursue, including midwifery, pay less than the careers that men traditionally pursue.

Another hugely undervalued field that is traditionally populated by women is the residential long-term care industry—including nursing homes, mental health or substance abuse facilities, or organizations that provide care for disabled Americans. A new report from the Economic Policy Institute finds that workers in this field are overwhelmingly women, and largely women of color, and they are paid three-quarters of the average American hourly wage. And for obvious reasons, the residential long-term care industry has had trouble finding workers since the beginning of the pandemic.

As a society we clearly need to reconsider the kind of work that we value, and how much we value it. Work that has traditionally fallen to women of color is underpaid, but it is essential work. If all the midwives and residential long-term care workers just didn’t show up for their shifts tomorrow, the American economy would grind to a halt.

We already know how to encourage higher paychecks in these fields, but our leaders don’t prioritize those policies. The Build Back Better bill that Congress considered last year contained a provision that raised pay for residential long-term care workers, for instance, but that policy was negotiated out of what would become the Inflation Reduction Act. Even though Congress has done some great work this year to invest in ordinary Americans, many have still been left behind. These are the workers who make our society possible. They deserve a raise.

Be kind. Be brave. Get vaccinated—and don’t forget your booster.

Zach