Friends,

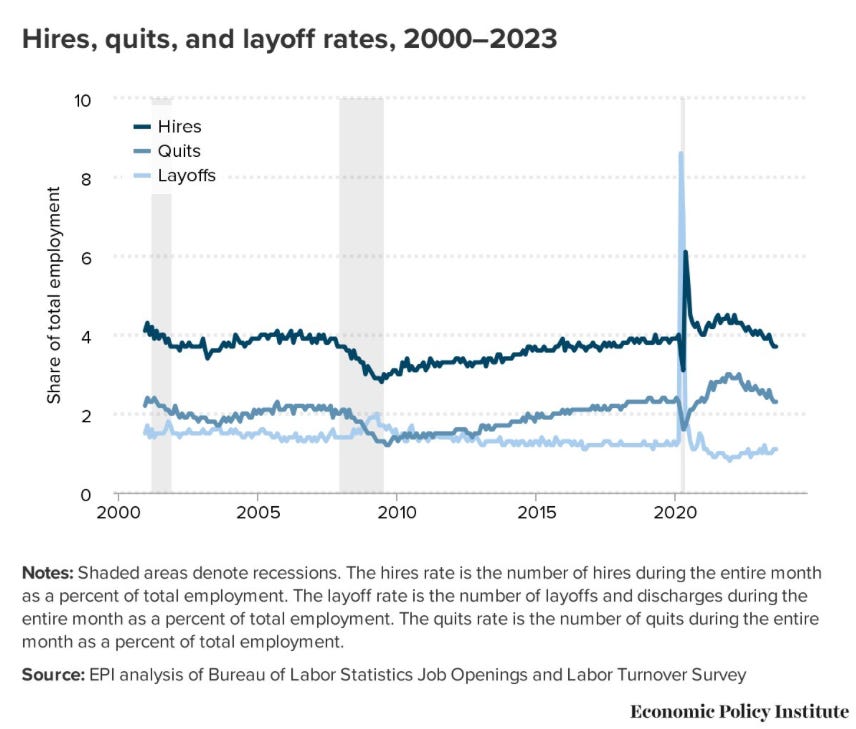

On Tuesday, the Bureau of Labor Statistics released the Job Openings and Labor Turnover Survey (JOLTS) report for August and it shows that the job market, while slowing down from its 2021 post-shutdown peak, is still strong for American workers.

“Hires, layoffs, and quits levels and rates are unchanged in August. The labor market is solid, no significant signs of trouble or overheating,” wrote economist Elise Gould on Twitter. “Over the last several months, we've continued to see a labor market returning to pre-pandemic conditions.”

There was one noteworthy signal in the JOLTS report that had economists buzzing, though: The number of job openings spiked by 700,000 in August, much higher than the trend. Economist Nick Bunker points out that the vast majority of those gains—more than 500,000—“was from one sector: Professional and business services.” The JOLTS report is almost always directionally accurate, but it does occasionally contain these surprising and inexplicable blips.

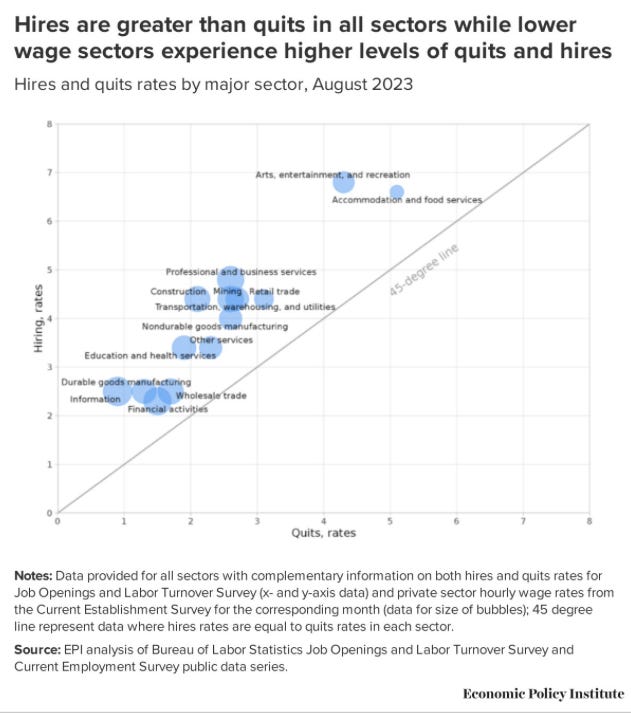

So generally speaking, Gould writes, “Hiring continues to remain above the quits rate in every sector. The great reshuffling isn't what it was two years ago, but it continues as workers look and find better job opportunities. The most churn is consistently in the lowest wage sectors.” It’s important that hires stay higher than quits so that workers can have the freedom to find better employment opportunities—and that high churn rate in low-wage jobs signifies that workers on the bottom end of the income scale understand that they can be paid more elsewhere.

The most important takeaway from the JOLTS report, Bunker writes, is that it “suggests the path to a soft landing remains open. Quitting held steady at 2.3%, its pre-pandemic average. If this key indicator can continue to stay resilient, wage growth will continue to slow but settle in at a still-rapid pace.” In other words, while wages aren’t rising at the unprecedented levels that we saw after Covid lockdowns ended, they’re still rising at a sustainably steady clip, and workers believe that they can get a better job at a higher wage if they were to leave their current job.

So this report shows that the economy is still growing from the middle out, with more Americans at work earning bigger paychecks. That’s exactly what we want the economy to be doing.

The Latest Economic News and Updates

Another Big Week for Labor

“More than 75,000 healthcare workers at Kaiser Permanente have started a three-day strike on Wednesday in the largest demonstration of its kind by healthcare workers in US history,” writes Michael Sainato at the Guardian. “The strike has hit the non-profit private healthcare provider’s operations in California, Oregon, Washington, Colorado, Virginia and Washington DC.”

This strike follows the pattern of the ongoing United Auto Workers’ strike and the recently settled Writers Guild of America strike in California, with workers specifically identifying mammoth profit margins and excessive executive salaries and bonuses as a central point of contention. Sainato writes, “Unions pointed to Kaiser Permanente’s recent profits of $3bn in the first half of 2023 and decried exorbitant salaries of executives.”

But like the other strikes, the workers are also arguing for non-wage benefits: Specifically, Kaiser healthcare workers are calling for more coworkers to help carry the oversized workload that healthcare professionals have been buried under since the beginning of the pandemic. Mary Kay Henry, president of the Service Employees International Union which represents most of the striking Kaiser workers, told the Guardian that workers in her union “are burnt out, scared for their patients and fed up. It’s time for Kaiser to act with the urgency this staffing crisis demands and to settle a fair contract that includes long-term solutions to the crisis like livable wages and benefits.”

Other workers, emboldened by these very visible labor actions, are voting to join unions of their own. Alan Blinder at the New York Times notes that “Resident advisers at the University of Pennsylvania have overwhelmingly voted to unionize, intensifying a swell of labor organizing among undergraduate students across the country.”

But at the same time, some elected leaders haven’t shown the same enthusiasm for unions that President Biden demonstrated when he joined a UAW picket line last week. For instance, California Governor Gavin Newsom quietly vetoed a bill that would have provided unemployment checks to striking California workers. This wouldn’t have been an unprecedented law—both New York and New Jersey both offer unemployment benefits to striking workers—but some insiders speculate that Newsom “didn’t want to be seen as putting his thumb on the scales of the negotiation between the Hollywood studios and the writers, since that was the highest-profile strike of the summer.”

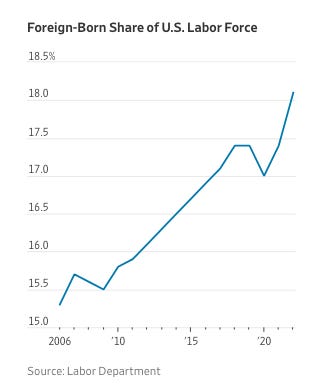

The Wall Street Journal reports that after a huge dip in immigration rates during the Trump Administration, immigrants are now coming to work in this country in record numbers: “Foreign-born workers’ share of the labor force—those working or looking for work—reached 18% in 2022, the highest level on record going back to 1996, according to the Labor Department. It has climbed further this year to an average of 18.5% through August, not adjusted for seasonal variation.”

Despite the protests of some very loud xenophobes, the fact is that the American workforce is stronger when people come to this country to work. These workers pay taxes and spend their wages in the local community, and they help create jobs with their consumer demand, just the same as American-born workers. And our unemployment rate is still lower than it’s been in decades, meaning that no matter what you might hear from some quarters, nobody is stealing anyone’s job. There’s more than enough work to go around.

We’ve mentioned a few times in the past few months that American wages are finally rising higher than inflation, pushed by big union wins and strong consumer demand. But back in the beginning of this job boom, trickle-downers were warning that higher wages were causing inflation, and I’d expect those arguments to start picking up again even though inflation is leveling out and paychecks are still growing.

To those naysayers, multiple recent reports have shown no correlation between rising wages and inflation. Peter Coy notes that a report from Rosenberg Research & Associates utilized “a statistical test (called Granger causality) that found inflation causes wage increases, but not the other way around.” And Axios reported on a new Goldman Sachs report finding that the “big wage hikes that unions are demanding — and some getting — are unlikely to set inflation soaring again”—even if UAW workers were to get the 40% wage increases that they were demanding at the beginning of the strike.

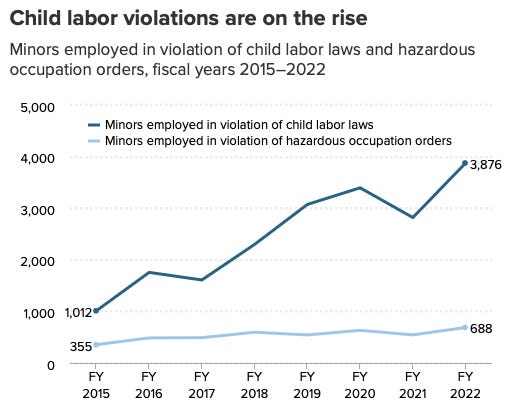

Legally and Illegally, Child Labor Is on the Rise

In the last two years, 16 states have passed or considered the passage of laws that would significantly roll back child labor protections. The Economic Policy Institute reports that the latest such rollback is in Florida: “Currently, Florida employers cannot schedule 16- and 17-year-olds to work more than eight hours per day on school nights or more than 30 hours a week while school is in session,” EPI’s Nina Mast and Jennifer Sherer note. “Newly proposed legislation would allow employers to schedule teens 16 and older for unlimited hours, including overnight shifts during the school year.”

Leaders in these states aren’t spontaneously coming to the decision to relax rules on child labor. There’s a lot of money behind this push, and EPI points the finger at one group that’s airlifting pre-written legislation in to states: “The bill bears similarity to child labor legislation heavily backed in other states by the Foundation for Government Accountability (FGA)—a right-wing dark money group based in Florida—and its lobbying arm Opportunity Solutions Project.”

And as many states relax their regulations, businesses are testing the limits of the regulations that are already in place to protect American kids from child labor. Over the last ten years, the number of child labor violations has more than doubled—and those are just the workplace violations that regulators are able to identify.

The EPI report makes it clear that this isn’t just your standard free-market trickle-down economics at work—it’s economic extremism, intended to erode the pillars that support American prosperity and democracy: “dismantling child labor laws is just one prong of a broad agenda FGA promotes to weaken and eventually demolish the role of government and public institutions (including public schools), reduce and privatize the provision of public services (especially those most needed by poor children and families), and suppress the democratic process.”

It’s easy to despair when you see politicians celebrating legislation making it easier for teenagers to work in slaughterhouses and on factory floors. The news is shocking and depressing enough that it can make you want to give up. Here’s a dirty little secret: That’s exactly what these trickle-downers are hoping for—they want to shock people into giving up on the political process. It’s our job to stand against them and reject their lowest-common-denominator rule of governance. Our forebears stood together to beat back the horrors of child labor a century ago. If they did it, so can we.

This Week in Middle Out

In another sign that housing continues to be the most complicated and challenging aspect of the modern economy, Wall Street investors believe that America’s single-family homes are overvalued, and so they’re not snapping up those homes away from American families. It’s good that Americans won’t have to compete with the bottomless funds of investment firms when looking for houses, but this is another confirmation that housing prices are unnaturally, unsustainably high around the country.

This week, a case regarding the constitutionality of how the Consumer Financial Protection Bureau is funded was brought before the Supreme Court. A coalition of payday lenders and other extractive financial institutions are arguing that the CFPB, which was created 12 years ago to protect consumers of financial institutions and which has levied multi-billion-dollar fines against bad actors like Wells Fargo, should be completely wiped out and all its actions should be “rewound.” Happily, court observers believe that several of the more conservative Supreme Court Justices didn’t buy this argument and are unlikely to unspool the CFPB.

A new lawsuit from the Justice Department lays out how the meat industry has colluded to keep meat prices artificially high for the past four decades, writes David Dayen at the the American Prospect: “Agri Stats, as described in the complaint, is essentially a work-around for explicit collusion by meat processors. The company delivers weekly reports based on proprietary data given to them by meat processors, which have so much granular detail that everyone in the industry knows precisely what everyone else is doing, including the prices they’re offering. This allows for specific coordination that raises prices for everyone purchasing meat, while boosting profits for the processor middlemen.”

A judge cleared the way for New York City’s new minimum wage for food delivery workers, ensuring that gig economy workers will get “about $18 per hour at first, starting in October, and to increase that amount to $20 per hour by 2025. Delivery workers currently make about $11 an hour on average, according to the city’s estimate.”

While Congress failed to renew the Child Tax Credit which pulled millions of American children out of poverty, fourteen states are enacting or have enacted child tax credits of their own, writes Marcus Baram of Capital & Main. “New Mexico is among the worst states for child poverty. Nearly a quarter of the children are poor due to economic inequality, high rates of working poor and a lack of funding for early childhood education and higher education, say anti-poverty advocates in the state. The federal credit helped lift about 38,000 children out of poverty in the state in 2021, and the powerful effect of that benefit — and its abrupt expiration — inspired the state to join others in enacting a new state child tax credit in March 2022.”

Credit rating agency Moody’s issued a report warning about huge risks in the private equity sector that could eventually harm the whole economy. It’s a (purposefully) complicated system, but basically: Private equity firms are borrowing money to scoop up weak companies and then they profit by offloading those companies. But Moody’s warns that PE firms and their lenders are getting too friendly and the loans are flowing too easily, with very little oversight. This could create a bubble in which PE firms don’t actually have the cash to pay their debtors, thereby risking the entire economy. More government oversight of this loan process would prevent such a bubble from ever forming.

And speaking of alarm bells around private equity, Rachel Phua warns that public worker pension funds are one of the leading funders of PE firms, meaning that working Americans are unfortunately footing the bill for this extractive form of capitalism that sucks value out of the economy without putting value back in.

We know that life expectancy in the United States is dropping, and that income inequality has a big role in why Americans are dying sooner than their peers in other technologically advanced nations. But now a new report shows that Americans without a college degree are dying younger than college-educated people. “For the least-educated, which roughly means high school dropouts, death rates have been rising starkly for white men and women, and rising slightly for Black women, while staying roughly constant for Black men,” Dylan Matthews writes at Vox. It’s easy to misinterpret this data, so let’s state it plainly here: More education doesn’t add years to a person’s life. The lack of a college degree hurts peoples’ lifetime earnings potential, and poorer people don’t have access to the healthy food, quality medical care, and stress-relieving leisure activities that extend life expectancies. Being poor in America takes years off your life.

This Week on the Pitchfork Economics Podcast

Roosevelt Institute economist Mike Konczal joins the podcast this week to talk with Nick and Goldy about why inflationary price increases are finally leveling out, and what this latest development has to say about the higher prices Americans have been paying over the last two and a half years. This is a thoughtful conversation about all the assumptions that the Federal Reserve (and mainstream economists) have made about inflation, and why comparing these higher prices to the 15-year inflationary crisis of the 1970s and early 1980s is a fool’s errand.

Closing Thoughts

JP Morgan CEO Jamie Dimon’s comments about artificial intelligence made headlines this week. Speaking on Bloomberg TV about the potential uses of AI, Dimon said, “Your children are going to live to 100 and not have cancer because of technology...And literally they’ll probably be working three-and-a-half days a week.”

Dimon is far from the first person to predict that the efficiency of technology will reduce the number of hours that humans need to work. Experts and academics have been confidently predicting that Americans will soon be routinely working 4-day workweeks since at least the 1970s. And even those economists’ predictions were on the mild side—back in 1930, economist John Maynard Keynes predicted that technology would cut the workweek back to 15 hours by now. (Bear in mind, too. that the “you” Dimon is addressing in the above quote is probably not the entire American public—he’s likely envisioning these benefits for an audience of the wealthiest few Americans.)

This is a time-tested strategy for the wealthy and powerful: When you invest heavily in a new technology, you sell it to the general public as a time-saving efficiency hack—one that will make life easier and eliminate wasted hours. Those optimistic promises make people more eager to buy into the new technology, which of course benefits wealthy CEOs like Dimon, who watch their fortunes swell as more people buy in.

We at Civic Ventures love technology and innovation—economic growth comes through the creation of solutions to human problems, after all, and the faster those solutions evolve the better we all do. But it’s important to remember that while technology often helps us work more efficiently, at no time in human history has technology ever magically reduced the number of hours that Americans work.

I love my iPhone, for instance, but it has absolutely not reduced the number of hours that I spend on the job. And I’m sure that in the coming years AI will transform my life in ways that I never thought possible, much the same way that I couldn’t imagine all the ways my iPhone would change my life back in 2005. But while AI might help me work smarter in the years ahead, it’s not very likely that it will cause me to work less.

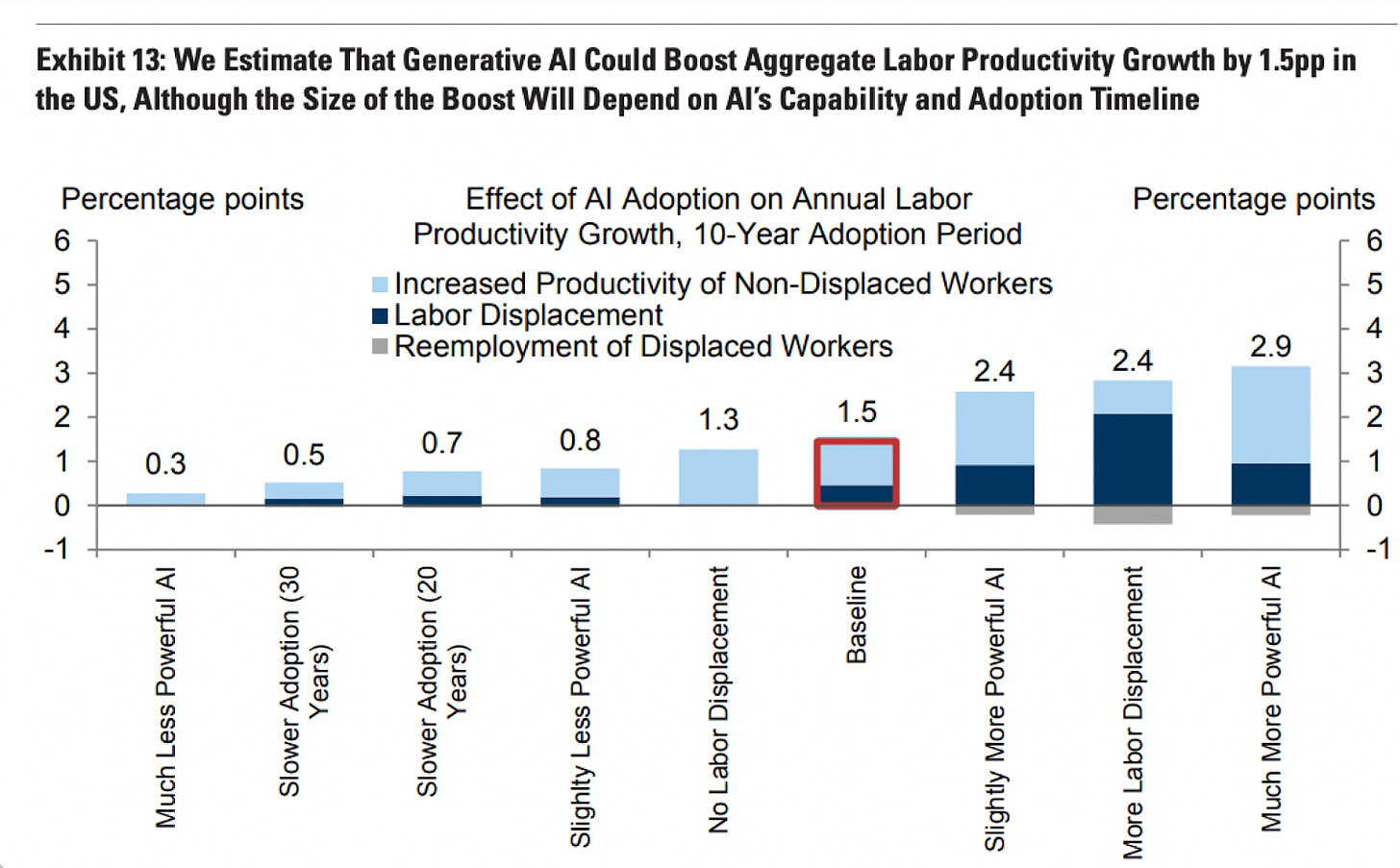

Paul Krugman wrote this week about a Goldman Sachs report on AI that predicted the most likely outcome would be a 1.5% increase in worker productivity per year, adding up to about a 15% productivity increase over a decade. The amount of “labor displacement”—in other words, workers fired because AI can do their jobs—varies greatly depending on how powerful the AI becomes, which fields it’s deployed in, and how quickly it’s adopted.

Keep in mind that this is all speculation on Goldman Sachs’s part. But I do have to note that none of Goldman’s scenarios include a shorter workweek or less work due to the proliferation of AI. That has never naturally happened in the history of technological advancement.

Workers have already made big gains in the burgeoning field of artificial intelligence in the workplace. For the New York Times, labor professor Adam Seth Litwin notes the historical success of the Writers Guild of America’s recent agreement which established that AI cannot be considered the primary author of a screenplay, saying “the W.G.A. has delivered a gift to future union negotiators. It’s illuminated an approach to negotiating around technology, and demonstrated the ways in which a white-collar rank-and-file can leverage labor solidarity.”

In fact, the only way that Americans were able to shift the standard from a six-day workweek to a five-day workweek was through consistent labor action—strikes, political persuasion, and other forms of protest. So you should always turn a skeptical eye to the promises of people like Dimon who stand to make a huge financial killing from the technology that they’re selling. If a four-day workweek is something that you feel passionate about, you shouldn’t trust Dimon’s claim that AI will hand it to you. You’ve got to work to create the world that you want.

Be kind. Be brave. Take good care of yourself and your loved ones.

Zach