Friends,

Last week, the New Republic released economic polling that every elected leader in America should study very closely. I’ll let TNR’s Ryan Kearney sum up the results in his own words:

“If the poll can be summarized in one sentence,” Kearney writes, “it’s this: Americans have a solid grasp of the highly unequal concentration of wealth in the United States—and they think it’s rotten.”

Over the last 40 years, “A resounding 78 percent of respondents said the rich have gained “much more” than the middle class, and another 10 percent said, “a little more.” (In this case, the 78 percent are absolutely correct—the wealthiest one percent have taken nearly $80 trillion out of the paychecks of working Americans over the last 40 years.)

“Nearly three in four poll respondents said that ‘the rich have too much’; even 48 percent of Republicans felt this way. Given that sentiment, it stands to reason that people also overwhelmingly believe that the rich aren’t taxed nearly enough,” Kearney continues. “Two-thirds overall, including 43 percent of Republicans, said that the top 0.1 percent pay ‘too little’ in taxes—and they felt roughly the same about the top 1 percent. A majority, 56 percent, also said that the top 10 percent aren’t being taxed enough.”

The full poll results from Embold Research (PDF) are well worth a read. They should stand as a warning that Americans of all political stripes are fully aware of the 40 years of trickle-down theft from their paychecks—and more importantly, they know exactly where that money went: Up to the top of the income scale.

This week, many were shocked by the victory of Democratic Socialist State Assemblyman Zohran Mamdani in the New York City mayoral primary. Mamdani won, at least in part, because he made inequality and prices central to his campaign by running on raising the minimum wage and lowering costs for groceries and housing for working New Yorkers. (If you’d like to explore how he addressed the issues, I thought Momdani’s interview with Derek Thompson was particularly revealing, and Eric Lach’s primary postmortem for the New Yorker explains Momdani’s messaging successes from the ground level.)

Some of Momdani’s proposed policy solutions to those problems aren’t my cup of tea (they just aren’t very feasible or middle-out), but it is significant that he was one of the only candidates talking about those problems, and putting forth ideas for solutions.

One of the simplest and most-ignored pieces of advice for people running for office is that you should let the people tell you where they want to go. Cynics like to portray American voters as ignorant or misinformed, but in my experience people in general have a great sense of what their communities need, and they have a pretty good initiation about how to address those issues.

In this case, the people have spoken loud and clear: the cost of living is too damn high. Elected leaders and candidates for office should listen, and respond by making income inequality a leading issue in upcoming elections and—most importantly—by proposing real solutions to the problem.

The Latest Economic News and Updates

The Economy Is Still Stuck in Wait-and-See Mode

Last week, the Federal Reserve left interest rates steady again. This is bad news for Americans with credit card debt, mortgages, and other debts that are subject to interest rates, and it’s also a decision that, in any other time, would have been construed as far too conservative on the Fed’s part. Over the last few weeks, employment numbers have been fairly steady, and inflation has shown a small amount of progress in the right direction. Both of those signals typically demonstrate economic stability, which usually inspire interest-rate cuts from the Fed.

So what’s going on? Former Biden economist Jared Bernstein explains that the Fed’s decision suggests that “Before they start cutting rates to get the interest rate they control back down to more normal levels, they need to better understand the tariffs’ impact on inflation.”

Bernstein adds that the Fed is “clearly forecasting tariff-induced stagflation—slower growth, higher inflation—meaning they’re in the same camp as many of us: tariff-induced inflation is likely to shortly be upon us.”

But we’ve been hearing this for months now, since President Trump first started warning about raising tariffs to the highest levels in a century. Many economists guessed that higher prices caused by those tariffs would begin showing up on store shelves around midsummer, which is pretty much now. While the economy certainly hasn’t boomed, it seems to be defying gravity and largely staying aloft.

Angry Bear blog claims to have spotted the first major instance of tariff-inspired pressures in May’s retail sales report. “As usual, real retail sales is one of my favorite indicators, because it tells us so much about consumers, and since consumption leads employment, it gives us information about the trend in that as well,” they report.

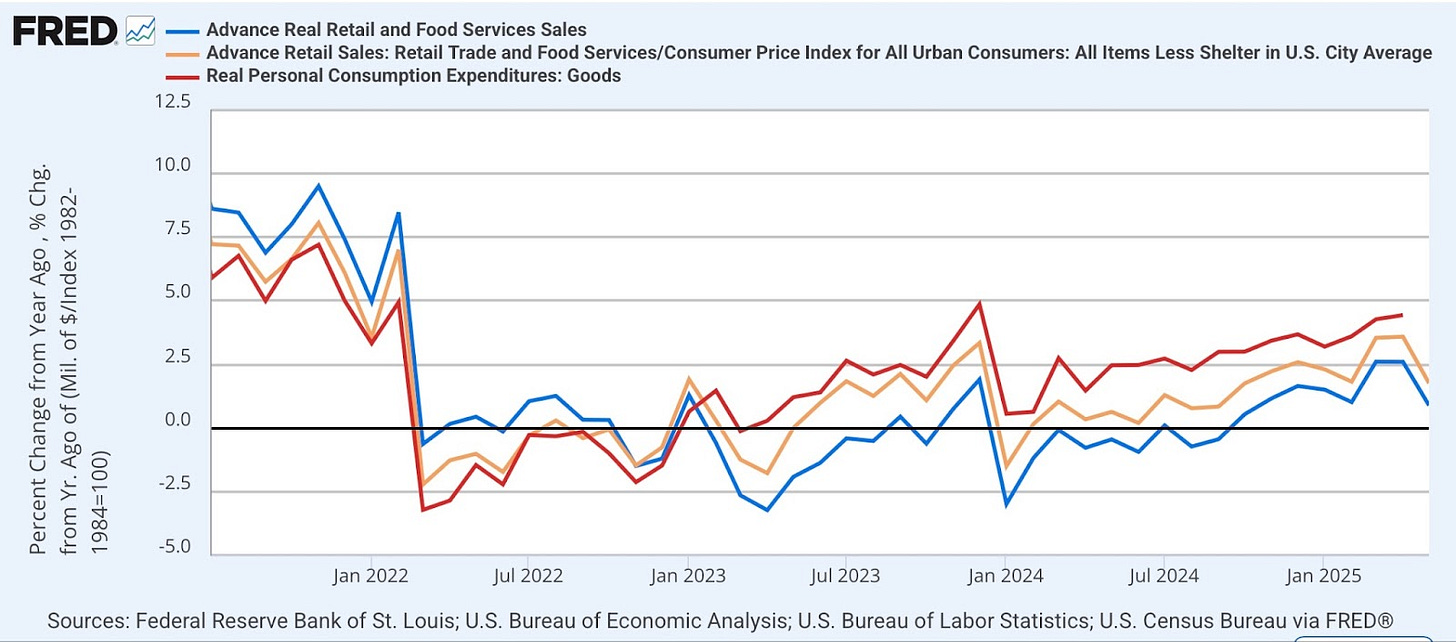

“Nominally retail sales declined -0.9% in May, and were up 3.3% YoY. But because consumer prices rose 0.1%, real retail sales declined -1.0% for the month (blue in the graphs below),” Angry Bear reports. “In recent months,I have also been calculating real sales excluding shelter, because [housing prices have] been distorting the CPI. This month real retail sales ex-shelter were down -1.1% (gold). In the below graph I also show real personal consumption expenditures for goods (red).”

“With rare exceptions – one of which was in 2023-24 – when real retail sales are negative YoY [year-over-year], a recession has followed shortly,” they note. “If next month’s report does not show a further decline, the YoY measure will still be positive. But if it further declines like this month, it’s likely the measure will be negative again.”

We know that retail sales correlate directly with job creation—if Americans are buying things, they create jobs with that consumer demand. Perhaps the American people can sense a shift in the economic dynamic, because an economic report from job recruitment and hiring site Glassdoor from this month shows that employee confidence has hit a record low.

“The share of employees reporting a positive 6 month business outlook fell to 44.1% in May 2025, down from 45.8% in April and breaking the previous record low set in February 2025,” reports Glassdoor economist Daniel Zhao. “Economic uncertainty and economic anxiety are compounding to create an uneasy morass for employees, driving employee confidence lower and lower.” Those numbers are even lower when you focus on entry-level employees—their confidence has plunged to 43.4%

“Economic uncertainty has surged in the last few months. In May, mentions of layoffs in Glassdoor reviews surged 9% and remain up 18% year-over-year as layoff fears continue to rise after plateauing in 2024,” Zhao writes.

As you might expect, the months of job cuts, hiring freezes and layoffs has left government employees feeling even worse than private-sector workers. “Employee confidence in government & public administration continues to plummet, with only 34.5% of employees having a positive outlook in May,” Zhao writes. “In the half year since the U.S. presidential election, employee confidence in the sector has dropped a staggering 14.5 percentage points—almost 1 in 2 (49%) employees expressed a positive outlook in November 2024, compared to just above 1 in 3 (34.5%) as of May 2025.”

So it’s not just the economists—a historic number of working Americans are waiting for the other economic shoe to drop, with prices expected to rise and the economy expected to shrink.

But when will it happen, if at all? Federal Reserve Chair Jerome Powell explained the situation in his press conference after the announcement that the Fed was keeping interest rates in stasis. When it comes to tariffs, Powell said, “There's the manufacturer, exporter, importer, retailer, and consumer. And each one of those is going to be trying not to be the one to pay for the tariff. But together they will all pay. Or maybe one party will pay it all.”

In the end, Powell said, “that process is very hard to predict. And we haven't been through a situation like this, and I think we have to be humble about our ability to forecast it. So that's why we need to see some actual data to make better decisions.”

In other words, the whole economy is locked into a waiting game.

The American People Don’t Like Trump’s Tax Bill

In the introduction to and conclusion of this week’s Pitch, we discuss a pair of political concepts that are hugely unpopular with the American people. At a time like this one, in which the American people have coalesced into two roughly equal-sized political factions that are diametrically opposed to each other, it’s surprising to see such lopsided polling.

But perhaps these increasingly wide gaps in polling are a result of that increased polarization. In other words, if a political party subscribes to more and more extreme ideas in order to differentiate themselves from the other party, it stands to reason that at some point, they’re going to embrace some wildly unpopular ideas.

That seems to be the case with the Trump Administration’s tax bill, which would deliver big tax cuts to wealthy people and slash Medicaid benefits, along with other unpopular ideas like the widespread selling off of public lands. (See this email’s conclusion for more on that policy.)

NBC News’s Sahil Kapur aggregates some of the most recent polling on the tax bill that’s currently waiting on approval in the Senate:

FOX NEWS: 38% favorable, 59% unfavorable

QUINNIPIAC: 27% favorable, 53% unfavorable

KFF: 35% favorable, 64% unfavorable

PEW: 29% favorable, 49% unfavorable

WaPo-IPSOS: 23% favorable, 42% unfavorable

And this is about more than just saying “no” to unpopular ideas. A majority of voters polled were clear about what they want from their leaders: “In a recent NBC News Decision Desk poll asking Americans what issue matters most to them, 51% picked ‘maintaining current spending levels on programs like Medicaid,” Kapur writes, while “21% picked ‘continuing and expanding income tax cuts and credits’ enacted by Trump in 2017, and 28% picked ‘ensuring that the national debt is reduced.’”

The next time you hear someone complain about the polarized and partisan American public, you should push back against their claims by showing them polling like this. It couldn’t be any clearer: Republicans don’t march in lockstep with their elected leaders—many of them can tell that they’re being sold a trickle-down bill of goods, and they outright reject it. If this bill passes through the Senate, it won’t be the will of the American people that did it—it will be a few dozen elected leaders doing the will of their wealthy donors at the expense of their constituents.

Housing Sales Drop While New Construction Hits Five-Year Lows

America’s housing crisis is spurred in large part by a shortage of available homes, and the only way to solve that problem is by building homes. Unfortunately, the latest data shows that doesn’t seem to be happening.

“Builders broke ground on home construction in May at the slowest pace in five years,” writes Courtenay Brown at Axios. “The issuance of building permits, an indicator of the appetite to build homes, also hit a five-year low.” Remember, five years ago was the dawn of the pandemic, when most of the country was in the middle of lockdowns. Brown adds, “Sentiment among homebuilders dropped to the lowest level since 2022 in June.”

“Housing starts fell almost 10% last month to an annualized pace of 1.3 million, well below the rate that economists expected,” Brown explains. “Building permits also came in worse than expected, particularly for single-family homes. They dropped to an annualized rate of 898,000, nearly 3% below April.”

Clearly, the demand for housing is out there. In an Econ 101 framework, the free market would simply fill that demand with a fresh new supply of houses. So what’s happening here? For one thing, the Trump Administration's 50% tariffs on steel and aluminum are starting to take their toll. For another thing, the Administration’s agenda of forced deportations is hitting the construction labor force, which is made up of a large number of immigrants.

At the same time, a new report from Redfin shows, “There’s a total of $698 billion worth of homes for sale in the U.S., up 20.3% from a year ago and the highest dollar amount ever.”

“The total number of homes on the market nationwide rose 16.7% year over year in April to its highest level in 5 years,” Redfin reports. “The typical home that sold in April took 40 days to go under contract, 5 days longer than a year earlier. There’s also a growing share of inventory that has been sitting on the market for longer than two months.”

More than 2 out of every 5 homes in the US have been on the market for at least 60 days without selling, which Redfin calls a “stale listing.” Stale housing inventory declined drastically during the pandemic, but the number of unsold homes is now a little higher than most of the years following the housing bubble and the Great Recession.

Home sales across the US are actually declining, but home prices rose 1.4% in April. Again, Econ 101 would tell us that prices should decrease along with demand, and houses should sell for exactly the price that they are worth on the free market—no more, no less. But the free market doesn’t determine value—human beings do. And human beings right now are wracked with uncertainty about the economy.

Mortgage rates are still very high due to the Federal Reserve’s decision to keep interest rates high. And the market is flooded with homes for sale because, as Redfin explains, “homeowners [are] trying to cash out due to economic uncertainty.”

Redfin expects home prices to decline by 1% over the next year, but it remains to be seen if that will be enough to convince potential buyers to come in out of the cold, particularly if mortgage rates remain high. In my home city of Seattle, single-family home prices have fallen by 1.2% and townhome prices have dropped by almost 5%, but the housing market is still very cool, with few buyers jumping in to take advantage of those lower prices.

To return to an earlier theme, it seems as though the housing market is deep into “wait and see” mode, with sellers unwilling to drop prices too far and buyers refusing to lock in to high mortgage rates. And with the construction of new housing dipping, it seems as though the housing crisis won’t be going away anytime soon.

This Week in Trickle-Down

A study from Penn Wharton finds that “Unauthorized immigrants paid about $24 billion in Social Security taxes in 2024 despite being ineligible for future benefits,” and it extrapolates that if the Trump Administration’s current schedule of deportations continues, “Replacing the lost revenue from permanent deportation would require increasing payroll taxes, or some other equivalent, to collect an additional $180 per year from the median U.S. household in 2025, growing at around 3.5 percent each year in the future.”

Users of Klarna and other buy-now-pay-later apps should beware: Starting soon, late payments on small BNPL loans will have a negative impact on their credit scores. “FICO announced Monday that it will begin incorporating buy-now-pay-later data into new scoring models, marking the first time the company has factored the popular loans into credit scores.”

This Week in Middle-Out

Vox explained how Oklahoma, one of the most conservative, trickle-down friendly states in the union, has had a universal free pre-k program for nearly three decades.

Next week, more than 880,000 workers around the country will get a raise when their localities enact minimum-wage increases on July 1st. The Economic Policy Institute explains that workers in Alaska, Oregon, Washington DC, and several cities will make an extra $397 million thanks to their local minimum wage laws.

This Week on the Pitchfork Economics Podcast

Atlantic writer Rogé Karma joins Nick and Goldy to discuss the big lie behind the argument that immigrants come to America to take jobs away from hardworking Americans. The mass deportations of the Trump Administration are cloaked in claims of economic populism, but Karma proves that immigrants actually grow the economy for everyone.

Closing Thoughts

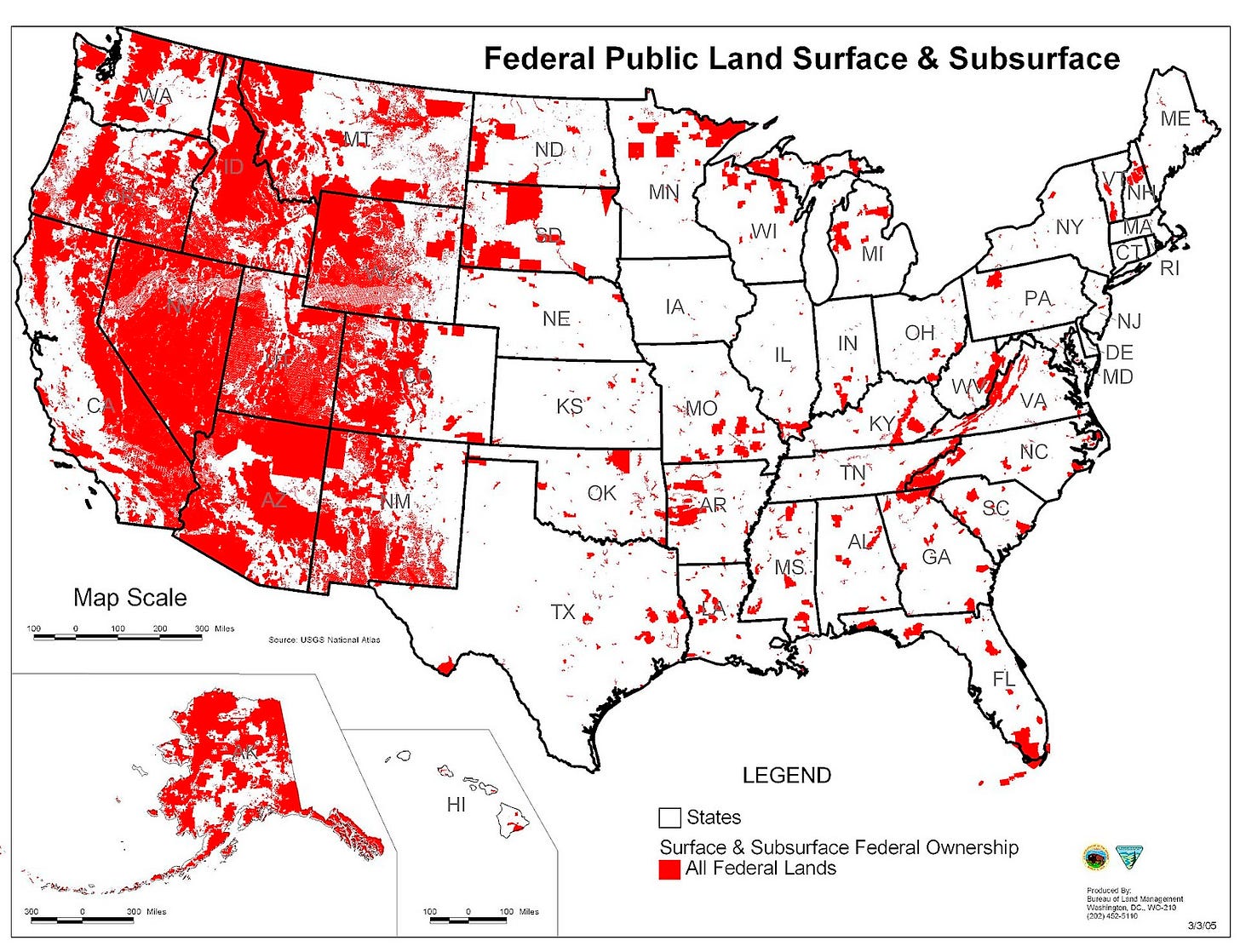

For the last two weeks, Americans have been sounding the alarm over one of the most under-reported policies smuggled deep inside the tax bill that the Trump Administration is trying to push through Congress: The forced sale of as much as 250 million acres of federal land in western states to corporate interests.

“These aren’t just any lands,” writes Janessa Goldbeck on Bluesky. “They include:

Wilderness study areas

Roadless national forests

Big game migration corridors

Local recreation lands

Tribal homelands and sacred sites (with NO right of first refusal)”

And the Wilderness Society explains that “The bill’s process for selling off lands runs at breakneck speed, demanding the nomination of tracts within 30 days, then every 60 days until the arbitrary multi-million-acre goal is met, all without hearings, debate or public input.”

In theory, this massive sale of public land is supposed to promote the building of affordable housing in order to address America’s housing crisis. But anyone who lives in western states could tell you that building a suburban development in most of the federally owned lands displayed on the below map would result in virtually no useful housing. The land is generally far away from jobs, infrastructure, and neceies like grocery stores:

If the buyers don’t build housing on the land they buy, they can resell the land after ten years. Goldbeck explains that it amounts to a “Wild West-style land rush, all to fund giveaways to the rich at the expense of veterans, rural communities, Indigenous nations, and every American who cherishes wild places.”

Obviously, selling off these lands would be an environmental catastrophe. Janet Kinneberg notes that one of the first packages that would be up for sale includes 3.3 million acres in the high country, which “is where the headwaters for 60% of the West's freshwater originates.” Whoever buys that land would then have tremendous control over fresh water throughout the western states.

The forced, speedy selloff of public lands to corporate interests feels like a liquidation sale—the kind of cash-grab that private equity vultures engage in after they’ve plundered a company of most of its valuable assets.

Some trickle-downers are arguing that the federal land is just sitting there, not creating any value. But that’s a painfully short-sighted and damaging way to think about economic value. Trickle-downism has been fighting the very concept of the public good for over 40 years now, and these protected lands are the epitome of serving the public good—they create drinking water for tens of millions of Americans, they offer places to hike and hunt and camp and explore, and they protect that land for future generations to enjoy or use as they will.

It should be said that this proposal is incredibly unpopular—even in Wyoming, which voted overwhelmingly for Trump in the last three elections. Americans who come into contact with these lands understand their importance, and they’re happy that it belongs to all of us, and not a handful of corporations. High-profile celebrities who are traditionally friendly with Republican lawmakers, including Ted Nugent and Joe Rogan, have also made their displeasure known.

And this week, the Senate Parliamentarian has announced that the sale of lands isn’t budget-neutral, which means the passage of that language into law would require 60 yes votes, as opposed to the 50 votes that the rest of the bill requires. Utah’s Senator Mike Lee, who wrote the selloff into the bill, announced on Tuesday that he was “making changes” in the language of the bill “in the coming days."

If you’re interested in making your voice heard on this issue, use the Outdoor Alliance’s form to reach out to your senator to protest the sale of federally owned lands and share it far and wide with your friends and family.

Be kind. Stay strong.

Zach