Friends,

This week began with news that the Trump Administration and China had reached a 90-day trade deal that would result in 30% tariffs on Chinese imports. That news inspired the stock market to soar back into positive territory for the first time in months.

But the stock market isn’t the real American economy—it’s more like a gauge for how the wealthiest Americans are feeling about the American economy. And for as much as trickle-downers like to try to convince us that the free market is a perfectly rational actor, the truth is that the people who make the decisions that drive the market are often prone to irrational, emotional outbursts—panic, fear, and false confidence all drive the stock market at different times. In fact, it’s pretty easy for someone with the power of the presidency to manipulate Wall Street for brief periods. That’s exactly what we saw this week.

This graphic from the New York Times perfectly illustrates why the trade deal announcement was not a great deal for the American economy:

As you can see here, the Trump Administration has levied a number of tariffs on China since taking office: First ten percent, then 20 percent, then 54% before ratcheting up quickly to 145%. On May 12th, the Administration simply agreed to lower the tariffs back down to 30 percent, which is still much higher than any tariff levied in the last century.

Put in a way that actually matters: At the height of Trump’s tariff fever in April, economists at Yale estimated that the average American household would pay an extra $3400 annually to account for the extra prices from tariffs. After the May 12th reduction, those Yale economists revised their numbers and determined that American households would still pay an extra $2200 annually to account for Trump’s tariffs. So while tariffs aren’t in the triple digits anymore, they still amount to an unnecessary four-digit annual expense for working Americans.

So why is Wall Street cheering on a “trade deal” that Yale’s economists say would raise inflation by 2% annually for American families? Here’s the dirty little secret about tariffs: They don’t affect everyone equally. Just as sales taxes disproportionately impact poorer Americans because lower-income families spend a bigger share of their income on goods than wealthier families, so will the tariffs be paid disproportionately by low-income families.

The tariffs also impact small businesses far more than big corporations. At the beginning of the tariff panic, big grocer Albertsons issued a memo telling its suppliers that they would not pay the tariffs on products in their stores. And because Albertsons basically has monopoly power over large swaths of the country, controlling access to millions of customers, small grocery suppliers have no choice but to absorb much of the cost of tariffs themselves.

For Seattle public radio station KNKX, Emil Moffatt talks to the owner of one of my favorite local ice cream shop chains, Molly Moon Neitzel, about what tariffs mean to her as a small business owner. Neitzel prides herself on paying a living wage to her workers and prioritizing local ingredients in her ice cream, but even she’s not immune to tariff troubles: The compostable spoons she offers in her ice cream shop are made in China and subject to the tariffs.

Under the previous 145% tariffs, Neitzel estimated that she would pay somewhere between an extra $90,000 and $250,000 on tariffs for the spoons alone. But even under a 30% tariff, that means she’ll lose thousands of dollars, maybe tens of thousands of dollars, every year to tariffs. That money could have gone to worker wages, or the opening of a new Molly Moon’s location.

Trump Administration officials claim that tariffs will ultimately help American small businesses by reshoring manufacturing right here at home. But that’s just another trickle-down lie, as false as the claim that raising the minimum wage kills jobs.

For the Washington Post, Heather Long visited PS Furniture, a small manufacturing company that employs 39 people in a low-income rural Pennsylvania town, to see how the tariffs are working out. While sales at PS Furniture did increase after the tariffs were announced, “Roger Clark, the company’s executive vice president, says it would probably take years of higher sales for it to expand.”

“While about 75 percent of what [PS Furniture makes] is truly American-made, some parts come from overseas: felt from Germany, tropical hardwood from Brazil and one folding chair from Taiwan,” Long reports. “They order only a little from China, but Kean pulls out a bill from his bag and shows me the extra “tariff fee” of 50 percent they just got charged for a part they weren’t able to import in time.”

Long continues:

I ask each worker how they think Trump’s tariffs are going. Not a single person thinks it’s going well. “It’s not good so far. We just pay more and more,” one tells me. “Maybe there will be a recession,” another adds. The No. 1 concern is prices going even higher.

The truth about tariffs is that they’re a classic trickle-down scam in slightly different clothing: Working Americans and small businesses will pay more while wealthy Americans do fine, and corporations jack up prices and report record profits. That may be reason for Wall Street to celebrate, but on Main Street, Americans know highway robbery when they see it.

The Latest Economic News and Updates

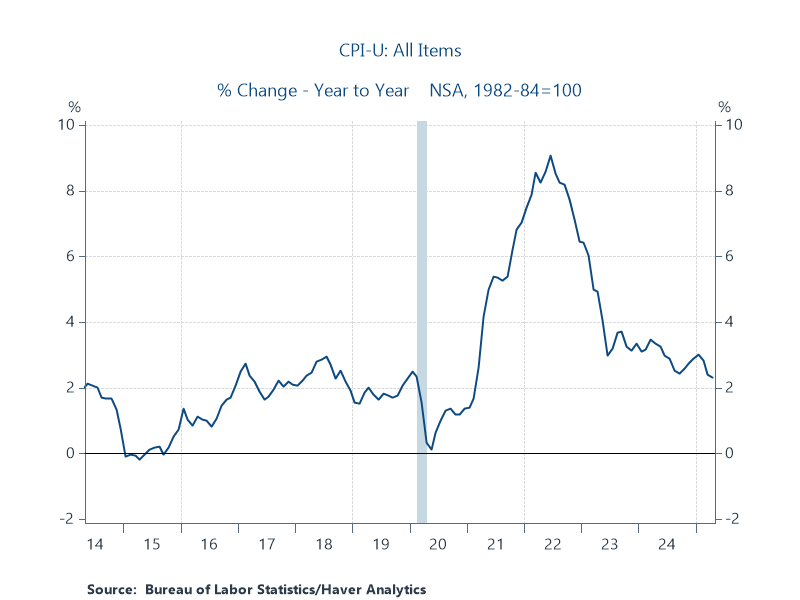

Inflation Doesn’t Show Signs of Tariff Shock—Yet

“U.S. inflation cooled slightly in April in what economists warn could be a final lull before a likely surge in consumer prices stemming from President Trump’s trade war,” writes Colby Smith at the New York Times.

“The Consumer Price Index rose 2.3 percent from a year earlier, the slowest annual pace since early 2021, data released by the Bureau of Labor Statistics showed on Tuesday,” Smith continues. “A closely watched measure of underlying inflation, which strips out volatile food and energy items, climbed 2.8 percent compared with the same time last year, in line with March’s year-over-year rise.”

Grocery price increases slowed by .1 percent in the last month, although most of that decline can be attributed to the nearly 13% drop in egg prices over the course of April. Though egg prices are still near all-time highs, last month saw prices drop due to fewer bird flu outbreaks, accompanied by a dip in demand that occurs annually after Easter.

Most experts predict that as tariffs begin to raise prices and slow down the number of imports, the inflation rate will rise in the months ahead. Stephen Juneau, an economist at Bank of America, told the Times that due to tariffs, he “forecasts that inflation will rise to as high 3.5 percent by the end of the year, as measured by the core personal consumption expenditures price index.”

And Jared Bernstein points out an ongoing weakness that is making life more expensive for Americans in every state: “Housing inflation, which accounts for about a third of the index, remains a solid point above its pre-pan level,” Bernstein writes. “This is a market that’s broadly undersupplied, especially in places where people want to live, and my guess is that it will continue to pressure the overall index.”

Housing is significantly more expensive than it was during the pandemic, and there’s no end in sight for the housing price inflation that has plagued American families for the last five years.

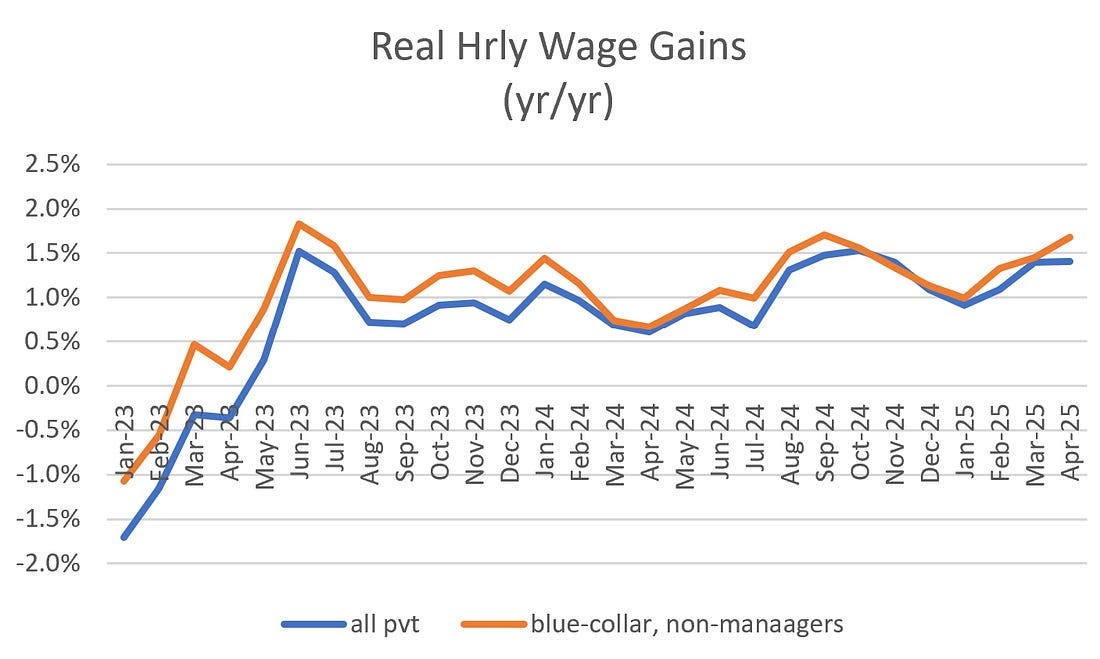

Still, Bernstein does deliver some good news about the paychecks of working Americans: “In April, real wages rose 1.4% for all private workers and 1.7%” for blue-collar, non-college-educated workers.

So the wages of the American people are continuing the rate of growth that they’ve held for the past two years, which is a solid economic signal. It’s not anywhere near enough to close the $80 trillion inequality gap that expanded over the last 40 years of trickle-down, but at least wages are growing, rather than shrinking.

Trickle-Downers Are Coming for Medicaid

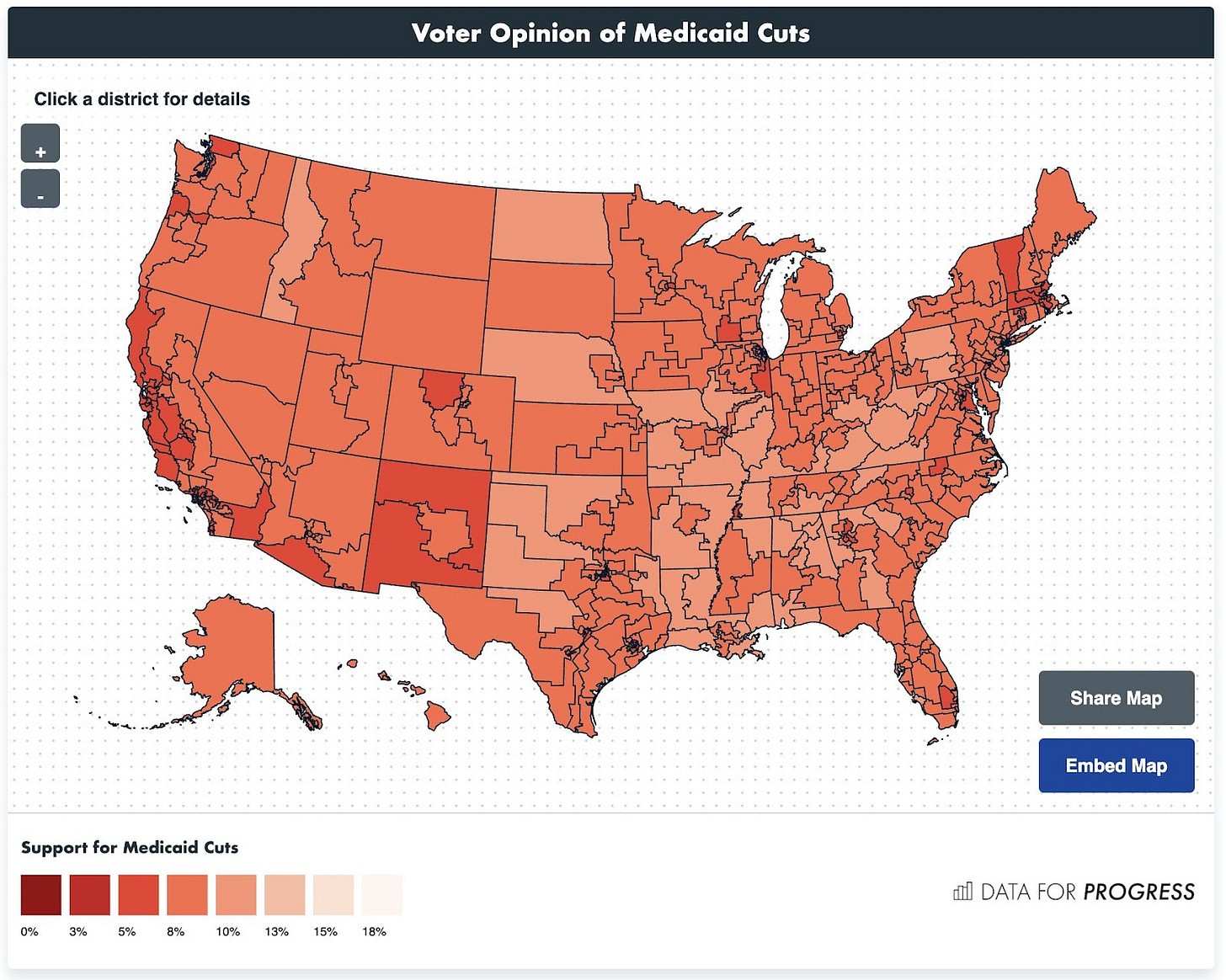

House Republicans this week admitted that their plan to cut taxes by $4.5 trillion will be funded in large part by “at least $880 billion in cuts largely to Medicaid,” reports Lisa Mascaro for the Associated Press. The Congressional Budget Office’s preliminary estimates show that “the proposals would reduce the number of people with health care by 8.6 million over the decade.”

This is dangerous territory for House Republicans to enter. Data for Progress research shows that “There is not a single congressional district in the U.S. where more than 15% of voters support cuts to Medicaid.” That’s an astonishing number—I’m hard-pressed to think of another issue that enjoys this kind of support among Americans. In fact, Data for Progress finds that a majority of voters want Congress to increase funding for Medicaid.

That’s why we’ve seen a remarkable outpouring of public support for Medicaid, including a protest in the Capitol this week that shut down a House budget hearing.

What are House Republicans trying to win by cutting Medicaid? A tax plan that overwhelmingly benefits super-rich Americans. The Tax Policy Center analyzed the tax plan and found that “more than two-thirds of the plan’s tax cuts would go to those making about $217,000 or more” per year, which represents “the highest-income 20 percent of households. The top one percent, those making more than $1.1 million, would get nearly one-quarter of the tax cuts.”

While about one-third of low-income households would get a tax cut of roughly $600, the Tax Policy Center finds, “more than 98 percent of the top one percent of households would get a tax cut.” And those richest households would get a lot more than $600 back. Specifically, they’d see tax cuts of “more than $100,000, or nearly 5 percent of their after-tax income.”

Meanwhile, the Center for American Progress reports that all the proposed service cuts in the House Republican budget could eventually wind up costing American families nearly $20,000 per year. From SNAP cuts to deregulation in the energy sector, American families will spend more money to get less under this proposal.

This is trickle-down economics at its most pure: Redistributing wealth from low-income households to the pockets of America’s wealthiest few, largely at the expense of a program that cuts expenses and provides efficient healthcare for millions of Americans who need it.

This Week in Trickle-Down

Senator Bernie Sanders released a report (PDF) showing that the Trump Administration has cut about 31% of the nation’s cancer research funding, and $12.7 billion in health funding altogether.

And the New York Times reports that other nations have started to capitalize on those research cuts by advertising to woo scientists and medical professionals who have lost jobs to the Trump Administration’s cuts.

We’ve come to expect trickle-down from the Trump Administration, but EPI reports that local leaders are systematically stripping rights from workers on a state level, too.

This Week in Middle-Out

The Roosevelt Institute makes a great case for why the federal government should prioritize climate change protections as an economic issue. Climate change is raising insurance costs and weakening economic activity for all Americans.

The Washington Center for Equitable Growth explains why federal and state dollars should be used to create jobs in parts of the country with distressed labor markets—meaning, places where it’s hard for a significant portion of working-age adults to find meaningful employment. The Center estimates that one-third of the American population lives in a distressed labor market.

This Week on the Pitchfork Economics Podcast

Economist Hal Singer joins Nick and Goldy to explain why the Trump tariffs could make another wave of corporate greedflation possible. Singer explains that just as corporations used the broken supply chain as an excuse to raise prices high above costs, thereby raking in record profits, they will also be able to exploit the expectation that tariffs will raise prices for American consumers. It’s a thoughtful conversation reminding us that the reality of economics is far more complex than the “markets are efficient determiners of supply and demand” trickle-down propaganda that we were taught in our Econ 101 classes.

Closing Thoughts

I saw a remarkable sign of progress on social media the other day that I wanted to share with you, but first, I have to provide a little bit of context.

Over a decade ago, back when Seattle was debating the adoption of a $15 minimum wage, one of the biggest challenges the Fight for $15 faced was that trickle-downers who hated the minimum wage basically had the entire media apparatus on their side.

It’s almost hard to recall now, but stories about the minimum wage in local newspapers, on the radio and TV, and even in progressive alternative weeklies at the time often featured credulous interviews with small business owners threatening to close their restaurants and stores if the wage went up, with zero pushback. There were no interviews with workers explaining how much better off they’d be with an increased minimum wage. There were virtually no interviews with economists who believed that raising the minimum wage would supercharge the local economy by ensuring that when restaurant workers make enough to afford to eat in restaurants, they’d create jobs with that increased consumer demand.

Reporters had completely bought into the trickle-down fiction that when you raise the minimum wage, your economy would always lose jobs. They treated this fiction as though it was fact: Raising wages kills jobs. I don’t blame the reporters for believing this—we were all swimming in a media pool that had been purposefully tainted with trickle-down economics for four decades, and that made trickle-down seem as obvious as the sun rising in the east.

This was a huge problem for the Fight for $15 coalition, and we spent a lot of resources pushing back on stories that repeated the trickle-down lie that raising wages kills jobs. We had a lot of conversations with reporters, and we wrote a lot of letters to the editor, and we worked hard to rebut any claim that credulously repeated that talking point.

All that is to explain why this Twitter exchange is so noteworthy. For those who don’t want to click through, Vox writer Kelsey Piper responds to data purporting to show that voters in lower-income California counties were more likely to vote against a minimum wage increase by writing, “seems bizarre to me to assume that poor people opposed to minimum wage increases to $18/hr are ‘voting against their own class interests’ instead of accurately noticing that a higher minimum wage might mean they and loved ones lose their jobs.”

Regular readers of The Pitch will immediately spot Piper’s rote recitation of the false trickle-down talking point that raising wages kills jobs. In the old days, Piper’s mistaken belief would have resulted in hours of work for middle-out economics proponents to attempt to debunk.

Instead, New York Times economics reporter Talmon Joseph Smith jumped in to correct Piper, quoting a Berkeley study that found “a $20/hr min wage in CA led to a wage ‘increase of 8 to 9 percent for workers...no negative effects on fast-food employment; and price increases of about 1.5 percent or about 6 cents on a four-dollar hamburger,” and that “fast-food establishments grew faster in CA than in the rest of the U.S.”

Smith continued, “there truly are few propagandistic lines from the small business community more successful than minimum wage hikes kill jobs.”

“We have years of evidence now,” Smith concluded, adding, “like what are we talking about??”

Let’s be clear that Smith is absolutely right: No reputable study in the past few decades has found that raising the minimum wage kills jobs. He backs up his claims with studies from Berkeley and Cornell, and he even goes on to identify the claim that raising wages kills jobs as “propagandistic.” This is exactly what an economics reporter should do when confronted with a trickle-down falsehood, and it was unthinkable a decade ago when Seattle was in the throes of the $15 minimum wage conversation.

This whole story is to say that progress is possible. It’s also a meaningful refutation of the idea that misinformation is some unstoppable, irreversible force: Here we see truth winning out over one of the most convincing lies in American history, thanks to hard work, the mobilization of workers and voters to change the narrative, and rigorous research. It’s important to recognize your wins when they happen, and this exchange is a win that would have been unthinkable a decade ago.

Be kind. Stay strong.

Zach