Friends,

At some point in the last six years, you’ve no doubt encountered the joke about young people spending too much money on avocado toast. It’s become the perfect sarcastic meme for millennials to express their dissatisfaction with sky-high housing prices, student loans, and other costs that their parents and grandparents didn’t have to worry about—for instance: ”maybe if millennials didn’t buy an avocado toast every single day, then they could afford to purchase a house in 1955 like everyone else.”

The idea of avocado toast eating away at the wealth of young people has become so ubiquitous that you may not remember it was actually a real argument put forth by a real millionaire—specifically Tim Gurner, an Australian real estate developer. “When I was trying to buy my first home, I wasn’t buying smashed avocado for $19 and four coffees at $4 each,,” Gurner told the Australian version of 60 Minutes, adding, “we’re at a point now where the expectations of younger people are very, very high.”

Gurner’s comments have become a symbol of how out-of-touch wealthy people have become from the realities of life for most people in an age of outsized wealth inequality. And this week, Gurner has returned to double down on the blame game. It’s not just millennials who are to blame for the problems in the economy, Gurner claimed—it’s all workers.

“In my view, we need to see pain in the economy. We need to remind people that they work for the employer, not the other way around,” Gurner announced at a summit on the Australian economy this week, adding, “When there’s been a systematic change where employees feel the employer is extremely lucky to have them as opposed to the other way around it’s a dynamic that has to change. We’ve got to kill that attitude.”

Gurner called for a 40 to 50 percent unemployment rate to put workers in their place—that’s not a typo—and he also said that Australia’s slowing employment rate has resulted in “less arrogance in the employment market.”

Most people instinctively know that Gurner is wrong. That’s because his idea of how the economy works is entirely backwards—it’s the workers who create jobs, not millionaire real estate developers and CEOs. When workers have more money, businesses have more customers and need more workers. It’s why a thriving middle class is the source of growth and prosperity in a high-functioning economy.

As intuitive as that is for most of us, executives and vulture capitalists share Gurner’s views – even though they are normally smart enough not to say it on a livestream. In the world of economics, where so many big words and confusing terms obfuscate the real-world impacts of the policy decision, it’s rare that someone so eagerly steps into the villain role and just admits (with glee) they want to harm workers.

One thing most people aren’t making about Gurner’s comments: while slightly blunter in tone, Gurner is essentially offering the exact same prescription that Larry Summers offered when he called for millions of Americans to be laid off in order to bring inflation down. And if you strip the “arrogant workers” barbs out of Gurman’s commentary, it’s not really at all different from mainstream economists’ understanding of how the economy works. Gurman isn’t an outlier—he’s just one of the only trickle-downers willing to admit how he really feels.

The Latest Economic News and Updates

Poverty Soars—but We Know How to Stop It

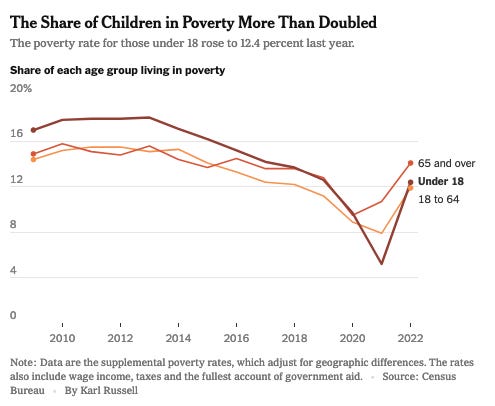

The US Census’s annual poverty report has dominated economic headlines this week—and it’s not good news. “The poverty rate rose to 12.4 percent in 2022 from 7.8 percent in 2021, the largest one-year jump on record,” notes the New York Times. Worse, “Poverty among children more than doubled, to 12.4 percent, from a record low of 5.2 percent the year before.”

The context around this rise is more complicated. As you’ll recall, the Child Tax Credit of 2021 brought child poverty to record-low levels. Last year, Congress failed to renew the Child Tax Credit, so the number of children in poverty basically returned to pre-pandemic levels, as you can see in this chart:

But you can’t rationalize or justify this kind of widespread misery. As the above chart shows, we know exactly how to fight—and potentially even outright end—poverty in the United States of America: Giving people money to spend as they see fit. At this point, a slim majority of our leaders in Congress are simply choosing not to do it.

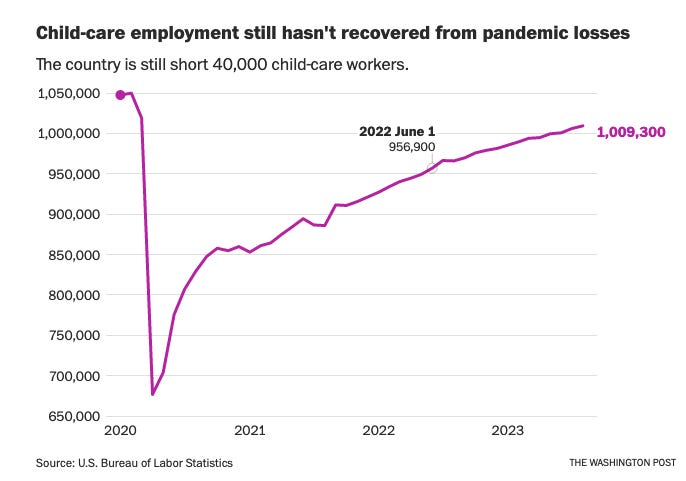

And we’re about to see another huge burden placed on working Americans spurred by the end of a pandemic economic aid program—this time in child care. States around the nation are reaching the end of the $24 billion in investments that Congress allocated for child care programs during the pandemic, reports Abha Bhattarai for the Washington Post.

“Now, with the last of that money expiring this month, an estimated 70,000 child-care programs — or about 1 in 3 — could close as a result of lost funding, causing 3.2 million children to lose care,” she writes. “That translates to $10.6 billion in lost U.S. economic activity, researchers found, adding new strain to a nation already struggling with a profound lack of child care.”

Combine the ending of child care investments with the fact that America’s child care is tied with the Czech Republic for the most expensive in the world, and the fact that there are still fewer child care workers in the nation than there were before the pandemic, and you have a crisis brewing—a crisis that, like the sudden spike in child poverty, is completely avoidable.

Memo to the Fed: On Inflation, Patience is a Virtue

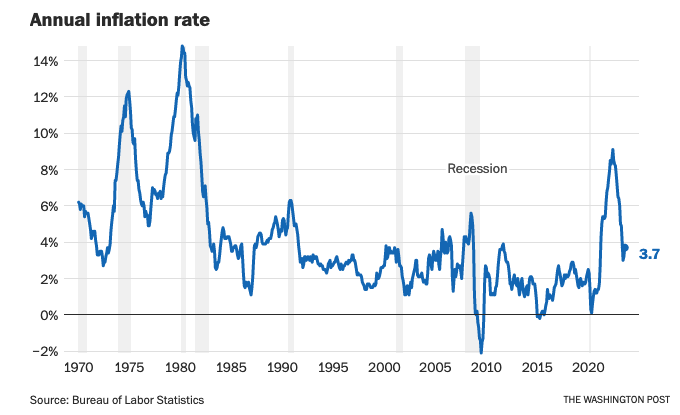

“The consumer-price index, a measure of goods and services prices across the U.S. economy, rose 0.6% in August from the prior month,” writes the Wall Street Journal, noting that “More than half of the increase was due to higher gasoline prices.”

The Journal continues, “So-called core prices, which exclude volatile food and energy items, rose by a relatively mild 0.3% last month after even lower readings in June and July. The August increase reflected higher costs for items such as airfares and vehicle insurance.”

Rachel Siegel at the Washington Post notes that another driver of the uptick, which was expected by most economists, was because “Rent rose 0.5 percent in August, slightly hotter than the 0.4 percent notched in July.” This month’s inflation report marks the 40th straight month of rent increases, Siegel notes. She continues:

Through it all, the economy continues to show remarkable strength. The labor market is still growing but at more sustainable levels, and the unemployment rate is at a tight 3.8 percent. Crucially, consumers are still spending — on new cars and concert tickets alike — keeping the economy and job market churning. Put together, that has economists growing more optimistic that there won’t be a recession. Goldman Sachs last week cut the chances of a downturn to 15 percent over the next 12 months, from a previous forecast of 20 percent.

Despite this uptick, Siegel reports that the economic mainstream still believes that when the Federal Reserve convenes later this month, they will not raise interest rates. Hopefully, the Fed will meet those expectations, because rising interest rates aren’t the economic force which actually brought prices down and they haven’t inspired mass layoffs as Larry Summers had hoped. In fact, those interest rates have largely only made it harder for Americans to afford housing—which is one of the leading causes of this month’s uptick in inflation.

The Fed should also pay attention to a new report from economist Mike Konczal at the Roosevelt Institute, which argues that the price increases which kicked off the inflationary crisis two years ago were almost entirely based on the supply side in the form of the Russian invasion of Ukraine and pandemic-damaged supply chains, and not the demand side—meaning that your paychecks aren’t pushing prices up at all.

Supply increasing as the driver of disinflation is very notable for core goods, where 87 percent is driven by an expansion of supply. This is something we’d expect, given opening supply chains and semiconductors and important raw materials becoming more accessible. But the Federal Reserve and other experts know this. And just as they looked through some of these big price increases in goods markets in 2021, they are also looking through the big price decreases in 2023 and focusing on services, which they worry has inflation that is more persistent. But, remarkably, we also see large supply shifts within services as well, where 66 percent of the decrease in services inflation has ended up with increasing quantities.

Paul Krugman argues that the Fed is misreading the inflation situation due to “seventies analogy disorder,” which he describes as “a propensity to react to any hint of inflation with the assertion that the stagflation of the 1970s has made a comeback.” He concludes that “the idea that the 1970s offer a useful template for where we are now looks quite wrong.”

Workers on the March for Bigger Paychecks

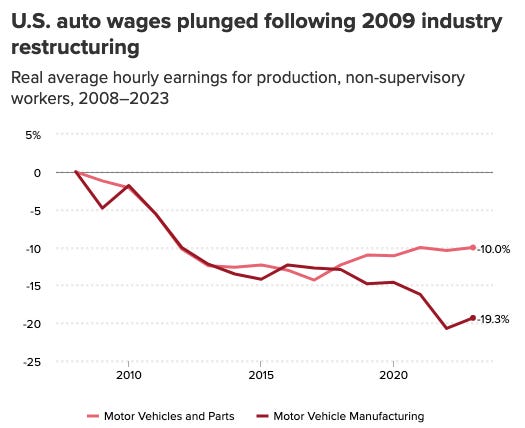

At midnight tonight, tens of thousands of members of the United Auto Workers union might go on strike, halting production at Detroit’s biggest car manufacturers. The UAW is calling for a 36 percent pay increase over four years. Unions at the Big 3 auto manufacturers allowed auto manufacturers to cut pay and benefits to help the companies survive the Great Recession and other economic shocks, and the companies have been highly profitable ever since. But unlike the auto executives, workers were never made whole for their sacrifices in 2009.

How much ground have auto workers lost? “Vincent Tooles, who makes $20.60 an hour assembling Jeep Wagoneers at a Stellantis factory in Warren, Mich., said he earns less an hour than his father did at the same company 20 years ago,” writes Jeanne Whalen at the Washington Post. This anecdote is not an outlier, as the Economic Policy Institute’s analysis shows:

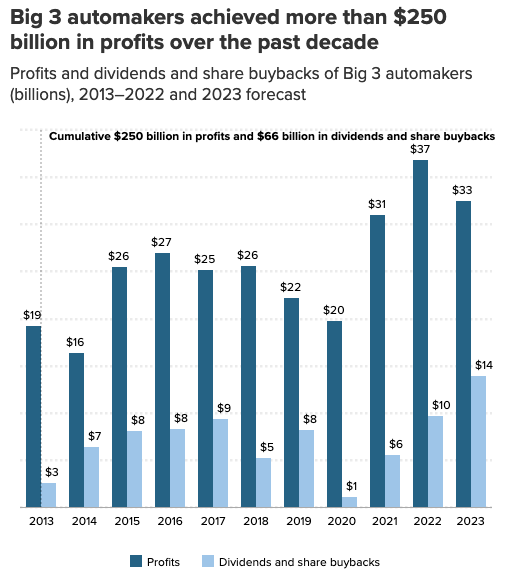

Auto manufacturers have responded to UAW’s demands by pleading poverty, arguing that they need to invest in electronic vehicle technologies in order to compete in a changed auto market. But the numbers prove that these manufacturers have plenty of money to put into worker paychecks: Over the same time that wages have fallen for workers, auto manufacturer profits have skyrocketed, and they have funneled those profits away to shareholders with no strings attached in the form of tens of billions of dollars of stock buybacks:

At the American Prospect, Robert Kuttner has some good advice for President Biden and other politicians: “The way for the White House to head this off is for Biden to get on the phone with auto executives, and warn them not to try to buy off the UAW with a deal that doesn’t include a unionized, good-jobs future for EV workers,” Kuttner writes. “If auto execs are willing to enter into serious negotiations about EVs as well as raises for current workers, the strike deadline could well be extended.”

But unions only cover a fraction of the workforce, and so it’s important to investigate other avenues to grow paychecks. The state of California last year created a council to bargain for higher wages for fast food workers. Several major corporations prepared to fight this council through an initiative, but Harold Meyerson reports that the state and fast food employers have reached a deal that ends the fight:

The deal that has emerged will give the state’s roughly 550,000 fast-food workers a raise, taking full effect in April, from an hourly wage of $15.50 to $20. It guarantees the workers an annual wage adjustment of either 3.5 percent or the increase in the cost of living, whichever is lower. With minor adjustments, it preserves the labor-management council that the law passed last year established. The nine-member council will consist of two franchise owner-operators, two representatives from the fast-food mega-corporations, two union representatives, two rank-and-file fast-food workers, and one public member.

That marks a major win for a new form of worker advocacy—and the Center for American Progress reports that new worker boards are forming all over the country, giving employees the opportunity to jointly bargain for an increase in wages and benefits. Expect to see more of these boards form on the state and local level, now that California has registered such a huge win for more than a half-million fast food workers.

Wealth Inequality Is Now Too Big for Republicans to Ignore

Last month, I noted that some Republican politicians were starting to take a few shaky steps away from trickle-down economics and toward a more middle-out economic approach. “This is a sign that income inequality has grown so large that the very trickle-down policies which created that inequality are now unpalatable to a large majority of Americans, and [Republican] politicians are finally taking notice,” I wrote.

I’m not the only person to notice the beginnings of a possible partisan economic paradigm shift. In the New York Times this month, Talmon Joseph Smith wrote, “More Republicans are coming to the view that economic inequality, or a lack of social mobility, is a problem in the United States — and that more can be done to enable families to attain or regain a middle-class life.”

Smith notes that “among Republicans making less than about $40,000 a year who see too much economic inequality, 63 percent agree that the economic system ‘requires major changes’ to address it.” Republican politicians are starting to take notice, and they’re considering some major policy shifts that would have been unthinkable even three years ago.

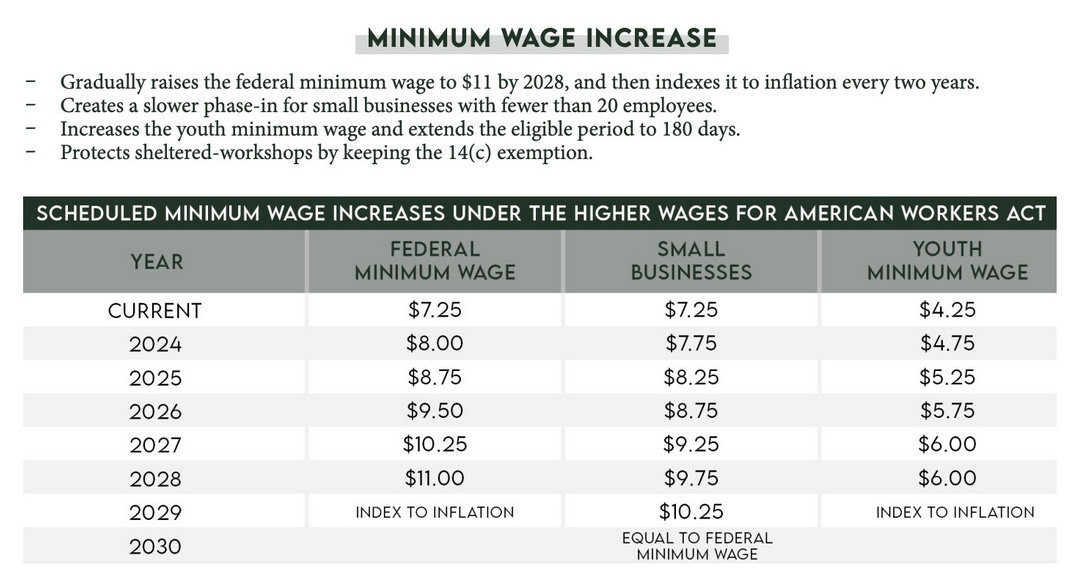

Case in point: Republican Senators Mitt Romney, Tom Cotton, Bill Cassidy, Susan Collins, Shelley Moore Capito, and JD Vance have just put forth a proposal to raise the federal minimum wage to $11 by 2028. Republicans on the federal level have aggressively fought minimum-wage increases for the past decade, so this is a real milestone in the minimum-wage debate.

Let’s be clear that the Republican proposals are way too small, and they take way too long to go into effect:

But Republicans aren’t going to change all their policies overnight. For instance, the bill would also require employers to enact E-Verify technology supposedly in an effort to freeze out undocumented immigrants. This legislation would actually just drive those workers further into the underground economy and make it easier for unscrupulous employers to exploit them.

And the text promoting the bill makes a point of arguing that raising the federal minimum wage to $17 per hour would “destroy at least 1.4 million jobs,” which proves that these Republican senators haven’t changed their erroneous trickle-down assumptions about who actually creates jobs in the economy. There is no proof—zero evidence—that raising the minimum wage kills jobs, and in fac there is plenty of evidence that raising the minimum wage creates jobs.

So while this bill does represent an awareness that income inequality has grown too big to ignore, it doesn’t represent a rejection of trickle-down economics or an acceptance of the fact that it’s your paychecks—not the bonuses of CEOs and outrageous profit margins of huge corporations—that actually create economic growth. There’s still a long way to go before Republicans throw off the trickle-down blinders that have dominated their economic thinking for decades, but this bill absolutely represents a strong first step in the right direction.

This Week in Middle Out Economics

More than four million Americans have applied for the Biden Administration’s SAVE Plan, which ends the accrual of interest on student loans for enrollees and which suspends payments and interest for workers who earn less than $15 per hour.

The Justice Department is taking Google to court, alleging that the company has built and maintained monopoly power over internet search. We’ll have much more to say about this as the trial unfolds, and I’d recommend following journalist Matt Stoller’s BIG newsletter for ongoing updates from the trial. And the American Prospect notes that more antitrust trials are on the horizon.

News flash: Corporations don’t want to pay taxes, and they’re lobbying Democrats in an effort to thwart the implementation of the corporate minimum tax that Congress passed last year. Those lobbyists are using virtually every fallacious trickle-down argument against taxes, including “it’s too confusing,” “it will somehow hurt small businesses,” and “it’s an unnecessary burden on corporations.”

The Roosevelt Institute offers a progressive proposal for permitting reform, which will allow green-energy companies to come online faster without sacrificing the safety and environmental regulations that keep us all safe.

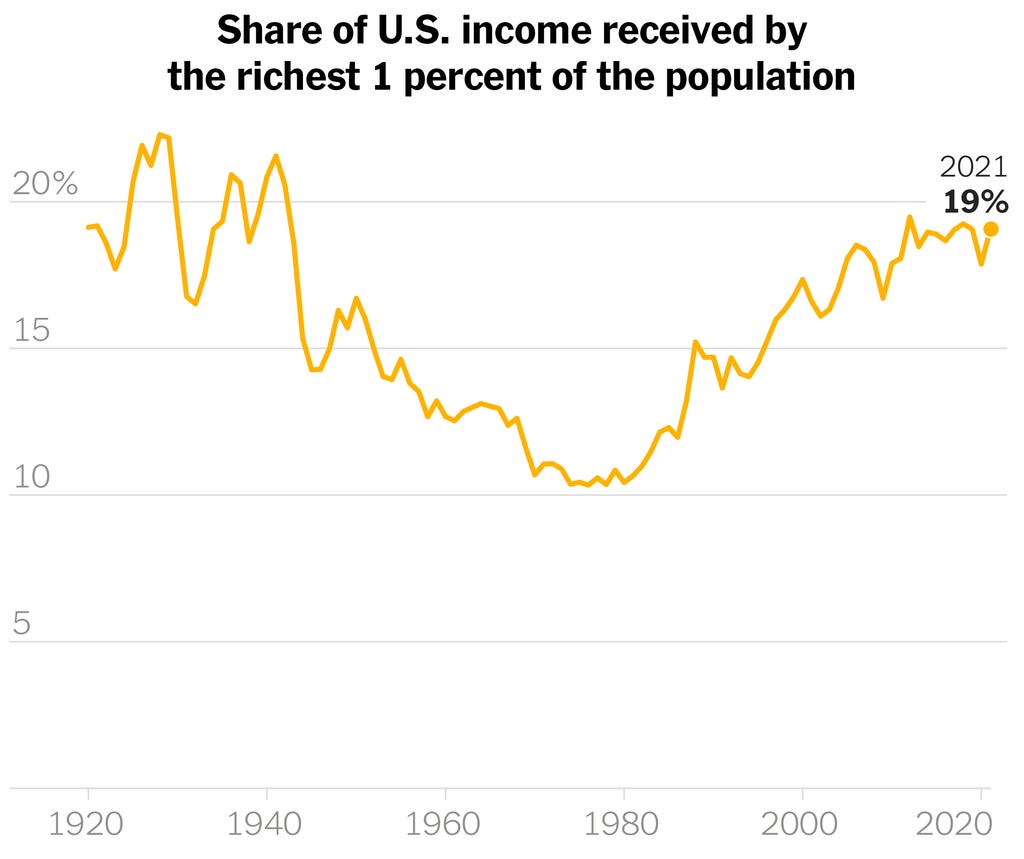

Peter Coy in his newsletter covers the Democratic shift toward trickle-down economics, including a chart that maps income inequality in a way that is at once familiar and new: The share of total income received by the wealthiest 1 percent of the economy. You see that dip from the 1940s to the 1980s? That’s when the American middle class had the most economic power, and the American economy was at its strongest.

This Week on the Pitchfork Economics Podcast

Because they’re steeped in the world of economics, Nick and Goldy are naturally more informed about the Biden Administration’s policies than the traditional news consumer. But over the course of a fun and breezy conversation in this week’s episode of the podcast, they learned a lot about the CHIPS and Science Act, the investments in American semiconductor manufacturing that President Biden signed into law a little over a year ago. Former White House CHIPS Coordinator Ronnie Chatterji explains the thinking behind the legislation, and he helps Nick and Goldy realize that there are even more benefits in the law—for the economy, for national security, and for research and development of technologies—than they initially understood.

Closing Thoughts

Jeff Stein at the Washington Post uncovered a policy proposal from the Trump presidential campaign: “Trump and his advisers have discussed deeper cuts to both individual and corporate tax rates that would build on his controversial 2017 tax law,” Stein writes. “The cuts could be paid for, at least in theory, with a new 10 percent tariff on all imports to the United States that Trump has called for, which could raise hundreds of billions in revenue.”

Given the American people’s widespread hunger for tax increases for the wealthy and powerful, it’s more than a little surprising to see Trump’s people considering another round of tax cuts in a hypothetical second term in office. Some two-thirds of all Americans favor the idea of raising taxes on Americans who earn more than $400,000 per year. And the Republican Party’s 2017 lies that the tax cuts would trickle down to everyone else in the form of more jobs and $4000 in annual higher wages look outright ridiculous to the ordinary American today.

The Trump tax cuts of 2017 in many ways felt like the last gasp of unexamined trickle-down lies. We all saw during the pandemic that investing in working Americans helped the economy weather the economic downturn better than any other nation on earth, and the strong labor market that Americans created with their supercharged consumer demand created the first consistent wage gains that many younger Americans on the lower end of the wage scale have ever experienced.

Something that I didn’t notice many online commenters pick up on, though, was a line in Stein’s reporting directly following the above quote. He wrote: “The sharp new tax cuts would help offset higher consumer costs caused by the tariffs.” It’s a short sentence, but there’s a lot wrong with it.

Now, to be clear, Stein is one of the best economic reporters working at a major paper today. But even the best reporters make mistakes…and there’s a whopper in the above sentence. Go back and see if you can find it.

That sentence is powered on one or two fallacious trickle-down assumptions: The idea that giving tax cuts to corporations will result in lower costs for consumers, and/or the idea that cutting the taxes of individuals would result in consumers who were happy to absorb higher prices caused by higher tariffs. The economy simply doesn’t work like that—and Stein understands that. It’s likely that he just missed a clause: ”Trump staff predicts,” or “some experts say.”

But it’s important to spotlight these minor mistakes when you spot them, because incorrect assumptions are how trickle-down economics spreads through the media. We’ve made remarkable progress in changing our understanding of the economy over the past three years. We can’t afford to backslide now that we’ve come so far.

Be kind. Be brave. Take good care of yourself and your loved ones.

Zach