Economic Freedom Is Worthless Without Economic Security

The Pitch: Economic Update for May 2nd, 2024

Friends,

For The Atlantic, Nobel Prize-winning economist Joseph Stiglitz writes about the collapse of trickle-down economics, which he refers to by the more polite term neoliberalism.

“It is remarkable that, in spite of all the failures and inequities of the current system, so many people still champion the idea of an unfettered free-market economy,” Stiglitz writes, adding that they believe that unregulated markets are the solution to society’s problems “despite the daily frustrations of dealing with health-care companies, insurance companies, credit-card companies, telephone companies, landlords, airlines, and every other manifestation of modern society.”

Even worse than those largely unregulated corporate bureaucracies that have been devised to suck every last cent out of the wallets of working Americans, Stiglitz argues, is the fact that “Unfettered markets have created, or helped create, many of the central problems we face, including manifold inequalities, the climate crisis, and the opioid crisis.”

And contrary to the argument that free markets will solve all problems, Stiglitz notes that “markets by themselves cannot solve any of our large, collective problems. They cannot manage the massive structural changes that we are going through—including global warming, artificial intelligence, and the realignment of geopolitics.”

“As income inequalities grow, people wind up living in different worlds. They don’t interact. A large body of evidence shows that economic segregation is widening and has consequences, for instance, with regard to how each side thinks and feels about the other,” Stiglitz writes. “The poorest members of society see the world as stacked against them and give up on their aspirations; the wealthiest develop a sense of entitlement, and their wealth helps ensure that the system stays as it is.”

And because that gap between the haves and have nots has become so vast, he writes, something much more significant than personal wealth is at stake: Our very democracy is imperiled. “Democracy requires compromise if it is to remain functional, but compromise is difficult when there is so much at stake in terms of both economic and political power,” Stiglitz concludes.

This is dark stuff, but Stiglitz sees plenty of cause for hope, arguing that “the key first step is changing our mindset.” Every week here in The Pitch we talk about middle-out economics, which is a new way of understanding how the economy truly grows—not from the top down, as neoliberalism argues, but from the bottom up and the middle out.

In this piece, and in his new book, The Road to Freedom, Stiglitz argues that in order to change this perception of how the economy grows, we must also address the idea of freedom. For the last 40 years, he argues, trickle-downers have argued that true freedom comes from a lack of regulations and taxes. But Stiglitz is saying that economic security is an essential component of freedom. In other words, it doesn’t matter how “free” you are from government intrusion in the trickle-down sense if you’re one $500 expense away from total economic ruin and your rent goes up by hundreds of dollars every year.

Stiglitz is one of the most influential economic thinkers of our time, and it’s meaningful that he’s putting his name to a book that seriously relitigates the economic decisions of the last 40 years. This will inspire a lot of people to start looking around for a new way to understand the economy. Now that they’re looking, it’s up to those of us who came early to middle-out economics to win them over to our understanding of economic cause and effect.

The Latest Economic News and Updates

The Fed JOLTS Awake?

Ben Casselman at the New York Times reports on yesterday’s Job Openings and Labor Turnover Summary (JOLTS) report from the Department of Labor. “Employers had 8.5 million unfilled job openings on the last day of March,” he writes. “They also filled the fewest jobs in nearly four years, suggesting that employers’ seemingly insatiable demand for workers might finally be abating.”

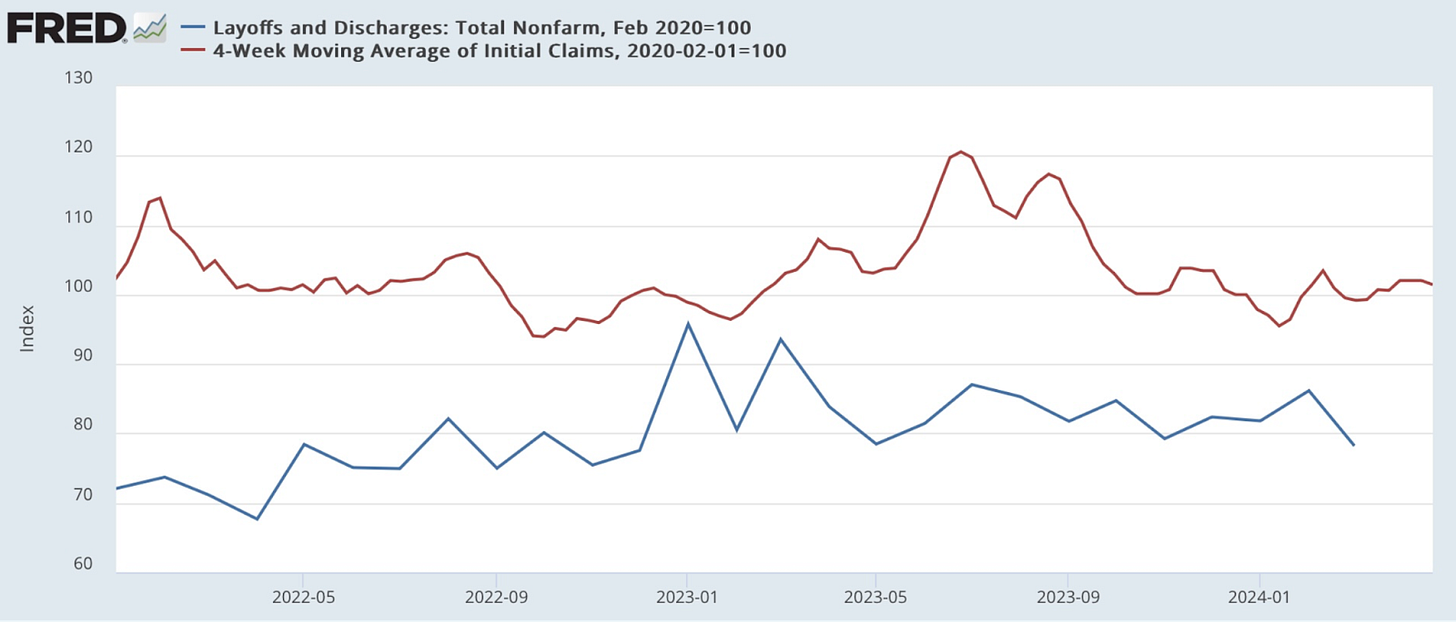

The “number of workers voluntarily quitting their jobs fell to 3.3 million, the lowest level in more than three years,” Casselman continues. But he is clear that the job market in general is in good shape: “Despite high-profile job cuts at a few large companies, layoffs remain low overall, and fell in March.” Angry Bear notes that layoffs “are still running 20% below the level they were at just before the pandemic, and indeed, at *any* point before,” which is a remarkable statistic. Finally, Casselman writes, “while job openings have fallen, there are still about 1.3 available positions for every unemployed worker.”

Just as important as the number of jobs is the size of their paychecks. We’re still seeing great news on that front: Axios notes that “Over the past year, wages and salaries for all workers are up 4.4%,” which is “ down from the peak 5.27% seen in 2022, but above the roughly 3% before the pandemic and the inflation shock.” (And of course inflation is taking bigger bites out of those paychecks, but the fact remains that paychecks are still rising higher than inflation.)

Before we really dig into those numbers, let’s turn to the Federal Reserve, which has been keeping interest rates high in an effort to “cool down the economy” and lower inflation. The Fed’s understanding, remember, is that increased consumer demand is pushing inflation rates up, so they’ve been making money more expensive to borrow by raising interest rates in the hopes that businesses will contract, lay off workers, and thereby drive consumer spending down.

To be clear, this isn’t actually why inflation has risen over the last few years. In reality, turning the global economy off and then back on again during the pandemic stretched supply chains past the breaking point, which drove prices up temporarily—and then corporations used those temporary increases as an excuse to jack prices up even higher to increase their skyrocketing profit margins.

But the Fed only has a handful of mechanisms with which it can combat inflation, so they’re sticking to the slate of interest-rate increases. You’d think that yesterday’s JOLTS report announcing that the number of job openings is drifting back to normal would be music to the Fed’s ears, but instead Fed Chair Jerome Powell announced yesterday that interest rates would stay exactly where they have been for months now, between 5.25 and 5.5%..

Powell presented some uncertainty that inflation would continue on the downward trajectory that it seemed to be on at the end of last year. “My expectation is that we will, over the course of this year, see inflation move back down,” Powell announced in a press conference, but he added that “my confidence in that is lower than it was because of the data that we’ve seen.”

Powell also recognized that the cause of the latest burst of inflation isn’t increased consumer demand: “What you see is economic activity at a level that’s roughly the same as last year,” he told reporters. Honestly, Powell’s uncertainty is a refreshing change. We can’t extrapolate too much from a single press conference, but Powell’s terse comments seem to leave room for the possibility that the Fed is starting to understand it has been on the wrong course.

But as the Fed ever-so-slowly comes to grips with the reality that it’s been using the wrong tool in the wrong way in its fight against inflation, the fact remains that interest rates are at their highest level in recent memory, and those rates are driving up housing costs for ordinary Americans—which are then reflected in the rising inflation numbers. We can’t afford to wait too much longer for the Fed to realize that it’s been trying to put out a house fire with a flamethrower.

I wanted to direct your attention to a great post published this morning by Barry Ritholz at the Big Picture blog. Titled “Why the Fed Should Be Already Cutting,” Ritholz explains in great detail why those high interest rates are keeping inflation artificially high. It’s a smart piece, and well worth your time.

So what does all this mean for American workers? For one thing, it’s unfortunately looking as though mortgage rates and rents will remain high for the time being—and so will credit card interest rates. But the job market continues to lean in workers’ favor—if you’re not satisfied with your paycheck, you should continue checking the market to see if one of those 8 million open jobs will pay you more.

But if those JOLTS numbers are in fact a sign that the labor market is returning to a pre-pandemic normal, our elected leaders should start planning to ramp up ways to ensure that worker paychecks keep growing. For instance, the Economic Policy Institute issued a report celebrating ways that the Biden Administration has undone much of the damage that President Trump caused to the National Labor Relations Board and offering some ideas on how to increase the NLRB’s power.

This is important because the NLRB protects and defends workers who seek to unionize their workplaces, penalizing employers who move to stop unionization efforts and advocating for workers who support unions. Given that unions are increasingly popular with American workers, and corporations like Trader Joe’s, Space X, Starbucks, and Amazon are arguing in court that the NLRB is unconstitutional, it should be pretty clear that simply preserving the NLRB’s power isn’t enough. Now that the NLRB is under attack, the Biden Administration should be moving to update and upgrade the organization for the modern era.

Economic Pain Is Not Administered Evenly

The Federal Reserve’s high interest rates are not affecting all Americans equally. For the New York Times, Jeanna Smialek writes that “ Credit card rates have skyrocketed, and rising delinquencies on auto loans suggest that people with lower incomes are struggling under their weight,” but that “for many people in middle and upper income groups — especially those who own their homes outright or who locked in cheap mortgages when rates were at rock bottom — this is a fairly sunny economic moment.”

In other words, those who already have wealth are able to absorb or sidestep those higher prices, even as the Fed’s push to keep interest rates high are penalizing the poorest Americans even further. Even though the bottom of the wage scale has seen the majority of wage increases over the last three years, they’re also paying higher prices than those who already had wealth before the pandemic began.

Another reason why housing prices have climbed: Smialek says that about 60% of all American homeowners locked in mortgages before the Fed started jacking up rates. Those six in ten homeowners are unlikely to sell their homes or make any major moves right now because those locked-in low rates are keeping their housing prices much lower than everyone else’s.

“That has combined with a moderation in home construction to make for a limited supply of housing for sale — which means that even though high interest rates have curbed demand, home prices have wobbled only slightly after a big run-up during the pandemic,” Smialek writes. “Across major markets, home prices are up about 46 percent from early-2020 prices. Fresh data on housing price data released Tuesday showed an unexpectedly strong pickup.”

But for everyone else—not just the four out of ten homeowners who have bought houses since interest rates spiked, but also the nearly 50 million Americans who rent their homes—costs are much higher than they were before the pandemic, and their confidence in the economy is slipping. “Consumer confidence dropped for the third straight month in April — hitting its lowest level since July 2022,” writes Emily Peck at Axios.

This is a fact that doesn’t get covered in the economic press when they report on the highs and lows of the economy—those highs and lows are never distributed evenly. The nation’s poorest people suffer more when inflation and unemployment rises, and they also gain less when personal wealth grows.

That’s why it’s important to keep an eye on the workers at the lowest end of the wage scale. We may think of California as a high-wage, wealthy state, for instance, but Capital and Main’s Mark Kreidler writes about a new report that reveals the state of workers on the low end of the wage scale. “One third of the state’s 19 million workers earn less than $18 an hour,” he writes. “Nearly a third are immigrants. Roughly 40% live with at least two other workers, likely the result of skyrocketing housing costs.”

Perhaps more surprising is where those workers are employed: “home health-care and personal-care aides make up the lion’s share of these low-wage jobs. Three quarters of the people working in those fields are connected with the state’s In-Home Supportive Services program, or IHSS, which uses a mixture of local, state and federal funds to pay caregivers who help low-income individuals stay safely in their homes and communities,” Kreidler writes.

One of the great revelations of middle-out economics is the fact that when worker paychecks grow, that’s good for everyone in the economy. That’s why lawmakers in California should direct all their economic policies to improve outcomes for those workers on the lowest end of the wage scale in particular—by improving their pay and making it easier for them to find affordable housing, lawmakers will grow the state’s customer base, and that increased consumer demand will create even more good-paying jobs. True wealth doesn’t trickle down from the top—it expands from the bottom up and the middle out.

If you needed any more proof that trickle-down economics is a policy failure, the Washington Center for Equitable Growth has released a report showing that the Trump Administration’s 20% tax cut for pass-through businesses—which include S corporations, LLCs, and other incredibly common business structures—didn’t trickle down at all. In fact, “More than half of the deduction’s benefits were captured by those in the top 1 percent by income in 2019, and 82 percent went to those in the top 10 percent.”

“By a ratio 45-to-1, the benefits of the deduction flowed disproportionately to White households, compared to Black ones, and it is likely that beneficiaries also skew male and old,” the Center reports. And in case you want to argue that the tax cuts resulted in higher wages and other investments in workers and customers, the report finds that the tax reform “did not produce an increase in business investment, jobs, wages, or output.” In fact, “45 percent of Section 199A deductions were generated by businesses that had no actual employees.”

In short: It never trickles down. Ever.

Department of Consequences

It’s a common argument in more cynical circles on social media to claim that wealthy people never have to face consequences for their transgressions. I can’t stand cynicism. While it’s easy to present a seen-it-all, jaded exterior to the world, the truth is that saying “I told you so” when the worst thing happens doesn’t accomplish anything. I’ll say it again: Cynicism rarely accomplishes anything—it just plays to the basest fears and worries in exchange for a quick hit of dopamine.

Worst of all, the cynical belief that the rich and powerful don’t ever pay for their crimes is not accurate. I noticed this week that a lot of headlines spotlighted wealthy people and companies who, to invoke a popular internet term, effed around and found out. I wanted to compile those headlines here so you can pass them on to your grumpiest, most cynical friend:

“Binance’s billionaire founder Changpeng Zhao was sentenced to four months in prison on Tuesday, after pleading guilty to charges of enabling money laundering at his crypto exchange,” notes NBC News. The judge handed down the sentence with an admonishment for Zhao: “You had the wherewithal, the finance capabilities, and the people power to make sure that every single regulation had to be complied with, and so you failed at that opportunity.”

One day after Zhao received his sentence, another leading crypto figure was caught by authorities. “Roger Ver [was] arrested for tax evasion on the sale of $240 million worth of Bitcoin in Spain,” writes Brady Dale. “Ver is charged with tax evasion after allegedly selling a stash of bitcoin…He concealed these sales from his accountant, according to prosecutors, and failed to pay $48 million in taxes that would have been due the IRS, as the property of domestic companies.”

“HomeServices of America, the largest residential real estate brokerage in the United States and owned by Warren E. Buffett’s Berkshire Hathaway Energy, has agreed to settle a series of lawsuits that could change the way commissions are paid to real estate agents,” writes Debra Kamin. Last week, Buffet’s company “signed off on adding $250 million to the mounting pile of damages won by home sellers who have successfully sued several brokerages and the National Association of Realtors over what they described as inflated commissions.”

And “The Federal Communications Commission on Monday fined the largest US wireless carriers nearly $200m for illegally sharing access to customers’ location information,” reports Reuters. “The FCC is finalizing fines first proposed in February 2020, including $80m for T-Mobile; $12m for Sprint, which T-Mobile has since acquired; $57m for AT&T; and nearly $47m for Verizon.”

True dyed-in-the-wool cynics can always find something to be cynical about: I’m sure someone will argue that Zhao’s sentence was lenient when compared to the three years that prosecutors were seeking, and others will claim that $200 million is a drop in the bucket for big telecom companies.

But here’s the thing: Nobody wants to spend four months in prison. And no business wants to be forced to pay a quarter of a billion dollars after a lengthy, expensive trial. By arresting, prosecuting, and imprisoning bitcoin ringleaders, the government is scaring untold hundreds of other aspiring Zhaos and Vers away from committing crypto fraud. And by levying nine-figure fines on corporate offenders, the government is reminding other big corporations that regulations exist for a reason.

The way you convince bad actors to get in line is through the consistent enforcement of the law, and the Biden Administration has done a great job bringing consequences back into the equation.

This Week in Middle-Out: Biden’s Big Week Edition

“The Biden administration on Tuesday released rules designed to speed up permits for clean energy while requiring federal agencies to more heavily weigh damaging effects on the climate and on low-income communities before approving projects like highways and oil wells,” writes Coral Davenport at the New York Times.

That’s not the only green-economy policy that the administration is trying to speed up. Brad Plumer adds that “The Biden administration [last week] finalized a rule meant to speed up federal permits for major transmission lines, part of a broader push to expand America’s electric grids.”

In even bigger green-economy news: “The Biden administration on Thursday placed the final cornerstone of its plan to tackle climate change: a regulation that would force the nation’s coal-fired power plants to virtually eliminate the planet-warming pollution that they release into the air, or shut down,” reports the New York Times. “The regulation from the Environmental Protection Agency requires coal plants in the United States to reduce 90 percent of their greenhouse pollution by 2039, one year earlier than the agency had initially proposed.”

It’s been a very busy last few weeks in Washington DC! Eva Dou reports that “The Federal Communications Commission voted 3-2 Thursday to put the internet back under ‘net neutrality’ regulation, reprising Obama-era rules that prohibit service providers from discriminating against certain websites by throttling or blocking them.” One difficulty for this restored rule is defining what “the internet” means in 2024, with smart-home and mobile computing much more common now than when the rule was originally written.

Finally, “President Biden, building on a week of favorable political developments, celebrated a $6.1 billion grant to Micron Technology on Thursday, saying it would help the United States become less reliant on Asian countries by bolstering the nation’s supply of semiconductors,” reports the New York Times.

And in non-Administration news, Elizabeth Warren and Ro Khanna have proposed new legislation that would ban trading water as a commodity”—a situation which currently allows moneyed interests to swoop in and buy up all the water in a drought situation.

When New York City and my home of Seattle established a minimum wage for gig economy food delivery drivers, big apps like Uber and Doordash responded by adding a number of outrageous fees to their services and blaming them on the new wage laws. Now, Whizy Kim at Vox reports that Senators Elizabeth Warren, Bob Casey, and Ben Ray Luján sent letters to DoorDash and Uber “calling on the companies to stop charging junk fees. ‘When additional hidden fees nearly triple the price of an order, that is price gouging — plain and simple,’ reads a copy of the letter sent to Vox. The letter also requests answers to exactly what the fees cover, including how much of the fees have gone to delivery workers versus to executive pay, among other questions, by no later than May 15.”

We’re starting to see some good progress being made toward housing affordability in states around the country. Rachel M. Cohen writes at Vox: “Over the last five years, Republican and Democratic legislators and governors in a slew of states have looked to update zoning codes, transform residential planning processes, and improve home-building and design requirements. Some states that have stepped up include Oregon, Florida, Montana, and California, as well as states like Utah and Washington. This year, Maryland, New York, and New Jersey passed state-level housing legislation, and Colorado may soon follow suit.”

And on a personal note of pride, I wanted to mention that yesterday was a big day in my home of Washington state: The city of Bellingham, north of Seattle by the Canadian border, adopted a $17.28 minimum wage, and various labor groups and political leaders gathered at Seattle City Hall to celebrate the tenth anniversary of Seattle’s adoption of the $15 minimum wage.

This Week on the Pitchfork Economics Podcast

In his new book The Alternative: How to Build a Just Economy, Nick Romeo argues that conventional economic wisdom is responsible not just for the increased economic inequality we’ve seen over the last four decades, but also for our current political instability. On the podcast this week, Nick and Goldy talk to Romeo about some of his proposed solutions—including worker cooperatives, public-option marketplaces, and job guarantee programs. While not everyone will agree with those policies, it’s hugely satisfying to debate the finer points of policies with someone when you broadly agree on outcomes like closing the income inequality gap.

Closing Thoughts

“Over the last few years, the U.S. has embarked on a sweeping set of new programs and experiments—everything from a child tax credit during Covid to cities trying to provide their least fortunate with a guaranteed income to states expanding Medicaid,” writes venture capitalist Roy Bahat in Forbes.

“These programs—which raised the floor for people in areas like family care, education, housing, income, wealth, and more, and more closely model how other Western countries operate—arrived on the back of a wave of working peoples’ anger,” he adds. “Millions of people have long felt that even if they play society’s game by the rules (work hard, get an education, stay out of trouble), they still can’t provide for a decent life for themselves and their families. That is a system in crisis.”

“If everyone felt economic safety, then more people could invest in their education and skills, and take chances on a better career,” Bahat writes. His editorial promotes a new book by fellow traveler Natalie Foster, The Guarantee, which examines how the government could give individuals the same protections and security that bankers, airlines, and other big businesses have taken for granted in the last two major financial crises.

These income guarantees could take many different forms, from the Child Tax Credit to the guaranteed basic income programs that are taking place in cities around the world—generally with incredibly popular results. One way that you can tell guarantees like this are gaining ground is the fact that Texas Attorney General Ken Paxton unsuccessfully sued to stop a Houston basic income pilot program, calling it “plainly unconstitutional” and an abuse of “public funds for political gain.” When the trickle-downers stop ignoring a program and start suing to block it and calling it unconstitutional, you know you must be onto something good.

After the success of the Child Tax Credit, it’s become clear that direct cash payments with no strings attached are a much more successful poverty reduction program than vouchers or other kinds of means-tested relief programs. There’s still a lot to debate about guaranteed income programs—I’m particularly concerned about them being misused as subsidies for low-wage employers—but it’s clear we’re entering a new phase of the public guaranteed income discussion.

The question is no longer about whether it makes good sense to make direct investments in people. Now, the conversation is turning to how and when we make those investments happen. That’s a conversation we should be excited to have.

Be kind. Be brave. Take good care of yourself and your loved ones.

Zach