Biden Broke the Four-Decade Trickle-Down Streak

The Pitch: Economic Update for December 12th, 2024

Friends,

“After decades of trickle-down economics that primarily benefitted those at the very top, we’ve written a new book that’s growing the economy from the middle out and the bottom up,” President Biden announced earlier this week at the Brookings Institution, in a speech that aimed to cement his economic legacy.

Biden explained that his administration has overseen economic growth that has been unparalleled in the time since World War II, with “over 16 million new jobs [created,] the most in any single presidential term in American history; the lowest average unemployment rate of any administration in the last 50 years; [and] 20 million applications for new [small] businesses.”

Biden also cited the doubling of union petitions during his presidency, the smallest racial wealth gap in 20 years, and the fact that more Americans now have health insurance than ever before in American history.

Acknowledging the inflationary elephant in the room, Biden recognized that “the entire world faced a spike in inflation due to disruptions from the pandemic and Putin’s war in Ukraine.”

“We acted quickly to get inflation down with the help of Republicans and Democrats. Inflation came down to pre-pandemic levels. Wages have increased,” Biden said, adding that “still, too many working- and middle-class families struggle with high prices for housing and groceries and the daily needs of life.”

Biden explained that his economic vision refuted the last 40-plus years of trickle-down economic policies that resulted in "slashing taxes for the very wealthy and the biggest corporations, diminishing public investment in infrastructure, in education, in research and development.”

“Lifting the fortunes of the very wealthy often meant taking the rights of workers away to unionize and bargain collectively,” Biden said.”It meant rewarding short-termism in pursuit of short-term profits and extraordinarily high executive pay, instead of making long-term investments.”

Despite the fact that his economic stewardship left the working class stronger, “by all accounts, the incoming administration is determined to return the country to another round of trickle-down economics and another tax cut for the very wealthy that will not be paid for,” Biden warned. This cut will “once again, cause massive deficits or significant cuts in basic programs, from health care to education, and veterans benefits.”

“On top of that, he seems determined to impose steep, universal tariffs on all imported goods brought into this country on the mistaken belief that foreign countries will bear the cost of those tariffs rather than the American consumer,” Biden warned. “I believe this approach is a major mistake. I believe we’ve proven that approach is a mistake over the past four years. We all know in time what will happen,” he concluded.

In the end, I think President Biden’s economic legacy will be that he was the first president in modern history to walk a picket line with striking workers and the first president in nearly 80 years to overcome an economic crisis by investing deeply into American workers. And even though the global inflation crisis and rampant corporate greedflation made the workers’ growing paychecks very difficult to see, the gains were very real.

New information this week helped to show how much workers have gained under Biden: The Economic Policy Institute reported yesterday that “Wage inequality fell for the second year in a row in 2023” in America.

“Average real earnings mostly held steady in 2023 (–0.1%) as inflation receded, but there were significant differences across the earnings distribution,” EPI writes. “The bottom 90% experienced the only growth of any group in 2023 (+0.9%), while the top 5% and the top 1% experienced losses of 2.0% and 3.3%, respectively. Even the top 0.1% experienced real wage losses in 2023 (–4.7%).”

The below graph clearly shows the benefits of investing in working Americans and not CEOs and billionaires: Inflation-adjusted wages over the last four years grew significantly for the bottom 90% of workers and actually shrank in the top 0.1%. (Of course, the higher you climb into the top one percent, the smaller the portion of wealth actually comes from wages—super-rich people tend to earn the vast majority of their wealth from investments, and not paychecks.)

This is a monumental change, but it’s still just a drop in the bucket compared to the gains that the wealthy have made in comparison to working Americans over the last 40 years of trickle-down policies.

But in just four years, the Biden Administration showed what happens when you reject trickle-down and embrace the middle class with your economic policies. Thanks to that contrast, it seems quite likely that the American people will see the trickle-down policies of the Trump Administration for what they are: A smash-and-grab by the wealthiest Americans, pulling from the paychecks of workers to enrich a handful of the super-rich and powerful corporations. If that happens, Biden’s economic legacy is likely to be remembered as the most transformational presidency in the last 40 years.

The Latest Economic News and Updates

A Note About the News

The big economics conversation this week is centered around the assassination of UnitedHealthcare CEO Richard Thompson and the arrest of his alleged shooter, a 26-year-old man named Luigi Mangione. Mangione allegedly targeted Thompson as an expression of his rage against America’s system of privatized health insurance, which makes ours the most expensive health care system in the world—Americans spent $4.5 trillion on health care in 2022—but which results in far from the most efficient or effective health care system in the world. In fact, our life expectancy has been dropping even as worldwide life expectancy rates have been improving:

Zeynep Tufecki at the New York Times offers a good overview of the populist outcry that accompanied the shooting and the arrest of its alleged gunman:

The rage that people felt at the health insurance industry, and the elation that they expressed at seeing it injured, was widespread and organic. It was shocking to many, but it crossed communities all along the political spectrum and took hold in countless divergent cultural clusters.

Even on Facebook, a platform where people do not commonly hide behind pseudonyms, the somber announcement by UnitedHealth Group that it was “deeply saddened and shocked at the passing of our dear friend and colleague” was met with, as of this writing, 80,000 reactions; 75,000 of them were the “haha” emoji.

Politicians offering boilerplate condolences were eviscerated. Some responses came in the form of personal testimony. I don’t condone murder, many started, before describing harrowing ordeals that health insurance companies had put them through.

The Pitch is an economics newsletter, and so I’ll save the conversation about civility in the public discourse for the pundits and academics to argue over. But this conversation is not likely to end anytime soon, and we’ll continue to monitor and comment on the economic analysis of the American healthcare system that is sure to come.

While frightened CEOs and other corporate leaders beef up their security after seeing the public response to this shooting, I do want to note that Civic Ventures founder Nick Hanauer’s ten-year-old TED Talk “Beware, fellow plutocrats, the pitchforks are coming,” has seen renewed interest on Tik Tok and other social media platforms.

In that TED Talk, Nick warned his fellow super-rich Americans that “if we do not do something to fix the glaring economic inequities in our society, the pitchforks will come for us, for no free and open society can long sustain this kind of rising economic inequality.”

Nick continued, “You show me a highly unequal society, and I will show you a police state or an uprising. The pitchforks will come for us if we do not address this. It's not a matter of if, it's when. And it will be terrible when they come for everyone, but particularly for people like us plutocrats.”

It’s impossible to watch that speech in December of the year 2024 and not see this shooting and its attendant outcry from Americans of both political parties to be a manifestation of the pitchforks that Nick warned us about a decade ago.

Workers Enter 2025 with Decent Employment Numbers and Stubbornly High Prices

“The consumer price index increased 2.7 percent in November from a year earlier, according to Labor Department data released Wednesday, hotter than a 2.6 percent annual rise in October,” writes Andrew Ackerman at the Washington Post. “On a monthly basis, inflation was 0.3 percent from October to November, the biggest gain since April, as prices for housing, energy and particularly food all rose.”

“For the past six months, core inflation has appeared stuck at an elevated level,” Ackerman writes. “Meanwhile, the incoming administration is expected to pursue new policies that could spur even more inflation.”

But while the inflation report delivered bad news of a stubborn rate, the jobs report came in with positive results. “The U.S. economy added 227,000 jobs, seasonally adjusted,” writes Lydia DiPillis at the New York Times. “With upward revisions to September and October figures, the three-month average gain is 173,000, slightly higher than the average over the six months before that.”

Economists suspect that workers hired in the aftermath of two big southern hurricanes earlier this fall, as well as 37,000 Boeing machinists returning to the job after voting to end their strike, resulted in a higher-than-expected number of jobs added to the economy.

The jobs report did deliver the unfortunate news that it’s getting harder for out-of-work Americans to find jobs. But for those who do have employment, “wages jumped more than expected and were 4 percent higher than they were a year earlier.”

If our leaders want the economy to survive the stubborn inflation numbers, they need to focus on ways to keep growing those paychecks and to get even more people back at work.

Here’s one policy area where leaders could focus to help workers: For Axios, Emily Peck reports that more Americans than ever are saying child care problems are keeping them out of the workforce. For the first time, more than one million people are out of the workforce because of a lack of childcare access.

“The number of these child care-affected parents increased by 19% from the pre-pandemic period to present day,” Peck writes. “Mothers living with a child under age five were twice as likely to face these problems as those living with older kids, or fathers.”

According to Peck, most of the problems with accessing child care can be boiled down to two factors: High prices and low staffing. That means it’s not enough for leaders to simply subsidize child care expenses for American workers—they also have to ensure that child care workers earn a living wage in order to make the jobs appealing to them. Creating good-paying childcare jobs would be great for the economy as well, as those workers would spend money in local businesses, creating jobs with their own consumer demand.

The Biden Administration tried to include universal Pre-K in the Build Back Better legislation, but that was wiped out by Senator Joe Manchin and a handful of other self-described moderates. It’s hard to imagine the number of workers pushed out of the workforce would be so high had that legislation passed a few years ago. And lawmakers continue to propose child care legislation that would help working Americans back into the workforce.

In short, these final two economic reports of 2024 indicate that the next presidential administration is getting an economy that is generally strong, but which has several weaknesses that definitively can’t be fixed with trickle-down, free market solutions.

The Hoover Institution’s Repeated Use of Bad Data Fueled Anti-Minimum Wage Sentiment

Lee Ohanion, a professor of economics and senior fellow at the conservative Hoover Institution in Washington DC, has been busy this year. Ohanion has been publishing paper after paper at Hoover about the negative effects of the $20 minimum wage for fast-food employers.

In five different pieces this year, Ohanion claimed that 10,000 workers lost their jobs after California’s fast-food minimum wage went up (published in April,) that another 1250 jobs were lost in June, that California lost 410,000 jobs (April again,) that California employers effectively stopped hiring due to higher regulations (August,) and finally that the minimum wage was effectively ruining all fast-food employment in California (October.)

Ohanian’s research was frequently used by opponents to warn voters against the minimum-wage initiative that was on the ballots in California in November. But there’s one big problem: All of those papers were written based on faulty data, and all of them have been retracted.

A Bluesky user who goes by the handle Invictus has been diligently unpacking all the misinformation in Ohanion’s research, and he’s been demanding that Hoover retract the pieces one by one. Here’s the retraction on one of the April pieces, the June piece, and the October piece.

The April 9th retraction is much more vague…

…as is the August retraction:

Granted, everyone makes mistakes. But the total retraction of five pieces by the same author published over the span of half a year? That’s a significant editorial breakdown—and the fact that an outsider had to find the errors and push Hoover to do the right thing and retract the pieces is especially galling.

Ohanion’s pieces got a lot of attention because their conclusions seem “obvious” to people who subscribe to a trickle-down worldview. But in fact, they fly in the face of reality: A vast and growing body of evidence shows that raising the minimum wage doesn’t kill jobs. In fact, it appears more and more obvious that the additional spending created by minimum-wage increases actually creates jobs. If you haven’t already, you should watch Civic Venture founder Nick Hanauer’s video explaining one such recent study:

But despite Invictus’s efforts to correct the record. Ohanion’s bad data spread far and wide on conservative media, and those pieces are still live and uncorrected—and the retracted pieces are still serving as sources in Google search’s AI-powered search results.

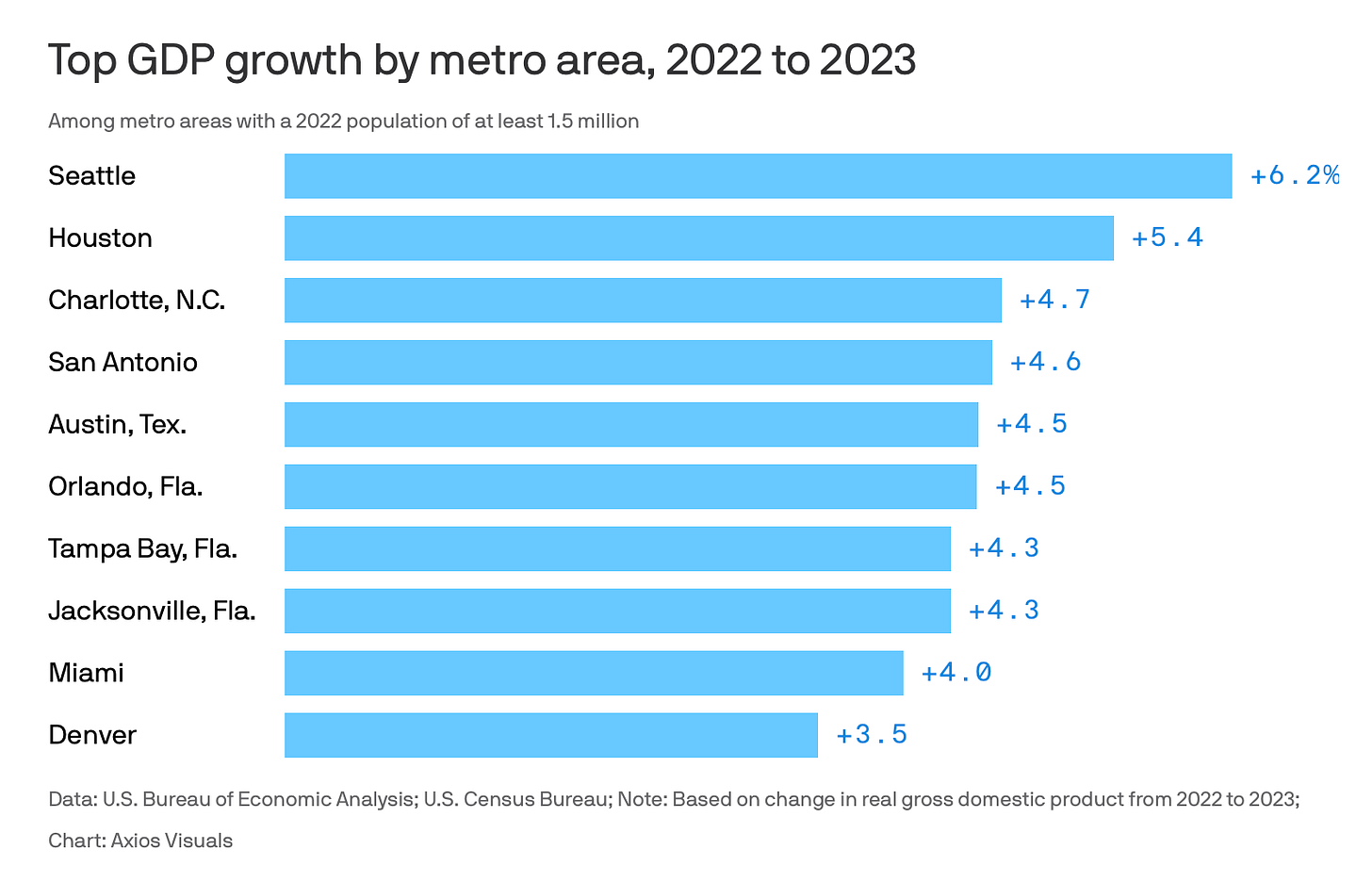

f you needed any more confirmation that raising the minimum wage doesn’t tank the local economy, Axios’s Melissa Santos reported yesterday that Seattle, which has one of the highest minimum wages in the nation at $19.97 in a state with the second-highest minimum wage in the nation of $16.28, “had the fastest economic growth among large U.S. metros last year.” Seattle’s 6.2% GDP growth far outpaced Houston, the second metro area city on the list, by nearly a full percentage point

I need to reiterate that GDP is a flawed measurement that doesn’t measure the health of an entire economy. But it’s useful here to prove Ohanion’s claims that raising the minimum wage to $20 freezes an economy or throws it into turmoil are completely false. In fact, those higher wages helped to grow the economy for everyone in Seattle.

This Week in Trickle-Down

Donald Trump’s incoming administration promises to move more than 100,000 government jobs out of Washington DC. “Trump tried to move federal jobs out of Washington during his first term — on a much smaller scale — and that resulted in mass departures of experienced workers, questionable cost savings and broad interruptions to government work,” writes Todd Frankel at the Washington Post.

The New York Times explains how one of the world’s richest men is trying to avoid paying the United States some $8 billion in estate taxes.

Donald Trump’s choice for IRS Commissioner is a trickle-downer Congressperson who has repeatedly sponsored a bill to eliminate the income tax, estate taxes, and the payroll tax and replace them all with a 30% sales tax.

Speaking of the IRS, nearly 30 Republican representatives have written a letter to Donald Trump urging him to kill the new Direct File program, which allows Americans to file their taxes directly with the IRS at no extra cost, unlike programs like TurboTax that charge exorbitant fees for the same service. The letter calls Direct File, which rolls out this year to 24 states, a “clear conflict of interest,” even though a vast majority of wealthy nations offer some sort of free tax-filing service and last year’s limited pilot Direct File program saved Americans $5.6 million in prep fees alone.

This Week in Middle-Out

The Biden Administration is racing to get some $400 million in EV and green energy investments out the door before the Trump Administration comes in and potentially kills them.

The EPA has banned two very common toxic chemicals used in dry cleaning, carpet cleaning, and other everyday uses in such a way that makes it hard for the Trump Administration to reverse.

For the American Prospect, Robert Cruickshank talks about successes in the Yes In My Back Yard (YIMBY) movement toward eliminating zoning restrictions and making it legal to build lots more housing everywhere.

This Week on the Pitchfork Economics Podcast

Sandeep Vaheesan and Brian Callaci from the Open Markets Institute join Nick and Goldy this week to discuss their recent article at the Harvard Business Review, “The Market Alone Can’t Fix the U.S. Housing Crisis.” The two explain how they’ve spent their careers writing about income inequality, but it wasn’t until they encountered a rent price-fixing scandal that they decided to investigate the American housing market. They found that to fix housing, leaders need to embrace a number of solutions—we do need to build more housing, of course, but we also need rent control and a public option for housing.

Closing Thoughts

“A federal judge in Oregon blocked Kroger’s $24.6 billion acquisition of grocery rival Albertsons on Tuesday,” wrote the Washington Post’s Jaclyn Peiser. “In issuing a temporary injunction, U.S. District Judge Adrienne Nelson said allowing the two giants to combine would reduce competition, raising the cost of food and other staples for millions of Americans.”

Judge Nelson’s injunction, happily, seemed to be the final blow to this enormous anti-competitive grocery merger that would have eliminated choice for millions of Americans across the country and potentially lowered wages for thousands of American grocery workers.

“The grocery chain Albertsons said on Wednesday that it had backed out of its $25 billion merger with Kroger and sued its rival for failing to adequately push for regulatory approval,” writes Danielle Kaye at the New York Times.

In their suit, Albertsons alleges that Kroger “refused to divest assets necessary for antitrust approval, ignored regulators’ feedback and rejected strong buyers of stores it had planned to divest,” essentially confirming the conclusions drawn by antitrust experts and Biden Administration regulators who had been arguing for months that the merger would only benefit the giant corporation.

This week’s news marks perhaps the final big win of the Biden Administration, which has bucked 40 years of pro-merger policies from both Democratic and Republican presidencies to instead combat monopolies and mergers.

And it might be the last antitrust action we’ll see from Washington DC for quite some time. “Donald Trump’s picks for merger enforcement is complete: The president-elect has chosen Andrew Ferguson to lead the Federal Trade Commission, making him one of the nation’s top antitrust cops,” notes the New York Times Dealbook newsletter, which calls Ferguson “ an almost polar opposite to the agency’s current leader, Lina Khan. The choice validates the view of corporate deal makers that a second Trump administration would be good for [mergers and acquisitions.]”

Ferguson’s FTC will likely have a chance to send its first signal about this with a big potential merger in the snack-food space. Mondelez International, the manufacturer of Oreos, Clif Bars, Sour Patch Kids, and dozens of other beloved snack brands, is considering a takeover of Hershey’s. If this merger goes through, the resulting mega-corporation would have a combined annual revenue of roughly $50 billion dollars.

Plenty of CEOs have praised the incoming Trump Administration’s deregulatory stance. Of course they have; they stand to make a lot more money in a more permissive environment that allows mergers, monopolies, and acquisitions with virtually no pushback. But these mergers kill competition, and that’s bad for everyone who’s not in the corner office.

American consumers are still reeling from two years of corporate greedflation, with big companies raising prices higher than costs in order to plump the bottom line. One of the main reasons companies have been able to push prices up so high is the fact that consolidation has allowed a handful of giant companies to dominate markets in food, clothing, and appliances. And workers have for years seen their paychecks shrink when big corporations buy each other, effectively killing competition in the labor market and making it easier for big employers to offer lower wages.

It’s important to celebrate our victories—and make no mistake, this failed grocery store merger is a huge win for American consumers and workers. The merger would likely have gone through under virtually any other presidential administration since 1980, but regulators were able to stop it this year. So we should take a moment to enjoy this victory—and we should use everything we’ve learned in this fight as an example in the years ahead to explain why the Trump Administration should not allow huge corporations to swallow each other up and get even bigger in the process. And now that we have a clear recent case study demonstrating what a middle-out antitrust agenda looks like, it will be easier for state attorney generals and other lawmakers to fight mergers in the future.

Onward and upward,

Zach