Friends,

“The May jobs report looks fine on the surface, but underneath there are signs of weakening in the labor market,” write Courtenay Brown and Neil Irwin at Axios.

Employment rose by 139,000 jobs, which was a sunny topline that seemed to put Wall Street’s anxieties about the labor market at ease. But Axios quotes Nick Stahle, an economist at Indeed.com: "This isn't a bad report, per se, but there are clear signs of erosion just below the surface that may not be apparent just by looking only at the headline numbers."

Axios explains a big source of Stahle’s concern: “The share of adults who were employed fell 0.3 percentage points to 59.7%, the lowest in more than three years. It was due to a whopping 625,000 fewer people in the labor force — neither working nor looking for work.”

Justin Wolfers points out that the last two jobs reports were revised downward: April’s jobs report lost 30,000 jobs after further evaluation, and March was revised down by 95,000 jobs.

“As a result, payrolls grew at only an average rate of +135k over the past three months, a notable slowing” from averages of +168,000 last year, Wolfers reports.

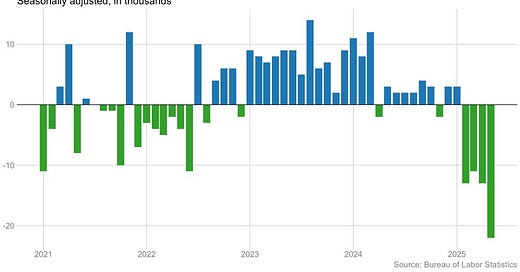

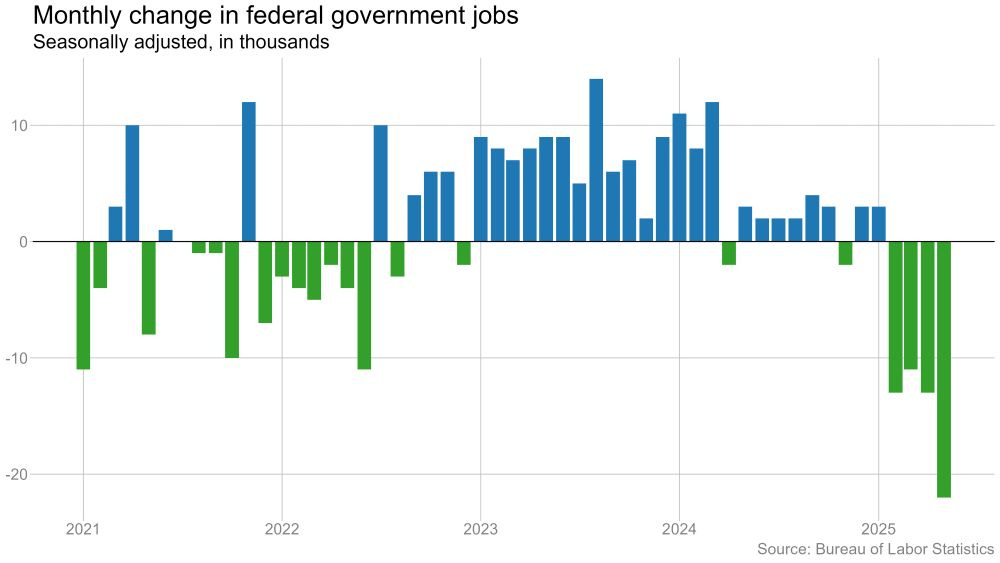

Most of the employment gains came in the health care sector, while tariff-adjacent jobs in importing and transportation declined slightly. And then there’s the DOGE in the room: “Federal government employment fell by 22,000 in May and is down by 59,000 since January,” Ben Casselman writes. “These numbers do not reflect people who are still on paid administrative leave, so expect the losses to grow substantially this fall.”

And then there are some other, less obvious signs of weakening deep in the jobs report. “Employment at temporary help agencies fell 20,000 jobs in May,” Casselman noted, explaining that “economists often consider declines in temporary hiring to be an early sign of softness in the labor market because companies are less reluctant to cut temps than permanent employees.”

Other analysts chose to interpret the data in a more generous manner. Morgan Stanley chief economist Ellen Zentner told the New York Times that “while the report confirmed the cooling trend we saw in almost all of this week’s data, continued labor market resilience could help the economy sidestep recession.”

However much the labor market has slipped, it is true that nothing in the numbers is showing a catastrophic collapse. But the trend is clear. Because of the economic uncertainty caused by tariffs, massive job losses in the federal government, and other slow-rolling economic concerns, employers seem to be both wary of hiring and wary of laying off large numbers of workers. And workers seem to be wary of quitting and trying to find another job. In short, the job market looks much the same as I described it last week: frozen in place.

And with every new job report from the Trump Administration, I’ve noticed a growing number of skeptics on social media who are concerned that the Trump Administration is cooking the books to make things look better than they actually are. The skeptics especially freaked out when the Bureau of Labor Statistics announced that it was cutting back the collection of consumer price data last week.

Casselman wrote a story taking those skeptics on directly. “Yes, I still trust the data. But with some important caveats,” he wrote.

“Many of the people asking this question are worried about the possibility of political interference in the data-collection or analysis process. There is no evidence that is happening,” he explains, adding that he believes an internal whistleblower would have already notified the public if those numbers were manipulated in a way that would make the Trump Administration look good.

Instead, Casselman spotlights a different issue: “many economists and other experts have a different concern: the gradual erosion in the quality of government statistics.”

He explains, “Many statisticians believe the agencies need to adopt new methods that rely less on surveys and more on data from administrative records and private sources like credit card companies and payroll providers.” Basically, the same kind of struggles that political pollsters have been experiencing in getting representative samples extend to economic survey-takers as well.

The sometimes-dicey relationship between the data that we use to measure our economy and people’s actual experience of the economy is something that we’ve talked about in The Pitch before. It’s mind-boggling, for instance, that the Federal Reserve doesn’t include credit card debt when determining the inflation rate. And the headline unemployment rate should reflect more of the Americans who have dropped out of the job market due to frustration, and the Americans who want to work full-time jobs with benefits but can only find part-time or contract employment.

Many of these models and measurements haven’t been meaningfully updated since the dawn of the trickle-down era in the late 20th century, and so they don’t reflect the raw deal that many American workers are experiencing in their lives today, because things like the gig economy didn’t exist when these metrics were established. Policymakers have to rely on economic data, and it’s important that the data be as comprehensive and accurate as possible. Otherwise, the gaps in our measurements could grow big enough for an economic catastrophe to just walk right through without ever showing up in the numbers until it’s too late.

That’s a real area of concern, but it’s a long-term problem. For now, the consensus on the jobs report seems to be that the deal for American workers is steady but slowly growing worse. Both employers and workers are white-knuckling their way through the first few months of the Trump Administration while they wait and see if the prevailing sense of economic uncertainty develops into a meaningful economic downturn.

The Latest Economic News and Updates

“Government Should Do More to Solve Problems”

There’s a lot of good news in a new report from the polling organization SSRS that I’m excited to share with you. But first, we have to bum ourselves out with a little bit of table-setting.

Pew polling found in 2022 that Americans reported near record-low trust in the federal government to do what is right always, or most of the time. If you look at the results of Pew’s long-term polling, you can see that despite some gyrations, trust in government has declined precipitously since the 1970s.

A lot of factors contributed to this drop: Watergate and Nixon’s resignation were a huge early blow to the trust that Americans felt in government, and the ongoing stagflation crisis of the late 1970s pushed those numbers even further downward. But then came Ronald Reagan and his trickle-down agenda that continued in both Republican and Democratic administrations for the next four decades. We can quibble over the causes of the peaks and troughs of that graph, but the overarching picture is clear: Trickle-down economics dissolves trust in government.

It turns out that slashing budgets, failing to grow worker paychecks, and cutting government services leads people to believe that government can’t get its job done. Then trickle-downers exploit that sentiment to promote the next round of tax cuts for the rich and deregulation for the powerful. It’s a negative feedback loop.

That brings us to the good news that I’m excited to share. Ariel Edwards-Levy reports for CNN that a new SSRS poll found something new bubbling up in the American public: “most Americans, 58%, now say that the government should do more to solve the country’s problems – a record high in more than 30 years of CNN’s polling.”

“While Democratic views on the role of government have remained largely unchanged over the past two years, the shares of Republicans and independents who say that the government is doing too many things have both fallen since the White House changed hands,” she adds.

Graphed out, it’s really quite a dramatic shift, the kind of turnaround that the poll has only shown in times of crisis. Note the uptick in pro-government sentiment after 9/11, and the sharp reversal as the Great Recession lingered:

This doesn’t mean that trust in government is likely to skyrocket anytime soon, but it does at least indicate a widespread, bipartisan desire for a different kind of governance and a new relationship between the American people and their government. The terrain is ripe for enterprising leaders to seize on this desire to do more, and then rebuild trust by making big promises, and following through on those promises.

All that said, there is a big negative point in the polling: “Americans are far more likely to see Republicans than Democrats as the party with strong leaders: 40% say this descriptor applies more to the GOP, with just 16% saying it applies to the Democrats,” Edwards-Levy writes, adding that respondents are “also more likely to call Republicans the party that can get things done by 36% to 19%, and the party of change, by 32% to 25%.”

“True independents, those who don’t lean toward either party, are particularly grim in their views of the parties on these issues,” Edwards-Levy adds, noting that “76% say neither party has strong leaders or can get things done, and 72% that they view neither as the party of change.”

That last datapoint is interesting from an electoral perspective because it shows that independent voters are frustrated with both sides of the aisle and could potentially be persuaded by one side or the other if they demonstrated real willingness to get stuff done.

While many Democratic leaders may not view these results positively, I see a lot of causes for optimism here. Americans always tend to be down on the losing party after presidential election years, and change candidates like Ronald Reagan and Barack Obama can single-handedly reverse public perception of parties in a matter of months. These all feel like weaknesses that can be overcome if the right leaders come along—and, most importantly, if they have the right economic philosophy to share with the people about growing the economy for everyone.

This Week in Trickle-Down

The New York Times reports on coal and gas plants that were preparing to close down, until the Trump Administration ordered them to stay open—even against the will of the plant owners.

The companies which make up Fortune 500 “posted an aggregate $19.9 trillion in total revenue — about two-thirds of the U.S. gross domestic product — and a record-setting $1.87 trillion in earnings” last year, reports The Currency. Those record-high figures mark a 9% increase from the previous year.

This Week in Middle-Out

The Economic Policy Institute has put together a brief policy package to foster progressive globalization, including better wages for workers in the US and incentives for worker protections in other countries that we trade with. In international trade, just as in domestic economic policy, the workers, not the wealthy and powerful, are key.

GM announced $4 billion in new auto investments in Michigan, Kansas, and Tennessee. UAW President Sean Fain celebrated the news, declaring that “The writing is on the wall: the race to the bottom is over. We have excess manufacturing capacity at our existing plants, and auto companies can easily bring good union jobs back to the U.S.”

This Week on the Pitchfork Economics Podcast

As Republicans work at breakneck speed to push another round of massive tax cuts for the wealthy, we thought it would be a good idea to revisit our 2019 conversation with Bruce Bartlett, a Reagan policy adviser and key architect of the 1981 tax cuts. Bartlett explains how the trickle-down logic he once championed turned out to be economic snake oil, because tax breaks for the wealthy don’t grow the economy—they just grow inequality.

Closing Thoughts

Last Thursday, pretty much the whole internet gawked in real time as President Trump and Elon Musk dissolved their partnership in train-wreck fashion. I admit that I couldn’t put my phone down for a few hours. It’s so rare in politics to see backroom tensions spill out so openly into the public eye.

I’m not shaming myself or anyone else who took some time to watch the drama play out on social media. Ultimately, though, I wish that some of the attention paid by the mainstream media to Musk and Trump’s feud last week—particularly the front-page New York Times story—had instead been paid to Senator Elizabeth Warren’s extensive report (PDF) on Musk’s 130-day stint at the so-called Department of Government Efficiency.

The report clearly and thoroughly lays out all the known abuses of power (both legal and potentially illegal) that Musk and the Trump Administration engaged in over the four months that Musk was involved with the Trump Administration. Warren lays out the offenses in three major categories:

First, “Before Trump took office, Musk’s companies faced at least $2.37 billion in potential liability from pending agency enforcement actions. Now many of those enforcement actions have stalled or been dismissed,” the report notes.

Second, “Musk’s companies have received or are being considered for large contracts with the federal government, with foreign governments, and with other private sector companies.”

And finally, “Musk and individuals acting on his behalf have been involved in dozens of questionable actions that raise questions about corruption, ethics, and conflicts of interest.”

The report lays out, with substantiating links, 25 different cases of Musk-owned companies that are now up for large contracts with government agencies or other forms of anti-competitive actions that would benefit Musk’s companies directly.

For instance, “Under DOGE’s influence, the [Federal Aviation Administration] reportedly told staff to find tens of millions of dollars to award Starlink a sweetheart deal,” and the FAA was ordered to find other ways to direct billions of dollars to Starlink in the form of contracts. This comes at a time when the FAA is already facing dire understaffing issues, information infrastructure failures, and a wave of accidents and aircraft near-misses that have thrown American air travel into a moment of crisis.

DOGE has also made Starlink eligible for rural broadband contracts that it had already been disqualified from competing for due to quality concerns, and the Trump Administration has threatened Musk’s competitors with legal action. The Trump Administration also tried to move official Social Security Administration communications exclusively to X, the Musk-owned social media site that used to be known as Twitter.

Conflicts of interest abound. Warren’s report also documents at least six instances of government agencies ending or burying cases against Musk-owned businesses while Musk was working for the Trump Administration. The report estimates that roughly 70% of all the government agencies that fell under Musk’s oversight this year have “direct business interests” with Musk’s businesses.

Government agencies also allowed SpaceX to double its number of proposed rocket launches in Florida and multiplied the number of legalized Texas rocket launches by five times, weakened self-driving regulations in areas where Tesla is trying to expand, and knowingly weakened mobile cell service coverage for everyone in order to prioritize Starlink’s cell service.

Musk had access to secret information that could give him an advantage over competitors, and he had influence over government officials who regulate his businesses. The report also documents no less than 20 instances of foreign governments making deals with Musk-owned businesses in a timeframe that could easily be interpreted as an attempt to curry favor with the Trump Administration.

The list of infractions goes on and on and on.

We devote a lot of time and attention in this newsletter to trickle-down politicians who slash taxes, reverse regulations, and weaken worker protections in order to redistribute wealth from the paychecks of working people to a few super-rich campaign donors and friendly corporations. The abuses documented in this report actually go beyond trickle-down into troubling new territory.

When one wealthy person takes the reins of power to manipulate government structures in order to enrich himself and damage his competitors, that’s an oligarchy—a government controlled by a wealthy few. That’s what this report relentlessly documents. And while Musk may be on the outside of the Trump Administration, it seems as though other oligarchic figures in the administration are quietly rigging the system in their favor.

In the end, maybe oligarchy is the logical final evolution of trickle-down economics. Even four decades of government directing wealth to a handful of wealthy people and corporations wasn’t enough to satisfy their greed. People like Elon Musk had to take out the middle-man and direct the flow of wealth and power on their own.

I hope you’ll share Senator Warren’s report far and wide to your social networks. Though many of these stories got attention during Musk’s time at DOGE, it is incredibly infuriating to see them all in one place like this.

Be kind. Stay strong.

Zach