Friends,

Yesterday, Nick Hanauer published a piece in The New Republic that is definitely worth your time. Titled “I Helped Coin the Phrase ‘Middle-Out Economics.’ Biden Is Making It a Reality,” the piece argues that the Biden Administration’s four big legislative achievements—not including yesterday’s student loan forgiveness, which we’ll get into soon—represent a refutation of the trickle-down economic thinking that had captured the imaginations of leaders on both sides of the aisle for nearly fifty years.

It’s not enough to simply point out that wealth never trickles down from the richest to ordinary Americans—it’s important to have an economic vision that understands how the economy actually works. Nick points out that the Biden Administration is instead investing deeply in ordinary Americans, growing the economy from the bottom up and the middle out.

And in addition to making those big investments, President Biden is explaining why they’re important. When it comes to changing economic narratives, it’s just as important to talk clearly and repeatedly about why you’re doing what you’re doing—to lay out how the economy really works.

Nick notes that the Biden Administration is doing a great job of conveying the middle-out message. He quotes the president’s Council of Economic Advisers, who argued that Biden’s policies “reflect the empirical evidence that a strong economy depends on a solid foundation of public investment, and that investments in workers, families, and communities can pay off for decades to come.”

If that statement simply sounds like common sense to you, that’s because it is. But since the 1980s, economists have argued the exact opposite—that the most efficient way to help the most people is to invest in the wealthy few at the top of the income pyramid. Biden is the first president since at least LBJ—and some even argue since FDR—to prioritize investing in ordinary Americans as an economic strategy.

There’s a lot yet to be done. Nick lists over a half-dozen policies that Biden should promote in order to keep ordinary Americans empowered as the real job creators. And if Republicans were to make big strides in the midterm elections, they could derail the middle-out agenda before it even really gets started. But this piece acknowledges the bigness of the moment, and the success of Biden’s campaign promise to bring a new economic understanding to the White House. To paraphrase what Biden himself once said to another president, this is a big effing deal.

The Latest Economic News and Updates

Student loan forgiveness is finally here

“President Biden announced student loan debt relief on Wednesday for tens of millions of Americans, saying he would cancel $10,000 in debt for those earning less than $125,000 per year and $20,000 for those who had received Pell grants for low-income students,” write Zolan Kanno-Youngs, Stacy Cowley and Jim Tankersley in the New York Times. You can find a similar opening paragraph in every newspaper in the country this morning.

And while many on the progressive left argue for tens of thousands more in forgiveness for individuals, or even total forgiveness, the fact is that this number will fully cancel the remaining debt of 20 million Americans with student loans. It will also ensure that virtually all community college students who take out loans will be debt-free within a decade of finishing school.

And amid all the $10,000 headlines, people are missing one of the bigger reforms to student debt that the Biden Administration just announced. First, they’ve capped the payments to 5% of the borrower’s discretionary income, which is half the previous cap and which means borrowers will have more money to spend in the economy. And second, they’ve ensured that the loans will not grow as long as borrowers keep up their monthly payments—effectively, the loans will remain at zero percent interest once people resume paying off the remainder of their loans on January 1st of next year.

Naturally, because inflation is in the news, many pundits are stoking fear that forgiving this much student loan debt will cause inflation to rise. In fact, most experts believe that it will not grow inflation, and that it may even bring prices down a bit. The Center for American Progress put together a great fact sheet showing the benefits of debt forgiveness, from narrowing the racial wealth gap to its outsized positive effects for students from the middle and lower end of the wealth spectrum.

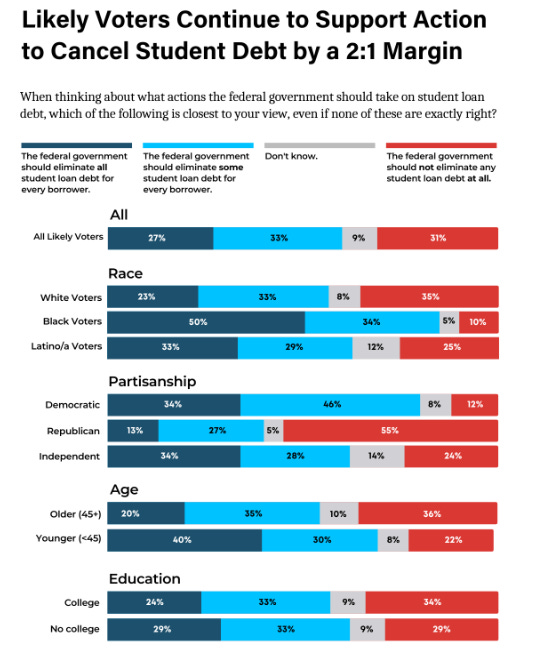

Biden’s student debt plan will take heat from pundits on both the left and the right side of the aisle, but it’s worthwhile to remember that student loan forgiveness is incredibly popular with the American people—particularly voters of color and voters who did not graduate from college.

It also helps that the policy is smartly targeted to benefit Americans in the working and middle class, giving them more money to spend in the economy and less life-crushing debt. It continues Biden’s trend of crafting policies that build the economy from the middle out and the bottom up—not the wealthy few at the top.

American companies are bringing jobs home

“U.S. Companies on Pace to Bring Home Record Number of Overseas Jobs,” The Wall Street Journal raved in a recent headline, with the story noting that “the 350,000 reshored jobs expected this year would far exceed the roughly 265,000 jobs added in 2021 and would be more than 50 times the 6,000 jobs reshored to the U.S. in 2010.”

This is a direct response to supply chain problems caused by the pandemic, when companies simply couldn’t get products across the world in any reliable fashion. American corporations are finally, after years of globalization and just-in-time manufacturing, realizing the importance of local manufacturing and distribution.

The CHIPs Act that just passed Congress, which invests in American production of semiconductors, will undoubtedly add to these record reshoring numbers in future years. Still, it’s not as simple as turning on manufacturing like a switch—for example, Kate Aronoff writes for the New Republic that it’s going to take time and some policy changes for the domestic electric car manufacturing industry to be established.

The job market is surging, but gains are uneven

The labor market continues to be quite strong, but that strength is not evenly distributed. Though tech workers are still getting laid off, those workers are finding new jobs relatively easily. And hardware megastore Lowe’s is investing $55 million in inflation bonuses for its workforce in an effort to improve worker morale. (These additional wages for retail workers would have been unthinkable before the pandemic, as Lowe’s traditionally prefers to dump its profits in billions of dollars of stock buybacks that enrich executives and wealthy shareholders.)

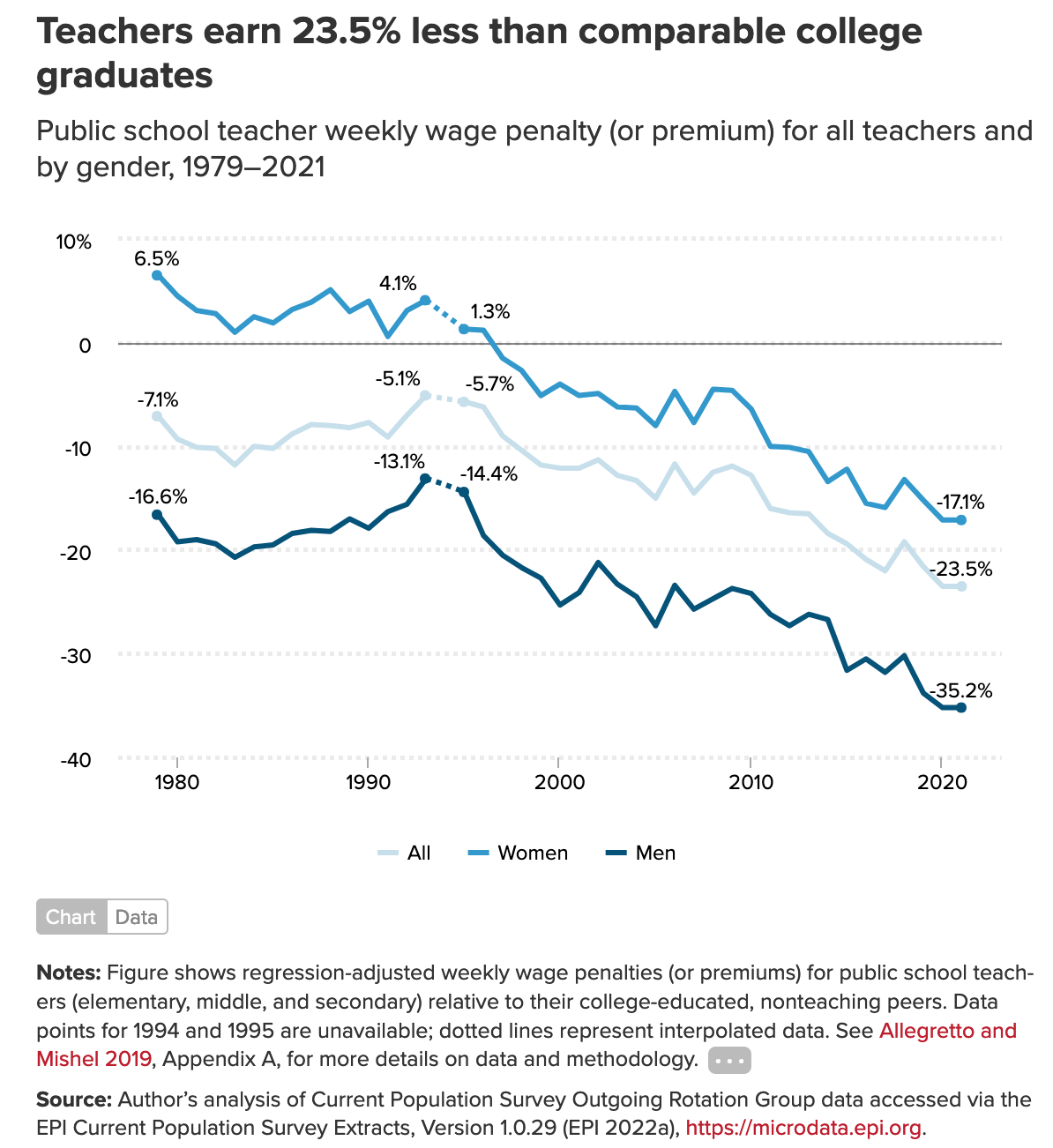

But some workers just aren’t seeing the higher wages that have become commonplace in much of the economy. The Economic Policy Institute ran a study of teacher pay over the last 25 years and found that wages have stayed relatively flat the whole time. Teachers earn nearly 24 percent less than their peers who graduated college with the same credentials.

And teacher pay is bad pretty much everywhere around the nation:

For The New York Times, Noam Scheiber notes that pharmacist used to be a high-wage occupation, but pharmacists’ paychecks have declined considerably over the past few decades. One of the biggest factors in this disturbing trend, Scheiber notes, is increasing market concentration: Big pharmacies like Rite Aid and CVS have bought up smaller chains and shuttered overlapping stores, resulting in fewer pharmacy positions available and little competition to increase wages.

This is part of the reason why employees at more than 220 Starbucks stores have organized and are taking their complaints directly to the Biden Administration’s National Labor Relations Board, which recently won the reinstatement of 7 Memphis Starbucks employees who were fired by the company. As long as the job market continues to be exceptionally strong, workers in low-wage fields will continue to agitate for better pay—and the Biden administration will likely continue to be on the side of the workers.

Mixed economic signals, with the poorest feeling the pinch

At the New York Times, Paul Krugman explains that the way we measure housing costs may inspire the Federal Reserve to keep interest rates high for longer than is good for the economy. It’s a delightfully wonky column, as we’ve come to expect from Krugman, but basically he warns that while many metrics indicate that skyrocketing rents have started to ease slightly, higher rent prices will continue to keep inflation up for nine months to a year in the future.

Meanwhile, we’re continuing to investigate exactly why inflation went haywire. The New York Federal Reserve issued a big report this week which suggests that supply constraints—largely supply chain issues and labor shortages—are responsible for about a third of the higher pieces we’re paying in the inflation crisis. “In the absence of any new energy or other shock, it is therefore possible that the ongoing easing of supply bottlenecks will cause a substantial drop in inflation in the near term,” the NY Fed writes. This is huge because it identifies that the high prices we’re paying right now were not caused by the same factors that created 1970s-style inflation, and it suggests that the tools we used to end the last inflationary crisis aren’t necessary to resolve this crisis.

And Jim Tankersly at the New York Times notes that low-income Americans are experiencing more food insecurity as pandemic-era stimulus investments disappear and prices still stay high. “In 2020, the Oregon Food Bank served 1.7 million people,” Tankersly writes. “That number dipped in 2021 to about 1.2 million. Now it’s rising again, toward what [Oregon Food Bank director Susannah] Morgan estimates could be 1.5 million. That would be the food bank’s second-largest caseload for a single year, behind only 2020.”

Many of the protections that were passed during the pandemic helped lift Americans out of poverty. But those programs are ending, and costs are too high. And for impoverished Americans in low-wage jobs, it’s simply too expensive to raise a child. A Brookings report recently determined that the cost of raising a child born in 2015 to the age of 18 in America has risen to $310,000—not including college tuition.

Our safety net was lifted and improved at a moment in which a majority of the population was in danger of losing everything. But now that the pandemic’s major economic effects seem to be waning—at least for a while—the safety net is diminishing back to pre-pandemic levels. Hopefully, the millions of ordinary Americans who relied on higher unemployment checks and increased food and housing assistance during the pandemic will understand that the bare minimum simply isn’t enough for American families in need of assistance. We can’t return to rock-bottom investments in impoverished Americans now that we’ve all seen how a strong program of investments and shared prosperity kept the economy afloat for everyone.

Real-Time Economic Analysis

Civic Ventures provides regular commentary on our content channels, including analysis of the trickle-down policies that have dramatically expanded inequality over the last 40 years, and explanations of policies that will build a stronger and more inclusive economy. Every week I provide a roundup of some of our work here, but you can also subscribe to our podcast, Pitchfork Economics; sign up for the email list of our political action allies at Civic Action; subscribe to our Medium publication, Civic Skunk Works; and follow us on Twitter and Facebook.

In his Business Insider column, Paul explains that the economy is doing better than cable-news pundits would have you think, and he argues that economists are prioritizing the wrong metrics as they try to determine whether we’re in a recession or not. What matters most, he says, is the prosperity and economic health of the average American.

In this week’s episode of Pitchfork Economics, Columbia Professor and Roosevelt Institute Fellow Suresh Naidu explains that what we called “essential work” during the pandemic, including grocery store workers and delivery drivers, is really forced labor. He reveals the tricks that employers use to manipulate the labor market and explains how workers have been stripped of power.

Closing Thoughts

Experts will be analyzing the economics of the pandemic for years to come. The conditions we saw in early 2020—a sudden, steep decline in productivity and household wealth, followed by a relatively fast return to economic normalcy—are utterly unlike anything we’ve ever experienced, and they offer a unique perspective on how the economy really works.

Earlier this month, the Washington Center for Equitable Growth analyzed pandemic-era economic data and issued a remarkable report about economic response to recessions. This report hasn’t gotten nearly the attention it deserves, because it completely rethinks what effective support programs should be.

“To weather the next economic crisis, and the ones after that, policymakers in the United States need to permanently strengthen the U.S. system of income supports,” the authors write. They explain why those supports “are essential, especially during economic downturns, how the currently weak income support infrastructure harms workers, and why proactive solutions are better for stable and broad-based economic growth.”

In other words, simple support programs that deliver people money quickly and efficiently aren’t just better for individuals going through an economic crisis—they’re better for the economy. The Center highlighted four criteria that lawmakers should consider when building a safety net for the 20th century: Investments should be inclusive, simple, long-lasting to meet the duration of the economic crisis, and calibrated to maximize spending.

This is a refutation of the austerity response to recessions that leaders on both sides of the aisle embraced for most of the 20th century through the beginning of the pandemic. Responding to a recession with budget cuts is basically like to responding to a house fire with an armload of dry twigs: It’s not just dumb, it’s actively harmful. The report is an embrace of middle-out economics, an understanding that since ordinary Americans create jobs with their consumer demand, their spending power must be encouraged through smart investments.

I don’t know about you, but I think it’s incredibly exciting to be alive at a time when so much of our accepted economic wisdom is being tested and found wanting. Between this report and President Biden’s economic agenda, we’re not just undoing the damaging systems of trickle-down economics that have extracted trillions from ordinary Americans the last 40 years—we’re developing a new, better understanding of how the economy works and rebuilding the economy around that new understanding. This is thrilling stuff.

We have a special edition of The Pitch in store for you next week as our offices take some time off for Labor Day. It’s going to be a busy midterm season, so I hope you’re also taking some time to relax, connect with family and friends, and recharge.

Be kind. Be brave. Get vaccinated—and don’t forget your booster.

Zach