Friends,

There’s no shortage of post-midterm election reaction pieces floating around the media this week. Perhaps because the results defied the conventional wisdom about an oncoming “Red Wave,” this year’s crop of postmortems are even more desperate for attention than usual. It’s easy to tune out the noise in an environment like this, but there’s one particular signal that I’d like to bring to your attention: For Democracy Journal, Civic Ventures founder Nick Hanauer made an observation that I haven’t seen elsewhere.

Specifically, Nick writes that “to find the most obvious parallel for Biden’s midterm performance we have to dig all the way back to 1982, when even amid high inflation and choppy economic conditions, Ronald Reagan managed to defend his party and hold the opposition party’s gains to a modest collection of wins.”

That’s an important parallel to make because 1982 was the year when Ronald Reagan began to establish trickle-down economics as the dominant American economic understanding of how the world works. For the last 40 years, if you were to ask a Democratic or Republican politician what happens when you raise the minimum wage or regulate polluters, that politician would be likely to respond “you’d kill jobs.”

Never mind the fact that study after study has debunked the lie that higher wages or stronger regulations kill jobs—neoliberal, trickle-down thinking became so ingrained in the public consciousness that virtually every leader and expert believed any policy which didn’t immediately help enrich the wealthy was bad for the entire economy.

Nick praises this year’s slate of Democrats for not only running on policies that are broadly popular—abortion access, voter rights, gun responsibility, student debt forgiveness—but for following President Biden’s lead in communicating about how the economy really grows: From the middle out and the bottom up.

“It is a story that puts the American people—not capital or capitalists—back at the center of the American economy,” Nick writes. “It is a story that argues that what’s good for the American middle class is always what’s good for the economy, an inherently pro-growth argument that is morally correct, easy to understand, and—above all else—demonstrably true.”

Nick argues that if Democrats continue to build on this solid platform of popular policy and middle-out economics, we could be entering a Middle-Out Era just as significant—and far more prosperous—than Reagan’s Trickle-Down Era. He calls Biden “the first post-Reagan President, advancing a new understanding of the economy that breaks from the trickle-down worldview that has captured our politics for decades.”

I agree with Nick’s assessment that we saw something generationally important begin to unfold on election night, and that Democrats have the chance to build long-lasting change by pursuing a middle-out economic agenda. But don’t just take my word for it: Senator Elizabeth Warren argues as much in the New York Times, too.

“Continuing to reduce inflation and putting money in people’s pockets, expanding the work force through affordable child care, lowering housing costs by increasing supply, raising taxes on the superwealthy, tackling corporate price gouging — this is not a progressive wish list,” Senator Warren writes. “It’s the unfinished business of the Biden agenda, and the way to help families and win elections.”

Great minds think alike, I guess.

The Latest Economic News and Updates

On economic issues, Democrats outmessaged Republicans

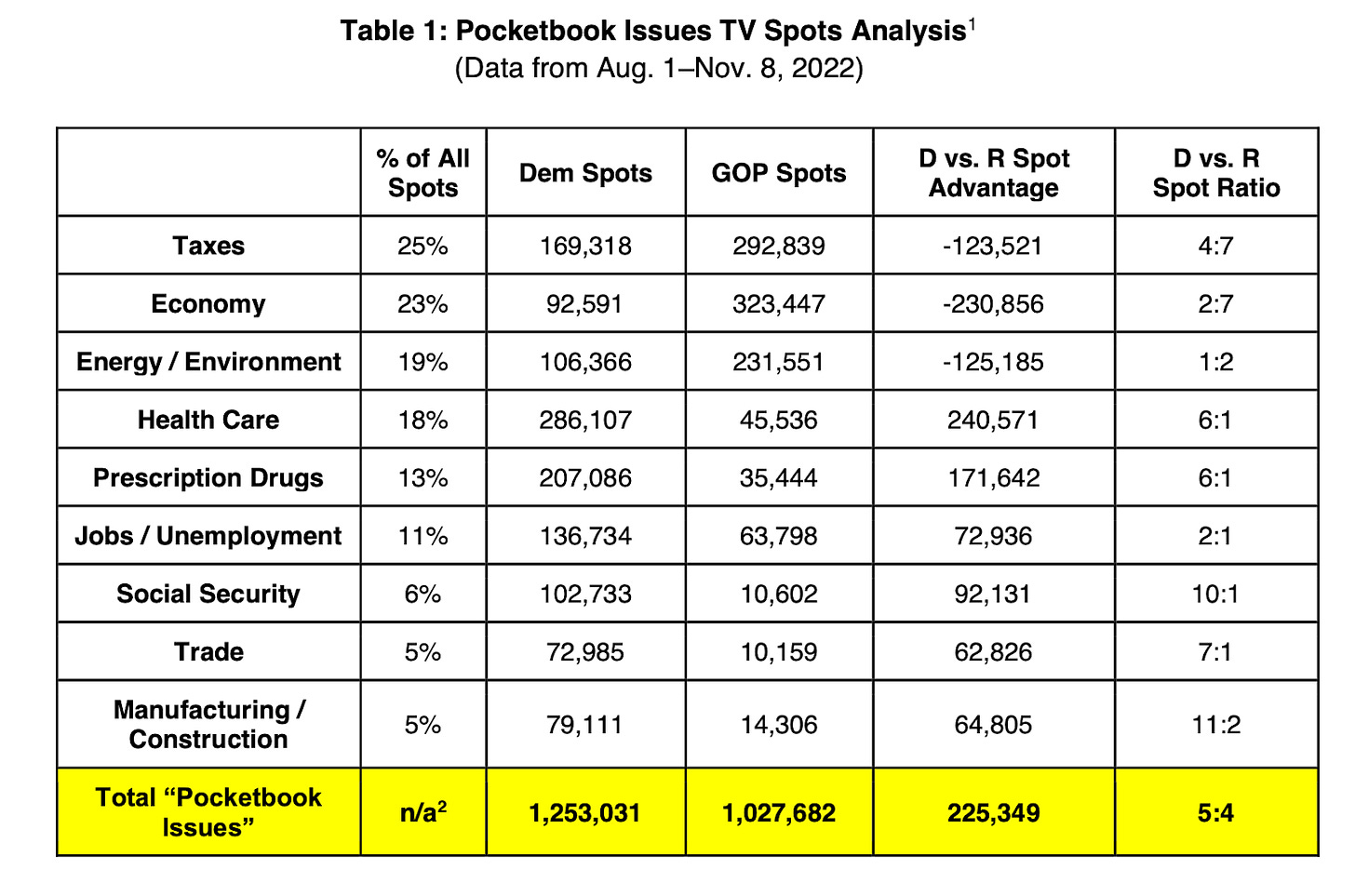

Before we leave the midterms entirely in our rear view mirror, I also wanted to point out this Winning Jobs Narrative survey of campaign ads, which found that Democrats played 200,000 more television ads about pocketbook issues than their Republican counterparts.

Republican candidates outnumbered Democrats in ads broadly bemoaning the state of inflation and the economy, but Democrats swamped their opponents with ads about specific economic topics like Social Security, job creation, manufacturing, and trade. That specificity mattered.

The American Prospect’s Harold Myerson agrees with this assessment: While voters recognized that inflation is a huge economic problem, they could also see that the Biden Administration’s economic policies were adding jobs and raising wages for Americans.

Specifically, Myerson writes, the Inflation Reduction Act “gave a boost to the economy—and to middle- and working-class Americans who were the intended beneficiaries of that boost—on a scale large enough to enable those Americans to feel confident about getting a good job and weathering the rising prices.”

Which is the greater danger: Inflation or recession?

Timothy Noah at The New Republic says that October’s inflation report marked “the fourth consecutive month during which the overall inflation rate fell,” which is obviously good news. The Wall Street Journal reports that supplier prices slowed for the second month in a row, which will also help to ease inflation. Wall Street seems to believe that inflation could finally be heading in the right direction, for whatever that’s worth. Let’s not write this in stone just yet: We’ve seen inflation numbers leap and dive earlier this year. And in an effort to tamp down expectations for victory over inflation, the Federal Reserve has signaled that the fight against inflation has “a ways to go.”

But Noah makes a great point: “The danger of recession is starting to eclipse the danger of continued inflation.” If they keep raising interest rates, the Fed risks making money too expensive, driving up unemployment and throwing us into a recession even as inflation continues to fall.

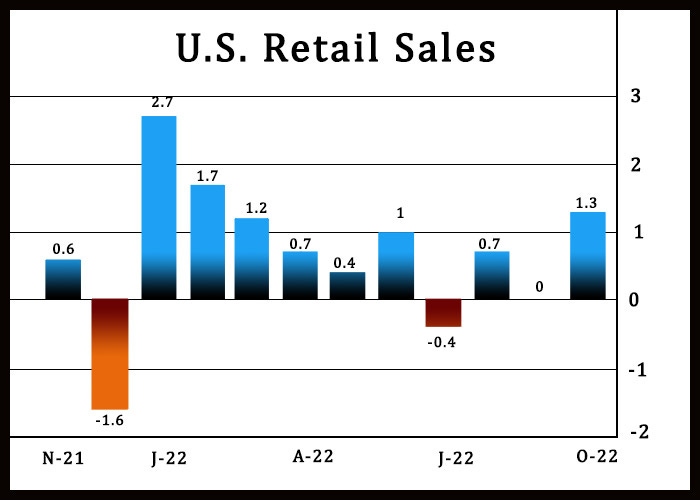

To be clear, we’re not in a recession yet. The numbers are still sending frustratingly mixed signals. U.S. retail sales climbed higher in October than they have in eight months, showing that Americans are still spending money despite high prices.

But despite those increased sales, Target yesterday announced a decline in quarterly profits of 52%, blaming customers for “waiting for sales rather than buying goods at full price.” (We have to take a moment to admire the audacity of this argument: how dare customers want to spend the lowest possible price for an item in a year when inflation has skyrocketed?) Walmart’s Q3 results were strong, but executives noted that the higher-than-expected 9% increase in sales came mostly in the grocery sector around cheaper items like hot dogs and canned beans. So it seems that sales are up but people aren’t spending on the big-ticket items that retailers would like them to be buying. Could this be a consumer pushback against the corporate greedflation that’s been pushing prices ever-higher this year?

Do tech layoffs predict a weaker job market?

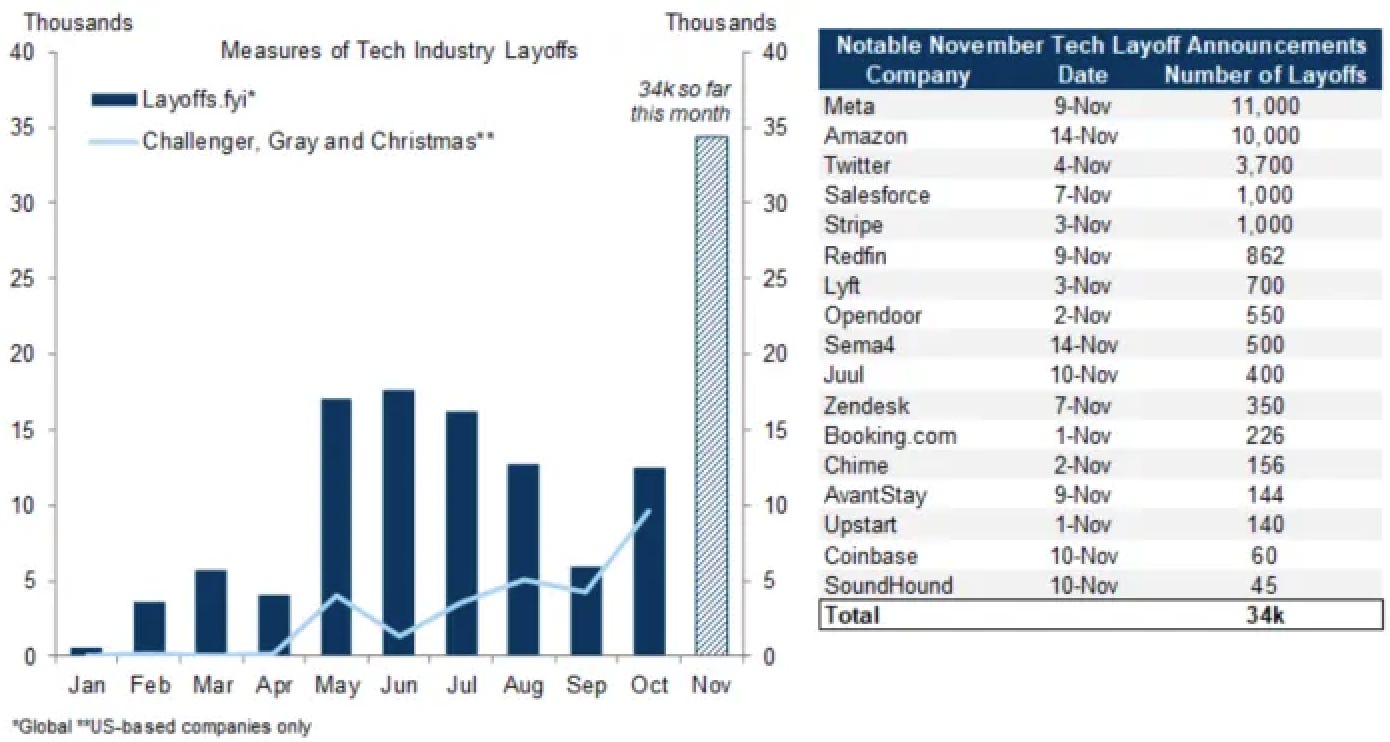

You have no doubt heard of the recent spate of tech layoffs—first Twitter, then Meta, and then Amazon announcing 10,000 layoffs this week—and you’ve probably wondered if these layoffs are the crest of a wave of broader layoffs that will signal a spike in unemployment numbers. Goldman Sachs on Tuesday issued a report arguing that tech layoffs “are not a sign of impending recession.” The report made a point of showing that this year’s layoffs are still relatively small, totaling 34,000 by their count.

Goldman economist Jan Hatzius writes:

First, the tech industry accounts for a small share of aggregate employment — for example, the unemployment rate would rise by less than 0.3 percentage points even in the inconceivable event that all workers employed in the “internet publishing, broadcasting and web search portal ’industry are immediately laid off — so any drag on the overall labor market should be small.

Hatzius also points out that tech employment is still higher than it was pre-pandemic. Of course, I would be remiss in my duties if I didn’t point out that Goldman Sachs doesn’t exactly own the moral high ground when it comes to recessions.

It does seem as though the layoffs are largely contained to the tech sector, which could potentially be bad news for tech hubs like Seattle, San Francisco, and Austin. But the job market isn’t currently behaving like it’s about to plunge into recession. Workers in other, lower-paying, fields don’t seem to be worried about layoffs—in fact, they’re going on strike to demand higher pay. The largest American work stoppage of 2022 happened this week when nearly 50,000 California academic workers went on strike. Part-time teachers at the New School in New York City also walked off the job this week to demand higher pay, and American Airlines flight attendants are picketing at airports around the country.

Future job reports will test this theory, but for right now it looks like the tech industry layoffs are the result of an industry correction as pandemic fears subside and American internet usage declines from its lockdown highs of 2020 and 2021. There are still plenty of blue- and white-collar jobs available for Americans and workers are using that strong job market as leverage to demand higher wages.

How good policy shapes the right kind of economic growth

At the United Nations’ conference on climate change this week, President Biden used the $369 billion commitment to growing green energy that he signed into law in the Inflation Reduction Act as an example for other nations.

“Our investments in technology, from electric batteries to hydrogen, are going to spark a cycle of innovation that will reduce the cost and improve the performance of clean-energy technology that will be available to nations worldwide, not just the United States,” Biden said in an international adaptation of his middle-out economics message—a reminder that an inclusive, prosperous economy helps every nation, not just the wealthy ones.

That green energy investment is already seeing returns in the US battery market, as businesses prepare to make enough electric vehicle batteries to power the coming fleet of more than two million EVs. “The law has turbocharged interest in US battery supplies, with companies committing about $13.5bn worth of investments since it was enacted compared to $7.5bn in the three months before,” write Harry Dempsey and Myles McCormick for the Financial Times.

Aurelia Glass and Karla Walter at the Center for American Progress broaden the scope a bit more to look at the investments Biden has made across his three signature legislative achievements—the IRA, the CHIPS act, and the infrastructure bill—to reject trickle-down economics and instead create good, high-wage manufacturing jobs around the nation. It’s a great overview of all the job-creating measures in those pieces of legislation, including exciting apprenticeship programs in the IRA and CHIPS act that until now managed to completely escape my notice.

Meanwhile, we’re still seeing a tremendous manufacturing swing away from other parts of the world and back to the United States. Apple CEO Tim Cook this week announced on a call that the tech company was bringing chip production back to the United States thanks to the CHIPS act.

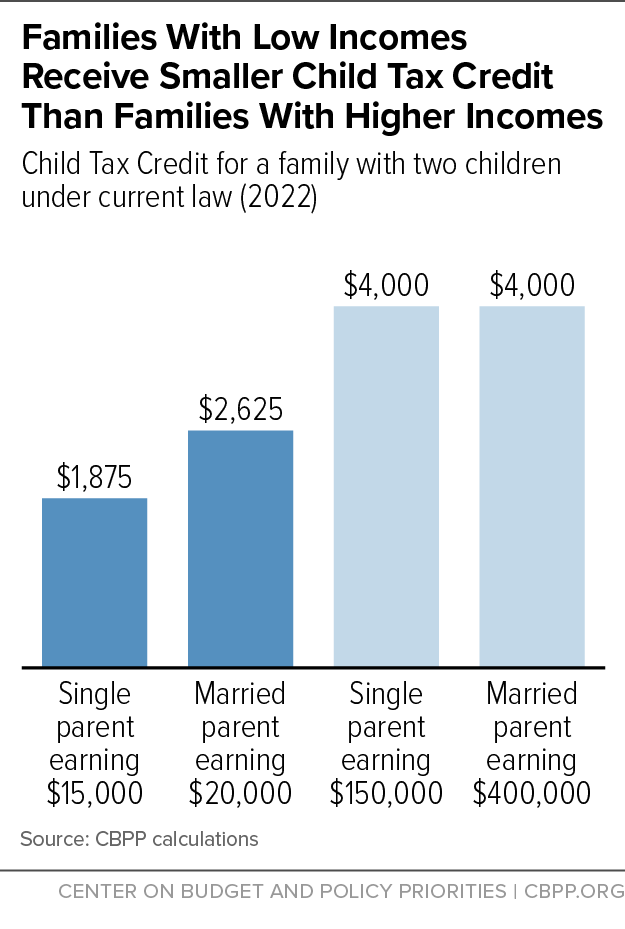

There’s always room for improvement. The Center on Budget and Policy Priorities makes a compelling case for the lame-duck Congress to expand the Child Tax Credit for the 19 million children who don’t qualify for the full credit. We saw that last year’s Child Tax Credit expansion lifted millions of children out of poverty and helped American families thrive through the second wave of the pandemic.

The current Child Tax Credit has a major design flaw: millions of families are prevented from receiving the full credit because their household incomes are too low. In total, an estimated 19 million children under age 17 qualify for less than the full $2,000-per-child credit or no credit at all because their families’ earnings are too low or because the adults were out of work that year.

This chart shows that the Child Tax Credit now does exactly the opposite of what it’s supposed to do by investing in wealthy families while leaving poor families behind:

If they act before the Republican House takes hold in January, Congress could immediately lift 1.7 million children out of poverty and help the nation’s poorest households at a time when prices are unnaturally high. What better way for Democrats to signal their commitment to growing the economy from the middle out than by using their last few days in charge of the House to invest in American families? Seems like a no-brainer to me.

Real-Time Economic Analysis

Civic Ventures provides regular commentary on our content channels, including analysis of the trickle-down policies that have dramatically expanded inequality over the last 40 years, and explanations of policies that will build a stronger and more inclusive economy. Every week I provide a roundup of some of our work here, but you can also subscribe to our podcast, Pitchfork Economics; sign up for the email list of our political action allies at Civic Action; subscribe to our Medium publication, Civic Skunk Works; and follow us on Twitter and Facebook.

Join us at 10:30 am PT tomorrow for Civic Action Live, when we’ll dig through the midterm election results, explain what the recent spate of Big Tech layoffs suggest for the economy, and talk about the FTX fiasco and whether crypto has a future.

This week’s Pitchfork Economics podcast featured a great conversation with Stacy Mitchell about the Kroger-Albertsons merger, and why it’s terrible news for shoppers and workers, but excellent news for a tiny investor class and corporate executives.

And Nick Hanauer was a guest on the excellent Money with Katie podcast to explain why the economy should prioritize the vast majority of working Americans, not wealthy people like Nick. This video is a great crash-course for middle-out economics and I’d recommend sharing it with anyone you think might be interested in learning how the economy really works. If you prefer podcasts to YouTube, you can check out the conversation here, and I’ve embedded the video below.

Closing Thoughts

It’s been a newsy month, with the midterm elections dominating headlines. In a more normal time—if such a thing as a “normal time” even exists anymore—the top story would undoubtedly be the shocking $8 billion collapse of the cryptocurrency exchange FTX, in which more than one million people and organizations lost money. And as the notoriety of FTX founder Sam Bankman-Fried rises to meet recent frauds like Bernie Madoff and Elizabeth Holmes, I expect this story to stay in the headlines for months to come.

Robert Kuttner notes that at the time of the collapse, Bankman-Fried was in the midst of lobbying to move cryptocurrency regulation away from the relatively hard-nosed Securities and Exchange Commission over to “the light-touch Commodity Futures Trading Commission,” and his push was gaining significant traction with senators and regulators. The economic damage that crypto scammers like Bankman-Fried could have caused had this push for deregulation been successful is almost unthinkable—a bankruptcy like FTX could very well have threatened the entire economy.

And FTX wasn’t even the only scam that Bankman-Fried was promoting. The New Republic’s Timothy Noah digs deep into his philosophy of “effective altruism,” which Noah explains “tries to distinguish itself from routine philanthropy by applying utilitarian reasoning with academic rigor and a youthful sense of urgency.”

But of course, common sense dictates that when super-rich men start sermonizing about how they’re going to use reason and philanthropy to save the world, you always should run, not walk, in the opposite direction. EA interests itself in solving long-term “existential threats” like nuclear war, but Noah points out that it doesn’t even acknowledge income inequality as a problem.

It’s a philosophy of philanthropy that prioritizes the threat of artificial intelligence taking over the world above saving the lives of humans who are starving to death in the streets right now, and it has spread like wildfire through the super-rich because it strokes their egos by casting them as saviors of very future of the human race. And EA’s practitioners subtly sidestep the fact that if the wealthiest Americans simply paid as much in taxes as the rest of us, the world would be a much better place immediately. While Bankman-Fried didn’t create the philosophy of EA, he was one of its biggest supporters, and hopefully his public collapse will take some of the bloom off its rose.

Meanwhile, Elon Musk—another multi-billionaire adherent of EA—has been falling on his face in full public view over the last couple of weeks. I don’t have the space, and you likely don’t have the patience, to list every single embarrassment that Musk has suffered since he’s assumed control of Twitter. If you’ve been on the internet for the last week you likely are familiar with at least some of the disasters he’s caused for himself.

Everyone loves to watch a rich idiot get their comeuppance—it appeals to our sense of justice when wealthy egomaniacs screw up in the spotlight, and their carefully crafted genius personas are revealed to be the PR stunts that they really are. This is not a new human impulse—more than half of Shakespeare’s plays are about the wealthiest and most powerful people in the world stepping on rakes and hitting themselves in the face, because that’s the kind of story that sold tickets at the Globe Theater.

But I can’t help but wish that more of the coverage about Twitter and FTX focused on the ordinary people who are getting screwed over—the Twitter employees who Musk revels in firing, the working Americans who invested their retirement funds in FTX because people in power told them it was a safe crypto exchange.

For every billionaire who fails, there are thousands of people who suffer life-changing financial damage, and history fails to record their names. The best way to stop these tragedies from unfolding in our headlines is to create a strong system of regulations to ensure that no one gets enough power to destroy tens of thousands of lives with a single mistake. Had we acted faster to regulate crypto, FTX’s collapse might never have happened. If Elon Musk paid the same share of taxes that you do, a $44 billion purchase of Twitter would never have crossed his mind. Regulations are how we stop these disasters before they start.

Be kind. Be brave. Get vaccinated—and don’t forget your booster.

Zach