Friends,

This week, President Biden made history as the first president to visit a picket line while in office. Biden walked the picket line on Tuesday to show his support for striking members of the United Auto Workers union who are calling for shorter workweeks, better benefits, and substantial raises that match the raises that CEOs at the big 3 American auto manufacturers have given themselves.

UAW President Shawn Fain offered Biden his bullhorn, and Biden told the picket line, "Wall Street didn’t build this country, the middle class built this country. The unions built the middle class. That’s a fact.” To cheers, he continued, “Let’s keep going, you deserve what you’ve earned. And you’ve earned a hell of a lot more than you’re getting paid now."

In his own speech, Fain underscored Biden’s points, telling the crowd, “These CEOs sit in their offices. They sit in meetings. They make decisions. But we make the product. They think they own the world, but we make it run.” Fain concluded, “The CEOs think the future belongs to them. Today belongs to the auto workers and the working class."

Biden’s appearance was a huge thumb on the scale on the side of workers. The presidential bully pulpit can’t be underestimated in terms of how much weight it carries and how much attention it garners. It’s also a powerful symbol.

President Reagan ushered in the Neoliberal Era when he fired striking workers. Biden is ushering it out by standing with striking workers. The Middle-Out Era has begun.

It’s quite telling that the most strident, high-profile attack on Biden didn’t come from a Republican politician or a Fox News host—instead, an Obama official came out with a lacerating statement against Biden’s appearance on NBC News:

“For him to be going on a picket line is outrageous,” Steven Rattner, who headed former President Barack Obama’s auto industry task force, said in an interview. “There’s no precedent for it. The tradition of the president is to stay neutral in these things. I get the politics. The progressives all said, ‘We don’t want a mediator; we want an advocate.’ And he bowed to the progressives, and now he’s going out there to put his thumb on the scale. And it’s wrong.”

Rattner, who led the Obama Administration’s bailouts of the auto industry during the Great Recession, has been advocating on behalf of the CEOs of the big 3 American automakers for a while now. He wrote an editorial for the New York Times trying to both-sides the UAW strike before it even began. “Yes, profits at the Detroit Three are at record levels — $37 billion last year,” Rattner wrote, before launching into a little sleight-of-hand: “But the auto industry usually operates at thin margins, and even though labor costs are a relatively small fraction of the companies’ overall expenses, those profits can evaporate quickly.”

In the throes of his bottomless sympathy for the potentially smaller profit margins of auto manufacturers, Rattner fails to acknowledge that Ford and General Motors handed a total of $6.3 billion in profits away to the shareholder class in the last year in the form of stock buybacks—and that the three automakers have raked in $250 billion in profits over the past decade. (The union has even proposed that if the CEOs of Ford, General Motors, and Stellantis wanted to continue with their spree of buyback handouts to shareholders, they would be amenable, so long as every UAW member received $2 per $1,000,000 in profits handed off to shareholders. Doing so would grow the paychecks of every unionized auto worker by four or five percent annually.)

Neither Biden nor the UAW workers resent the success of automakers. They appreciate the record profits that they have created for auto manufacturers, and support the companies’ strategic advances into the green economy. The workers are simply asking for a clear-eyed assessment of how those profits are allocated, and demanding their share of the cut, along with investments that will benefit consumers and the communities where these workers live. This is a message that appeals to Republican and Democratic workers alike.

When he headed up President Obama’s task force during the Great Recession, Rattner helped convince union workers to accept smaller paychecks in order to help their employers survive the economic downturn. Rattner’s bargain paid off, and the Detroit Three rebounded in a huge way.

Now, President Biden is simply amplifying the union’s call to renegotiate. The union sacrificed a lot to help their employers navigate rocky economic waters. Now, the bill is due, and all the American employers who kept wages stagnant for most of the past four decades should be taking notes. With the president’s help, these unions aren’t just advocating for themselves—they’re teaching American workers how to advocate for themselves in the middle-out era.

The Latest Economic News and Updates

The Government Shutdown Is a Trickle-Down Manifesto

It seems highly likely that the federal government will shut down this weekend. First, it’s important to be transparent about the causes of this shutdown: A handful of extremist Republicans in the House are holding their party’s leadership hostage. They are warning that unless the government adopts an extreme series of huge budget cuts, they will throw a monkey wrench into the workings of the federal government, stopping everything from functioning.

This is not a natural disaster, and it is not how a healthy government functions. Even Republicans in the Senate have worked with their Democratic counterparts to avert this shutdown from happening, but the extremists refuse to listen to reason.

So in the short term, you can expect so-called “non-essential” government services to shut down at midnight on Saturday. (That phrase, “non-essential,” feels in itself like a malicious bit of trickle-down framing—especially in the wake of the pandemic, which reaffirmed which jobs are truly “essential” for the day-to-day running of the nation.) Zach Montague at the New York Times offers a nutshell view of what happens next: “For hundreds of thousands of federal employees, that means either being furloughed while the government is closed, or continuing to work without pay. For the public, that typically means dealing with interruptions to a variety of government services and facing a range of inconveniences and disruptions to daily life.”

Immediately, you can expect national parks to close; regulators to end routine checks for food safety; investments into working Americans, including nutritional assistance and educational assistance, to cease; and funding for science and health initiatives to dry up. If you’re looking for more information, The Center for American Progress has put together a good explainer of what you can expect if the shutdown begins this weekend.

The longest government shutdown ran for just over a month. My advice for paying attention to this shutdown is pretty clear: There will be a lot of headlines full of bluster and bravado as Republican extremists like Matt Gaetz brag about how far they’re willing to take the shutdown. Ignore those. Ignore the political pundits who try to frame this as an issue which implicates both sides of the aisle, or who call for a compromise to save the day.

Instead, pay attention to and amplify those reports that cover the immediate economic impact of these shutdowns—the people who are harmed, the money that stops flowing through communities, the jobs that are killed.

We will highlight reports of the shutdown’s economic impact here in The Pitch, and I hope you’ll amplify and elevate these stories on social media in the coming weeks so everyone can see the impact the shutdown is having on working Americans. The extremists who are forcing this shutdown to happen are doing so because they want to pass a series of draconian cuts that will reduce the government’s effectiveness and remove trillions of dollars of investments in the American economy. This shutdown offers a preview in miniature of what they want day-to-day life in America to be like.

In short, we are getting a preview of the preferred outcomes of trickle-down economics, and a taste of what might happen if middle-out economics is beaten back at the ballot box next year. To get a sense of what MAGA trickle-downers like Gaetz want our economy to be, pay attention to the inconveniences, the hardships, and the pain that Americans will endure in the days and maybe weeks to come—and then multiply them by a thousand.

What Happens Next?

In part because this week doesn’t feature the release of many consequential economic reports, a lot of the media conversation has centered around the general health and direction of the economy. Case in point: The New York Times’s Paul Krugman and Peter Coy devoted a column this week to a dialogue over whether the economy will experience a “soft landing” from widespread price increases, or if a recession is still in the cards. Krugman is on Team Soft Landing, while Coy is more pessimistic.

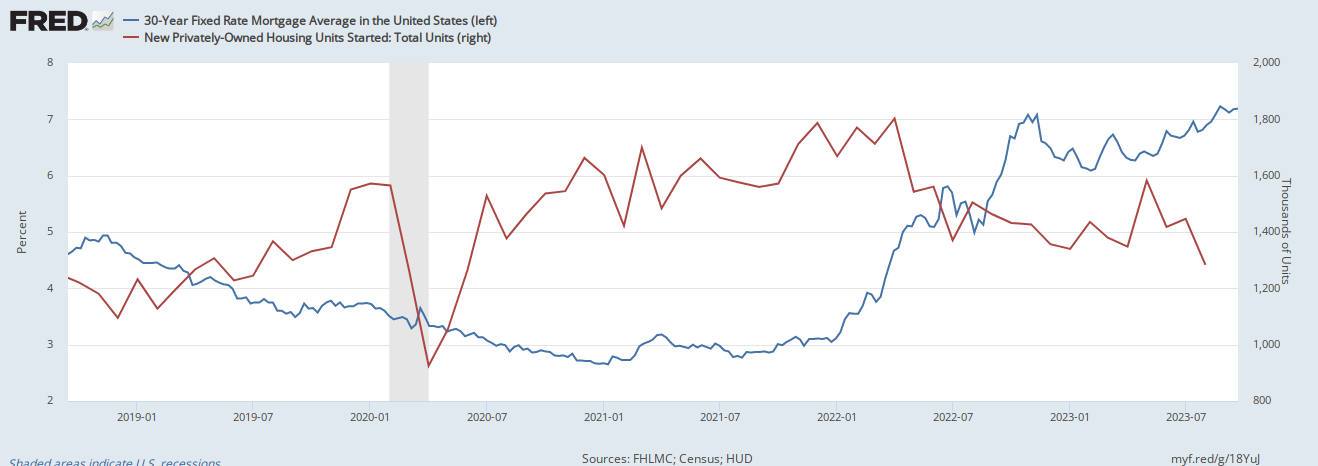

Both Krugman and Coy center their economic concerns on housing—specifically, the Fed has raised interest rates to the point that mortgages are adding hundreds or even thousands of dollars to the monthly price of purchasing a home. (And on top of those high mortgage rates, new and existing housing prices still continued to rise this summer.)

“Fed hikes led to a big rise in mortgage interest rates, which hit 7 percent almost a year ago and have fluctuated since then,” Krugman writes. But on the other hand, he notes, “housing starts, after an initial drop, have stayed fairly strong — at or above prepandemic levels.”

Housing starts are a measurement of new private home construction in the United States, and they are a major indicator of the economy’s health. And housing, in general, is the highest-risk portion of the American economy right now. At some point, those interest rates will be too much for the American people to bear, and so much of the housing market’s health is dependent on the actions that the Fed takes next: If they bring interest rates down following steep historic patterns, many experts believe mortgage rates should drop, and so should the cost of housing. But if the Fed keeps interest rates high and slowly lowers rates over years, as they’re expected to do, housing costs could continue to hammer at working Americans for the foreseeable future.

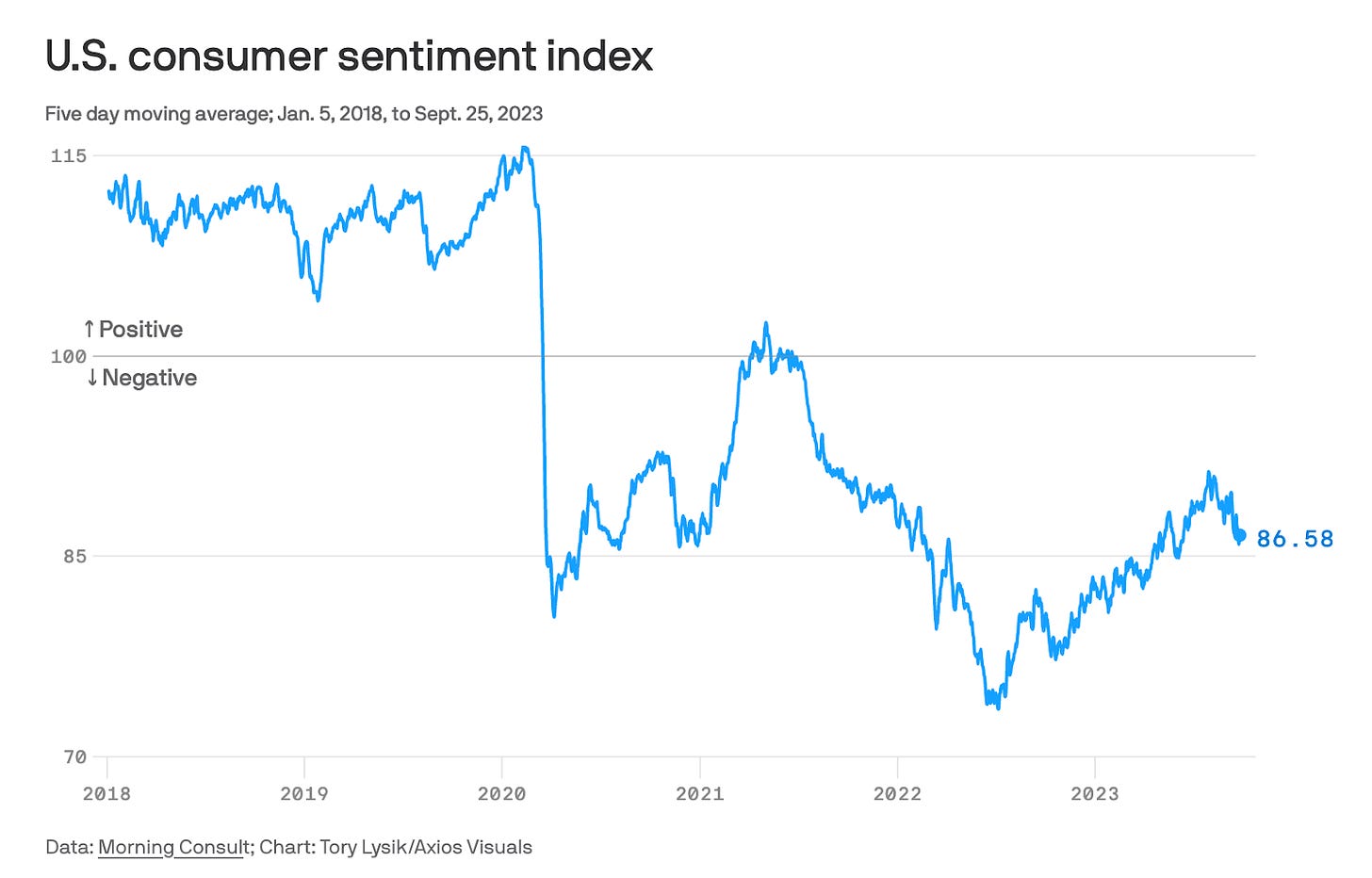

So really, the question is how much stress the American consumer can withstand. Axios reports that American consumer sentiment, which has been climbing for most of the past year, is dipping again—perhaps pushed by rising gas prices

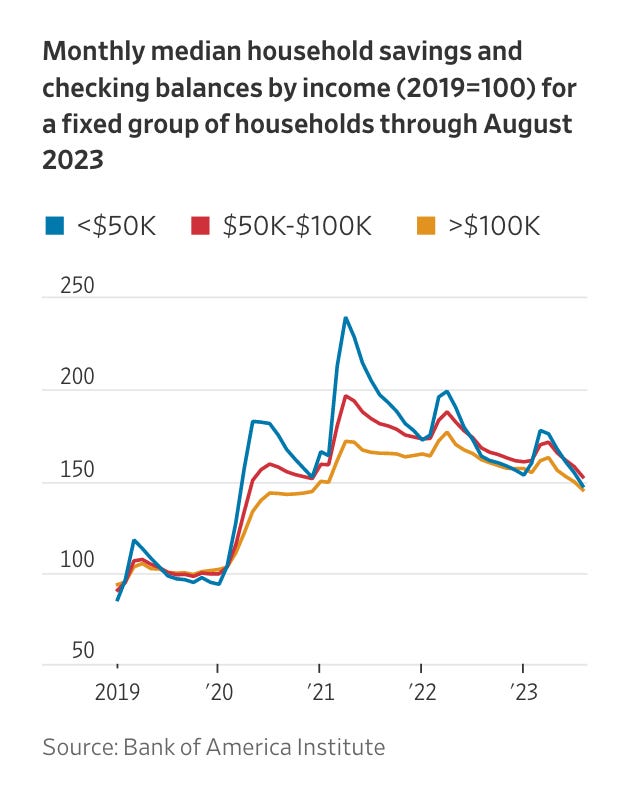

As we’ve learned in recent years, though, partisanship and other factors tend to distort the results of self-reporting sentiment studies. It’s better to watch what consumers actually do. For the Wall Street Journal, Justin Lahart examines American personal saving trends. In April of 2020, he writes, American savings rates “surged to 33.8%, which compared with 8.8% over the course of 2019. It stayed elevated throughout 2020 and most of 2021, but last year it was just 3.5%. This year it has only been a bit better, averaging 4.3%.”

So savings are moving in the right direction—probably thanks to the bigger paychecks that Americans have been getting—but they’re not as robust as they have been in the recent past. But what matters most is who those savings accounts belong to. “If they are mostly in the accounts of the very rich, for example, that would provide less oomph for consumer spending than if they were held by middle-class and poorer Americans,” Lahart writes. Wealthy peoples’ savings tend to languish in accounts for years or decades at a time, while working Americans tend to save for a larger expense in the near term. (As a side note, let’s take a moment to note how remarkable it is to see this middle-out economic understanding of how the economy really grows stated as fact in the traditionally conservative, trickle-down WSJ.) Lahart cites Bank of America data showing that the savings are pretty evenly distributed across the economic scale, with poorer Americans saving more as a result of wage gains made over the past two years.

Martha C. White at The New York Times says that adults in Generation Z (defined as people born between 1997 and 2012) are “paying an increasing amount of their disposable income servicing their debts, more than Americans in other age groups do.”

There are some positive signs for young people, including the fact that 2/3rds of Generation Z workers are already saving for retirement. But on the other hand, a retirement expert told the Times that “four in 10 Generation Z workers have taken a loan, early withdrawal or hardship withdrawal” from those 401ks and other retirement funds.

Vox’s Emily Stewart has characterized our current situation as a “hold-your-breath” moment for the American economy. With the shutdown looming over everything else, economists are waiting to see if prices decline with continued job growth or if any one of the unpredictable variables we’ve discussed above will somehow tip the economy over into a recession.

At the center of all of this: working Americans. If wages continue to rise above price increases, and if people keep spending those paychecks in their local communities, it’s likely that workers will pull the economy through by creating jobs with their consumer demand.

Labor Is More Than Cars and Screenplays

In the opening of this newsletter, I talked about the UAW strike, and in the closing of this newsletter, I talk about the conclusion of the WGA strike. These are definitely the top two labor stories of the week, but they’re far from the whole story of work in the United States.

For instance, hospitality workers in Las Vegas just voted to authorize a strike that could bring some 60,000 housekeepers and restaurant workers to the streets, joining hotel hospitality workers who are currently still on strike in Los Angeles. These unions are calling for better pay, more work safety regulations, and a guarantee that they will be called back on the job if they are ever laid off due to a pandemic or economic crisis.

A new report from the Washington Center for Equitable Growth shows that unions aren’t just good for workers—they also bolster the long-term health of companies:

In new research, we show that stronger unions have the unintended benefit of improving overall financial stability in the economy by prompting firms to make less risky borrowing decisions. This is because the collective bargaining process pushes firms to take fewer financial risks, thereby reducing the prospects of firms going bankrupt or undergoing layoffs.

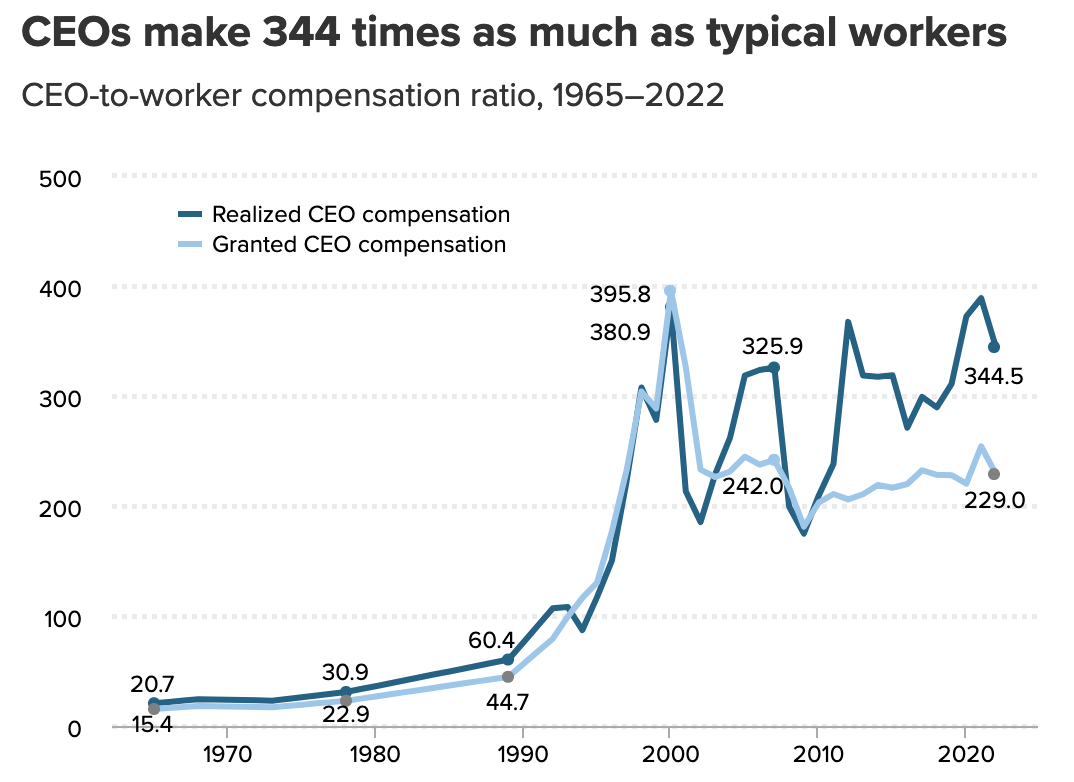

And a new study from the Economic Policy Institute helps dimensionalize the wage gap that these unions are trying to overcome. EPI shows that while average American CEO pay dipped slightly last year, they still are compensated 344.5 times the pay of their average workers. By contrast, CEO pay only rose from 20 times the average worker to 60 times the average worker between the 1960s and 1990s.

While workers are busy fighting for their rights, some employers and politicians are trying to make it easier to hire children, who are more easily exploited. Akin Olla at the Guardian writes, “politicians – including Democrats – in at least 11 states have introduced or passed bills that weaken child labor laws.”

As Olla correctly identifies, this push for child labor is a direct response to the labor empowerment of the last few years: “At a time when adult workers are demanding a fairer slice of the increasingly behemoth pie of corporate profits, child labor is a capitalist work-around to increase the labor pool and lower the wages of all those who have to work for a living.”

And make no mistake: Employers will absolutely put children in dangerous situations without proper safety precautions. We know this because a recent New York Times expose of illegal child labor at Tyson Foods and Perdue Farms has inspired President Biden’s Labor Department to investigate those firms. The Times report “found migrant children working overnight shifts for contractors in the companies’ plants on the Eastern Shore of Virginia. Children as young as 13 were using acid and pressure hoses to scour blood, grease and feathers from industrial machines.”

It’s vital for our leaders to be out on the front lines of combating these exploitative practices, but unions are also battling child labor by raising the standards for employment in America. If unions hold employers to account when it comes to safety, good wages, and benefits, everyone benefits.

This Week in Middle Out

Here’s a policy change from the Biden Administration that should have gotten much more attention: Last week, the administration moved to bar unpaid medical bills from affecting peoples’ credit scores. “The regulations, if enacted, would potentially help tens of millions of people who have medical debt on their credit reports, eliminating information that can depress consumers’ scores and make it harder for many to get a job, rent an apartment, or secure a car loan,” writes Noam N. Levey at KFF Health News.

The Federal Trade Commission, in conjunction with 17 states, finally announced a long-awaited antitrust lawsuit against Amazon this week, accusing the retailer of “interlocking anti-competitive actions that, [the suit] says, have inflated prices for consumers, harmed third-party sellers in Amazon’s marketplace, and made it nearly impossible for other e-commerce platforms and retailers to compete,” Sara Morrison writes at Vox. “The complaint includes 20 charges, including monopoly maintenance of the online superstore market and the online marketplace services market, unfair methods of competition, and violations of various state antitrust laws.”

Meanwhile, Google is trying to ensure that its antitrust trial takes place under an unprecedented level of secrecy. “Not only has Google argued for the landmark trial to be largely closed off to the public, but so have other companies that are involved, such as Apple and Microsoft,” notes the New York Times.

Speaking of Amazon, the National Employment Law Project just issued a wide-ranging report calling on Amazon to “improve the standard of living for many in the U.S., including for the Black workers on whom it relies disproportionately for its front-line operations, and for Black women in particular, who make up the largest group of front-line workers at the company.” The report argues that anyone who works in Amazon’s distribution warehouses should be able to live a solid middle-class lifestyle.

“The Biden Administration plans to bring back open internet rules that were enacted during the Obama administration and then repealed by the Trump administration,” writes the New York Times. “The earlier open internet rules, known as net neutrality, prohibited broadband internet suppliers — telecommunications and cable companies — from blocking or slowing online services. It also banned the broadband companies from charging some content providers higher prices for priority treatment, or ‘fast lanes’ on the internet.”

And while leaders in Washington DC are holding listening sessions to discuss the potential regulation of artificial intelligence technologies, Axios reports that venture capital firms are working with the Commerce Department to develop “responsible AI” guidelines for companies investing in AI startups. “These commitments are critical first steps that can serve as a bridge to regulation. We're encouraged to see venture capitalists, startups, and business leaders rallying around this and similar efforts,” an unnamed Commerce official told Axios. Though I try to celebrate economic optimism when I see it, it’s hard not to be skeptical when a public official praises a company’s enthusiasm for self-regulation, when the wealthy have for forty years rigged regulations to work in their favor and against the public good.

This Week on Pitchfork Economics

One of Nick’s favorite authors, philosopher Michael Sandel, joins the podcast this week to talk about the idea of meritocracy. In America, we’ve come to believe that merit, not your class or race or gender, should be the ultimate measurement of our success. Sandel argues that our belief in meritocracy has instead created a massive divide in politics and culture, contributing to the fissures that have developed in almost every aspect of American life.

Closing Thoughts

Before President Biden picked up his bullhorn at the UAW strike this week, unionized American workers had already won a huge victory. The Writers Guild of America announced on Sunday that they had reached a tentative agreement with the heads of Disney, Netflix, Warner Brothers, and other Hollywood studios. The WGA rank and file has yet to vote to approve the agreement, but writers are already back on the job as of yesterday, and the agreement looks to be popular with the workers.

The New York Times notes that the WGA “was able to secure concessions on most of their demands from the studios, including increases in royalty payments for streaming content and guarantees that artificial intelligence will not encroach on writers’ credits and compensation.”

Because SAG-AFTRA, the Hollywood actors’ guild, is striking for many of the same reasons that the WGA struck, and because the two unions have been strategizing in tandem, most industry insiders expect the actors to come to a similar agreement with studio heads fairly soon.

Many of the professional writers and artists who have been rocked by the debut of high-profile generative artificial intelligence technology this year were eager to see what the WGA could negotiate in terms of AI agreements. The studios have agreed that no screenplay can be officially authored by an artificial intelligence—that no matter how much generative AI might have contributed to the writing of a script, a human being always deserves to be the primary author on a creative work. That could establish an important precedent for all the copywriters, legal researchers, PR professionals, and other workers who might someday soon be expected to cooperate with AI tools over the course of a typical workday.

Artificial intelligence and generative language models are already beginning to reshape the world of work for freelancers and white-collar workers. It’s important that the WGA has given workers a seat at the table at one of the earliest conversations about how to successfully apply this technology in a way that benefits both employers and workers.

Be kind. Be brave. Take good care of yourself and your loved ones.

Zach